Instant Download Secrets of a Winning Trader By Gareth Soloway – Includes Verified Content:

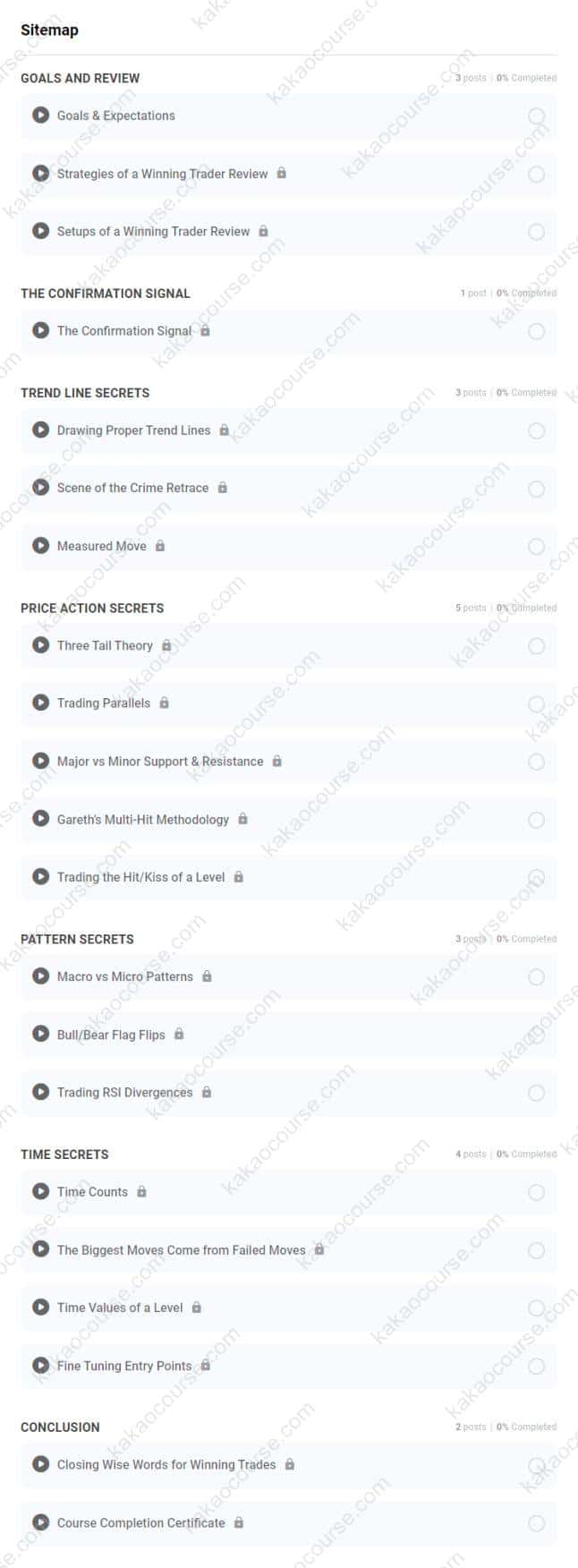

Secrets of a Winning Trader By Gareth Soloway, Check Out the Full Course Contents:

Secrets of a Winning Trader By Gareth Soloway, Get More Details in This Free Video Sample:

Secrets of a Winning Trader By Gareth Soloway, Grab Your Free PDF Sample Below:

Overview this course

Secrets of a Winning Trader by Gareth Soloway is the mastery-level program in the Winning Trader Series for investors who want a complete, systematic approach to technical trading across crypto, stocks, commodities, and forex. Instead of piecing together scattered tactics, you’ll study the full architecture behind Gareth’s personal methodology—how he structures decisions, validates setups, manages risk, and executes with discipline to achieve a historically high win rate.

Filmed as an advanced, step-by-step curriculum, the course distills two decades of real-market experience into clear principles you can apply the moment you open a chart. You’ll learn the confirmation triggers Gareth trusts most, when and how they stack into high-probability trades, and how to recognize top and bottom inflection zones with precision. The emphasis is on rules, probabilities, and repeatable execution—so your results are driven by process rather than headlines or hype.

This is not an entry-level walkthrough. It is a rigorous training in professional-grade technical analysis and trader psychology that shows you how to remove noise, follow the chart, and let risk management do the heavy lifting. If your goal is to trade with confidence in any market climate, this course is designed to help you build—and use—an edge.

Why should you choose this course?

-

A complete, rules-based framework: Move beyond single indicators; learn how setups, confirmations, and context align before you risk capital.

-

Advanced technical clarity: Study Gareth’s favorite signals—including proprietary concepts like Confirmation Signal and Tail Theory—with precise entry, stop, and target logic.

-

Inflection mastery: Learn how to identify key reversal zones, distinguish minor from major levels, and avoid the traps that form around tops and bottoms.

-

Cross-market relevance: Apply one unified method to crypto, equities, commodities, and FX, so you can stay active without reinventing your playbook.

-

Execution discipline: Install habits that reduce emotional bias—predefined plans, robotic rules, and post-trade reviews that sharpen your edge over time.

-

Deep practice materials: Structured modules, detailed chart breakdowns, and on-demand replays to refine your skill set at your own pace.

-

Safety by design: Emphasis on risk sizing, invalidation points, and capital preservation so one trade never defines your month.

What You’ll Learn

A multi-factor blueprint for high-probability trading

-

Market structure & context

-

Read trend, range, and transition phases; know when conditions favor mean reversion vs. breakouts.

-

Build top-down bias: higher-timeframe levels first, then intraday precision for entries.

-

Differentiate strong vs. weak trends using momentum and breadth without overfitting indicators.

