Free Download Subject to Investing eCourse 2025 by William Bronchick – Here’s What You’ll Get Inside:

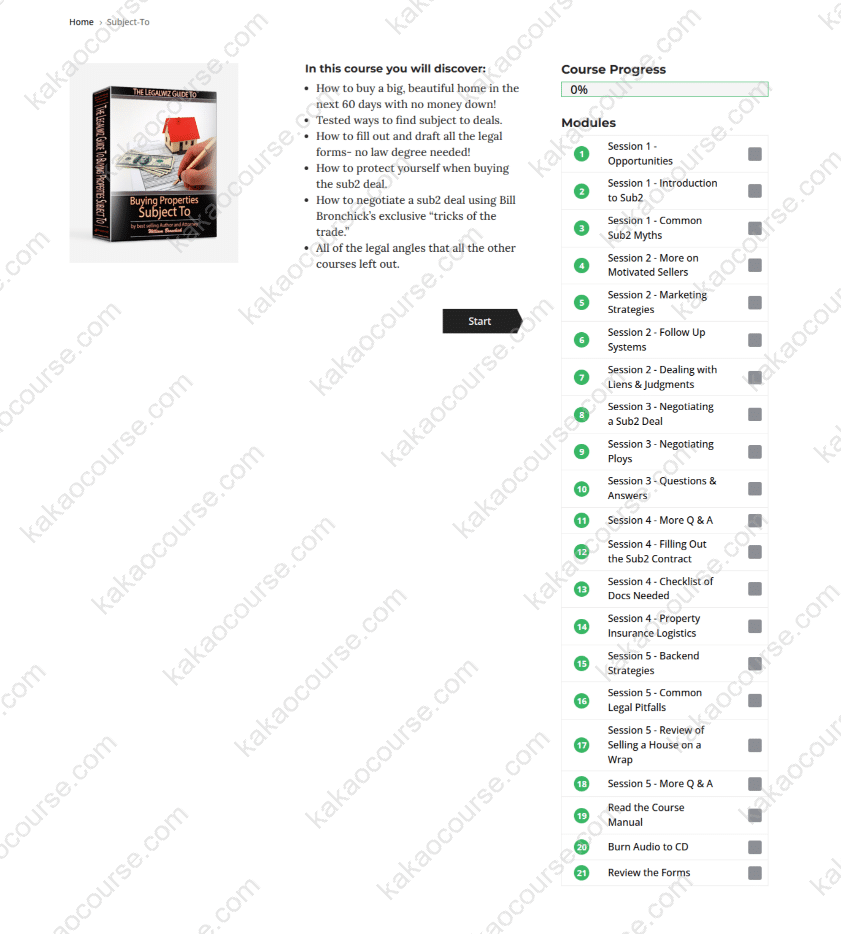

Subject to Investing eCourse 2025 by William Bronchick, Sneak Peek Inside The Course:

Subject to Investing eCourse 2025 by William Bronchick, Watch Our Free Video Sample to Find Out More:

Subject to Investing eCourse 2025 by William Bronchick, Grab Your Free PDF Sample Below:

Subject to Investing eCourse 2025 by William Bronchick is a step-by-step training designed for investors who want to acquire properties without chasing bank approvals, large down payments, or high interest rates. Built around the practical, legal, and ethical execution of “buying subject to” the existing mortgage (often shortened to “Sub2”), this eCourse equips you with modern sourcing tactics, airtight documentation, and negotiation frameworks that work in today’s market—so you can move from theory to action with confidence.

Overview this course

Traditional financing can slow you down—especially when interest rates are high and underwriting standards are strict. Subject to investing offers an alternative: you acquire the deed to a property and agree to keep making payments on the seller’s existing mortgage, while structuring the paperwork and disclosures to protect all parties. Done correctly, this approach can help you buy income property with minimal cash out of pocket, create solutions for distressed or highly motivated sellers, and grow a portfolio faster than conventional routes.

This eCourse is authored and taught by William Bronchick, a best-selling author and attorney with thousands of transactions under his belt. Rather than a teaser, the program is a “meat-and-potatoes” curriculum: you get a comprehensive manual, streaming videos, audio lessons, editable forms, and a proven seller conversation script. Each component is crafted to help you implement right away—no fluff, no filler.

Across concise modules and clear checklists, you’ll learn how to find off-market Sub2 opportunities, communicate value to sellers, overcome common objections, and paper your deals with the correct forms and disclosures. The goal is simple: help you acquire more properties, responsibly and efficiently, in any market cycle.

Why should you choose this course?

-

Built for 2025 realities

Lending standards, title practices, and seller expectations have changed. This course reflects current tactics, documentation, and risk controls suited to today’s environment. -

Guidance from a practitioner-attorney

You’re learning from an instructor who has both executed deals and advised on them legally, so you understand the mechanics and the guardrails. -

A complete, implementation-ready toolkit

Editable MS Word forms and disclosures, a Sub2 contract with addendum language, a refined seller telephone script, and analysis calculators ensure you’re not guessing at the next step. -

Clear negotiation frameworks

You’ll know exactly how to start conversations, qualify motivation, present options, and respond credibly to tough objections. -

Off-MLS deal flow

Dozens of ways to source sellers—so you’re not dependent on the MLS or a single, fragile marketing channel. -

Ethical, transparent approach

The curriculum emphasizes proper disclosures, documentation, and communication that respect sellers and protect your reputation. -

Flexible learning formats

A searchable, printable manual, streaming videos, and downloadable audio mean you can study at home, in the car, or between appointments.

