Immediately Download TimeEdge Weekly Option Strategy Workshop by Amy Meissner – Includes Verified Content:

TimeEdge Weekly Option Strategy Workshop by Amy Meissner, Check Out the Full Course Contents:

TimeEdge Weekly Option Strategy Workshop by Amy Meissner, Check Out This Free Video for Additional Information:

TimeEdge Weekly Option Strategy Workshop by Amy Meissner, Get Your Free PDF Sample Here:

Overview 🔁

TimeEdge Weekly Option Strategy Workshop by Amy Meissner teaches a rules-based, repeatable system designed for short, weekly cycles on SPY and SPX. Instead of juggling indicators or second-guessing the market, you’ll follow clear entry, adjustment, and exit rules you can execute in 3–5 trading days on average—then reset and repeat.

Built for busy traders, the workshop combines live training (with full replay), step-by-step examples across multiple market regimes, and two streamlined adjustment paths (minimal-margin or expanded-margin) so you can align the method to your account and comfort level. You’ll also get a No-Touch Weekly Strategy bonus and historical trade logs (2022–2025) to see how the rules behaved in different conditions.

Primary keyword: TimeEdge Weekly Option Strategy

Secondary keywords: weekly options income, SPX options, SPY options, rules-based options strategy, options adjustment rules, Amy Meissner

Why it matters 📈

Most weekly options ideas fail for the same reasons: too many discretionary decisions, over-optimization, and emotional execution when markets move fast. TimeEdge aims to fix that with:

-

Simplicity: one core system, one optional adjustment—no indicator maze.

-

Time efficiency: trades typically last 3–5 days, syncing with a weekly rhythm.

-

Liquidity & fills: the strategy is taught on SPY/SPX, instruments known for deep markets and tight spreads.

-

Repeatability: a rules-first checklist helps you execute consistently and evaluate results objectively.

The goal isn’t to “predict” markets; it’s to apply a tested process you can measure, improve, and scale.

Benefits you’ll notice 🎯

-

Clarity under pressure: Know your entry, risk parameters, when (and how) to adjust, and when to exit—before you place the trade.

-

Weekly cadence: Short trade durations and a rinse-and-repeat structure make progress easier to track.

-

Flexible capital use: Choose between minimal-margin or expanded-margin adjustments based on your account.

-

Data-driven learning: Review historical logs (2022–2025) to sharpen pattern recognition.

-

No technical analysis required: You’ll rely on rules, not subjective chart reads.

-

Skill stacking: Learn position sizing, risk caps, and scenario planning—portable skills for any options playbook.

-

Confidence to iterate: With a defined checklist and metrics, you’ll refine the system without guesswork.

(Performance figures referenced are from backtesting and historical logs; all trading involves risk. See notes at the end.)

What you’ll learn 🧠

-

Strategy setup from A to Z

-

Underlying selection (SPY/SPX) and why liquidity matters

-

Contract selection logic (strike distance, DTE, skew considerations)

-

Position sizing frameworks (account-based and risk-per-trade)

-

-

Clear entry rules

-

Timings that align with the weekly cycle

-

How to structure the spread for directional neutrality or bias

-

Checklists to confirm risk/reward before you click “send”

-

-

One simple adjustment (if needed)

-

Exactly when the play qualifies for adjustment

-

Two paths: minimal-margin vs. expanded-margin

-

How the adjustment re-centers risk and alters payoff

-

-

Exit rules you can trust

-

Profit targets, time-outs, and max-loss protocols

-

What to do on event weeks (CPI/Fed/earnings spillover)

-

Playbook for gap moves and fast volatility changes

-

-

Risk management that scales

-

Account-level risk caps and drawdown governors

-

Weekly and monthly risk budgeting to avoid over-trading

-

Logging and review routines that compound performance

-

-

Execution without technical analysis

-

Order placement tactics for SPX/SPY

-

Working orders, fills, and slippage controls

-

When to step aside (low-edge conditions)

-

-

Bonus: No-Touch Weekly Strategy

-

Setup, risk box, and exit logic

-

When “hands-off” is the higher-probability choice

-

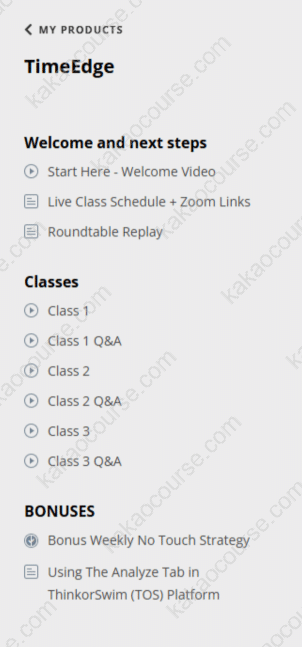

Key features & modules 🧩

-

Live Workshop + Full Replay

Learn the complete rule set, watch real examples, and get clarity on edge cases. -

Entry → Adjustment → Exit, step-by-step

Every stage is broken down into if/then rules with sample fills and alternatives for differing margin profiles. -

Two Adjustment Paths

-

Minimal-margin path: Keep capital requirements tight while managing risk.