-

-

Support, resistance, and smart levels

-

Draw accurate trend lines and channels; validate them with touch count, slope integrity, and confluence.

-

Map major vs. minor zones so you avoid chasing price into supply/demand pockets.

-

Use round numbers, gaps, and anchored reference points to anticipate reaction areas.

-

-

Confirmation Signal (Gareth’s playbook)

-

Learn the exact checklist that upgrades a “nice chart” into a trade you can size: structure, trigger, and follow-through.

-

Time the second test vs. the first touch, and why waiting often improves odds and risk-reward.

-

Scale-in logic for partial fills while maintaining clear invalidation.

-

-

Tail Theory (precision on reversals)

-

Identify exhaustion wicks and capitulation tails that reveal trapped order flow.

-

Pair tails with volume and location (e.g., at prior weekly level) to improve reversal confidence.

-

Manage entries against tails with tight stops that respect market noise.

-

-

Pattern library for momentum and reversals

-

Bull and bear flags that actually continue (and how to spot when a flag is morphing into the opposite structure).

-

Double tops/bottoms, head-and-shoulders, wedges, and failed breakouts—what confirms, what invalidates, and how to target.

-

Multi-timeframe pattern alignment to avoid false breaks on lower timeframes.

-

-

Calling major tops & bottoms (responsibly)

-

Build confluence: higher-timeframe levels + momentum divergence + tail behavior + volume anomalies.

-

Use staged profit-taking near first trouble areas; let runners trail if breadth confirms.

-

Recognize early warning signs (RSI/MACD context, breadth deterioration, risk-on/risk-off rotations).

-

-

Risk management & trade mechanics

-

Position sizing by volatility and distance to invalidation; avoid uniform “one size fits all.”

-

Pre-define three numbers before any click: entry, stop, and first target; no exceptions.

-

Journaling templates for setup quality, execution grade, and outcome vs. plan.

-

-

Robotic execution & psychology

-

Build routine: pre-market prep, watchlist pruning, alert placement, and after-close review.

-

De-program FOMO and fear by systematizing your decision tree.

-

Separate signal from story—reduce news and social noise to preserve objectivity.

-

How the course is structured

-

20 advanced modules (~8 hours) with segmented lessons: watch, pause, rewind, and study at your pace.

-

Independent learning portal: progress tracking, variable playback speed, and module notes for quick review.

-

Live-style breakdowns: real chart case studies that connect principles to practice across asset classes.

-

Practice checklists: confirmation criteria, pattern diagnostics, and risk rules you can print and use.

Key skills you’ll walk away with

-

A codified edge: from “I think” to “If A + B + C, then trade; otherwise, pass.”

-

Chart literacy that travels well: stocks one day, crypto the next—same method, consistent language.

-

Risk fluency: position sizing and invalidation that protect capital while allowing winners room to run.

-

Timing sense: patience to wait for confirmation; decisiveness to act when your criteria align.

-

Self-review habit: objective logs that convert experience into measurable improvement.

Tools, concepts, and bonuses highlighted inside

-

Confirmation Signal—the final green light sequence Gareth uses to enter with confidence.

-

Tail Theory—how capitulation and exhaustion present visually and how to exploit the snapback.

-

Reversal diagnostics—divergence context, volume footprints, liquidity sweeps, and level retests.

-

Pattern continuation vs. failure—know when a bull flag is degrading into a bear flag (and how to flip bias).

-

Bear & bull market playbooks—adapt tactics to volatility, trend persistence, and macro backdrop.

-

The “Robotic Trader” model—checklists, alerts, and if-then rules that reduce emotional interference.

What’s included

-

Over 8 hours of master-level content across 20 modules led by Gareth Soloway.

-

On-demand access to the online portal—rewind, rewatch, and review notes anytime.

-

Advanced strategy deep dives featuring Gareth’s go-to signals and multi-factor confirmation.

-

Execution frameworks—from trendline discipline to support/resistance hierarchy and pattern validation.

-

Mindset training—methods to trade the plan, not the noise, and to maintain composure through volatility.

Note: This educational program focuses on technical analysis and systematic decision-making. It is not financial advice; all trading involves risk. The value here is in the repeatable process and disciplined execution you develop.

Who Should Take This Course?

-

Experienced retail traders who have the basics down but need a cohesive, higher-probability system to scale consistency.

-

Active swing and day traders in crypto, equities, commodities, or FX who want multi-market tools and a unified language for setups.

-

Technicians leveling up from chart patterns and indicators to context + confirmation models with clearer odds.

-

Investors with a tactical sleeve who want to time entries/exits more effectively around major levels.

-

Analysts and educators seeking a rigorous, teachable framework for pattern validation and risk design.

-

Re-builders returning from drawdowns who need structure, patience, and risk discipline to regain momentum.

If you’re ready to replace impulsive decisions with systematic execution—and measure your results by adherence to plan rather than outcome—this course meets you where you are and installs the professional habits that compound.

Conclusion

Winning in markets is less about predicting the future and more about responding to the present with rules you trust. Secrets of a Winning Trader shows you how to build that trust: define structure, wait for confirmation, manage risk with intention, and execute like a professional. You will see precisely how advanced signals align, how tops and bottoms form, and how to adapt the same method across assets and regimes.

The payoff is practical and measurable. You’ll cut noise, stop forcing trades, and focus on high-quality opportunities where probabilities and risk-reward converge. Over time, the edge you practice becomes the edge you own—one setup, one journaled trade, one disciplined decision at a time.

Start trading like a professional—enroll now, study the first modules tonight, and put your confirmation checklist to work on your very next chart.

Reviews

There are no reviews yet.