What You’ll Learn

1) Sub2 Fundamentals—The Model, Legally and Practically

-

How “subject to the existing mortgage” is structured, what you take title to, and what stays in place.

-

Roles of buyer, seller, lender, and closing/title company.

-

Why disclosures matter, and where they belong in the file.

-

Typical timelines from first call to closing.

2) Finding Sub2 Deals (Beyond the MLS)

-

Targeted outreach methods to reach motivated sellers—distress signals, life-event triggers, and property data that indicate Sub2 fit.

-

Direct-response letters and digital campaigns that open doors without hype.

-

Local relationships (investor meetups, attorneys, property managers) that consistently surface leads.

-

A weekly system for prospecting, follow-up, and pipeline hygiene so momentum never stalls.

3) Negotiating with Sellers—Scripts That Earn Trust

-

Discovery call structure: qualify motivation, monthly payment pressure, and timing.

-

How to frame the Sub2 option as a solution, not a gimmick.

-

Objection handling, including:

-

“What if you stop making payments?”

-

“What happens to my credit?”

-

“Will the bank call the loan due?”

-

-

Role-play examples showing language that’s clear, accurate, and reassuring—without overpromising.

4) Paperwork, Forms, and Disclosures—From Offer to Close

-

The essential documents: purchase contract (subject-to language), seller disclosures, authorization to release info, limited power of attorney (where appropriate), trust/LLC structures, and escrow instructions.

-

Documentation flow: when each form is presented, signed, and stored.

-

How to keep a clean, auditable file that a title company (and your future self) will thank you for.

-

Addendum elements you can adapt with local counsel to fit your jurisdiction.

5) Practical Risk Controls

-

Servicer communication strategies and payment verification.

-

Insurance considerations (hazard, liability, additional insured requests).

-

Understanding the “due-on-sale” clause risk and common mitigation practices used by professionals.

-

When a deal is not a Sub2 deal—and how to walk away early.

6) Deal Analysis & Profit Models

-

Fast underwriting using rental comps and expense benchmarks.

-

Calculating true cash flow with taxes, insurance, vacancies, and cap-ex reserves.

-

When numbers are tight: wraps, lease-options, or quick resales as exit strategies.

-

Spreadsheet calculators to set your maximum allowable offer and stress-test scenarios.

7) Working with Title/Closing Pros

-

How to present your deal to a title company or attorney so they understand your structure.

-

What to expect at closing (escrow instructions, payoffs, prorations, servicing handoffs).

-

Funding small incidentals without derailing timelines.

8) Foreclosure & Over-Financed Properties—Turning “Lemons” into Deals

-

How to approach sellers with little or no equity in a way that’s ethical and mutually beneficial.

-

Crafting terms that keep payments current and preserve a seller’s credit trajectory.

-

Compliance checkpoints when timelines are tight.

9) Your First 60 Days—A Repeatable Weekly Rhythm

-

Outreach volume targets, follow-up cadences, and KPI tracking (contact rate, appointment set, contracts signed).

-

Building a light CRM using spreadsheets or simple tools so nothing slips through the cracks.

-

A simple post-close checklist for smooth onboarding of each property.

What’s Included in the eCourse

-

A detailed, 100+ page course manual with step-by-step instructions, completed examples, and checklists.

-

Four streaming training videos that break down the process with real scenarios.

-

Downloadable audio lessons for learning on the go.

-

A proven telephone script (plus audio walk-through) showing how to steer conversations and capture the right data.

-

All the key legal forms and disclosures—including a stand-alone Sub2 contract and an addendum that integrates with common state “standard” contracts.

-

Editable MS Word documents so you can tailor language with your local attorney.

Important note: Real estate law is jurisdiction-specific. The course shows you what to use and why, and encourages you to adapt forms and strategies with qualified local counsel.

Who Should Take This Course?

-

New and intermediate investors who want a faster path to additional doors without relying on traditional bank loans and large down payments.

-

Buy-and-hold landlords looking to add cash-flowing properties while preserving capital for repairs and reserves.

-

Investors in competitive, low-inventory markets who need “outside-the-box” acquisition strategies to win deals others miss.

-

Agents and acquisition managers who want another arrow in the quiver to monetize leads that don’t fit conventional financing.

-

Time-constrained professionals seeking a structured, ethical way to acquire assets part-time with repeatable systems.

-

Problem-solvers at heart who value creating win-wins for sellers in challenging situations (pre-foreclosure, payment fatigue, or relocation).

If you appreciate clarity, checklists, and legal precision—and you want an approach that respects sellers while scaling your portfolio—this program is built for you.

Conclusion

“Buying subject to” is not a loophole; it’s a professional strategy that, when executed properly, solves real problems for sellers and accelerates portfolio growth for investors. The Subject to Investing eCourse 2025 by William Bronchick distills years of hands-on experience into a practical, current, and ethical system: how to find the right sellers, how to have the right conversations, and how to document deals the right way.

You’ll walk away with a complete operating playbook—prospecting plans, negotiation scripts, legal documentation, and risk controls—so you can evaluate opportunities with precision and close confidently. Whether you’re pursuing your first Sub2 deal or building a repeatable acquisition machine, this program gives you the structure and tools to move forward decisively in today’s market.

Take the next decisive step—enroll now and start acquiring properties the smart way, without waiting on bank approvals.

Reviews

There are no reviews yet.