-

Expanded-margin path: Increase flexibility when you can allocate more buying power.

-

-

Historical Trade Logs (2022–2025)

See how the strategy handled trending, choppy, and volatile stretches. Use the logs to calibrate expectations and reinforce discipline. -

Bonus System: No-Touch Weekly Strategy

A complementary setup for weeks when “less is more,” including parameters and exit logic. -

Ongoing Replay Access

Revisit any section to solidify rules and build execution confidence.

Who it’s for 👥

-

Newer options traders who want a single, well-defined strategy with minimal moving parts.

-

Intermediate traders seeking a weekly income rhythm without relying on complex indicators.

-

Busy professionals who need a checklist-driven process that fits into limited screen time.

-

Small and large accounts looking for a system with adjustment flexibility and clear risk caps.

-

Process-oriented learners who value data, logs, and objective review over “gut feel.”

Why this weekly approach works (when you work it) ⚙️

-

Defined edges, not predictions: The rules target structural features of SPY/SPX (liquidity, option pricing dynamics, weekly cycles).

-

Tight feedback loop: With 3–5 day trade durations, you get rapid, repeated reps—crucial for building execution skill.

-

Risk boxed in advance: You’ll pre-commit to max loss, time-based exits, and the single adjustment path.

-

Metrics over narratives: Win rate, average win/average loss, and expectancy guide improvements more than headlines or opinions.

How a typical week might look ⏱️

-

Day 0 (pre-open prep): Check the weekly calendar; confirm no-trade days or “reduced size” notes.

-

Day 1 (entry): Place the position per checklist; record planned exits and adjustment triggers.

-

Day 2–3 (monitor): Price and vol checks at scheduled times; no impulsive changes.

-

If needed (single adjustment): Execute one adjustment by the rulebook—minimal or expanded margin.

-

By Day 3–5 (exit): Close on target, time-out, or max-loss—no exceptions. Log the result and tag the scenario.

Sample trader toolkit 🧰

-

Printable entry/exit checklist for fast pre-trade validation

-

Adjustment decision tree (minimal vs. expanded margin)

-

Risk-per-trade and weekly budget templates

-

Exec tips for SPX/SPY (order types, fills, partials)

-

Review rubric to turn logs into improvements

Results & social proof (what traders highlight) 💬

-

Historical performance snapshots (from backtests and recorded logs) report annualized returns in the 100%–200%+ range with a win rate above 83% and average trade duration of 3–5 days.

-

Trader feedback often centers on clarity and repeatability:

-

“You are literally changing my life and I can’t thank you enough.” — Mike P.

-

“Trading your strategy has allowed us to generate enough monthly income to pay for our multi-month trips to Europe and the Caribbean and to donate to our favorite charities, as well.” — Bob H.

-

These results reflect historical logs and backtesting; real-time outcomes vary. Use position sizing and risk caps appropriate to your situation.

What makes TimeEdge different 🧩

-

Rules first, not feel first: No technical analysis required; decisions are checklist-based.

-

One core adjustment: Reduces over-managing, limits path-dependence, and keeps reviews clean.

-

SPY/SPX focus: Tight spreads, deep liquidity, and mature options markets for more consistent execution.

-

Weekly repetition: More cycles = more data = faster skill growth.

-

Transparent records: Access to historical logs (2022–2025) to study behavior across regimes.

Conclusion ✅

If you’ve been seeking a straightforward, weekly options process you can execute without living on charts, TimeEdge gives you a practical path: a single ruleset, one optional adjustment, and tight risk protocols—all taught on SPY/SPX so you benefit from liquidity and consistent fills. Layer in historical logs, live instruction with replay, and a bonus No-Touch setup, and you have a framework you can practice, measure, and refine week after week.

-

Trade a clear plan instead of opinions.

-

Use defined exits and a single adjustment to keep emotions out.

-

Build a weekly rhythm that compounds skill and confidence over time.

Start your weekly edge now 🚀

Join the Proven TimeEdge Weekly Options Workshop by Amy Meissner to learn the complete rule set, watch step-by-step examples, and begin trading a repeatable weekly process you can run in 3–5 days—then reset and repeat.

Important notes: Options involve risk and are not suitable for every investor. Past and backtested performance does not guarantee future results. This content is educational, not financial advice; always trade within your risk tolerance and consult a licensed professional where appropriate.

Reviews

There are no reviews yet.