Free Download The Ultimate Guide to Fix and Flips 2025 by William Bronchick – Includes Verified Content:

The Ultimate Guide to Fix and Flips 2025 by William Bronchick, See What’s Included In This Course:

The Ultimate Guide to Fix and Flips 2025 by William Bronchick, Check Out the Free Sample Audio Here:

The Ultimate Guide to Fix and Flips 2025 by William Bronchick, Check Your Free PDF Sample Here:

Fix-and-flip isn’t about swinging a hammer—it’s about mastering numbers, timelines, and teams. The Ultimate Guide to Fix and Flips 2025 by William Bronchick presents a structured, compliance-minded blueprint for finding undervalued properties, renovating with discipline, and exiting profitably. Authored by best-selling writer and attorney William Bronchick, this program distills years of field experience into a step-by-step system you can follow without guesswork. If you want larger, faster “chunks” of cash to accelerate debt payoff, seed new investments, or fund big life goals, this course shows you how to pursue that outcome with professional rigor.

Overview this course

This course walks you through the complete life cycle of a flip—from first lead to final closing—so you can make confident decisions at each stage:

-

How to source deals consistently beyond crowded listing sites

-

How to underwrite in minutes, then verify with deeper diligence

-

How to write offers that get accepted without overpaying

-

How to scope, budget, and schedule a rehab that stays on track

-

How to hire, manage, and pay contractors while maintaining leverage

-

How to market and sell like a pro to compress days-on-market

-

How to document each step for clean closings and defensible files

Rather than relying on “luck” or market appreciation, you’ll learn to build profit into the deal at acquisition, then protect it with tight execution: realistic ARV, conservative budgets, defined milestones, and exit strategies planned from day one.

Why should you choose this course?

-

Instructor credibility you can count on

William Bronchick is both an active investor and an attorney. You get practical tactics backed by legal clarity—vital when contracts, disclosures, and compliance determine outcomes. -

Built for 2025 market dynamics

Inventory mix, buyer expectations, and permitting timelines have evolved. The course reflects today’s valuations, materials lead times, and title/escrow workflows so you operate on current realities. -

Numbers-first decision making

You’ll adopt a consistent underwriting framework: conservative comps, realistic repair budgets, true carrying costs, and sensitivity tests that help you walk when the math doesn’t work. -

Operational discipline

Learn milestone-based payments, written change-order rules, and punch-list close-outs—controls that prevent cost creep and “one more month” of holding pain. -

Full toolset, ready to use

Checklists, scripts, templates, and calculators remove the guesswork. You’ll know what to send, what to say, and what to sign—at the right moment. -

Ethical, transparent approach

The training emphasizes clean paperwork, fair dealing, and accurate marketing—because your reputation compounds faster than any single deal.

What You’ll Learn

1) Deal Sourcing That Works Outside the MLS

-

Neighborhood data patterns that hint at hidden value (days-on-market outliers, condition-adjusted comps, partial rehabs).

-

Off-market channels: tired landlords, inherited homes, relocation timelines, code/permit leads, targeted direct mail, and agent “pocket” opportunities.

-

A weekly pipeline rhythm so lead flow continues even while a project is underway.

2) The 7-Minute Screen (Then the Deep Dive)

-

Rapid filters for price per square foot, repair level, local ARV ceilings, and resale buyer profiles.

-

When to advance to a full underwrite using a T-chart budget (must-do vs. nice-to-have), vendor quotes, and inspection cues.

-

Red flags that kill deals early: unpermitted additions, foundation movement, strange easements, or zoning/HOA hurdles.

3) Underwriting & Offer Strategy

-

Calculating MAO (Maximum Allowable Offer) with accurate ARV, repair costs, carrying costs, and a margin that respects risk.

-

How to structure offers that solve seller problems (timing, as-is, clean close) without sacrificing your spread.

-

Multiple outs and document requests that protect you during due diligence.

4) Rehab Planning & Budgeting (Before a Tool Is Lifted)

-

Building a detailed scope of work with quantities, finish levels, and acceptance criteria to get apples-to-apples bids.

-

Creating a contingency appropriate to project age, permit risk, and trade availability.

-

Sequencing that saves time: demo → rough-ins → inspections → close-ins → finishes—plus ordering long-lead materials early.

5) Contractor Selection & Control

-

How to qualify GCs/subs: license, insurance, references, backlog, crew control, and past punch-list performance.

-

A milestone-based payment plan with retainage, daily logs, and weekly check-ins.

-

Written change-order workflow (scope, cost, added days) to stop “scope creep.”

-

Using partial and final lien waivers to prevent double-pay risk.

6) Compliance & Building-Department Basics

-

Which scopes typically require permits (structural, electrical, plumbing, HVAC, egress/life-safety).

-

Scheduling inspections to match the critical path—so crews aren’t waiting on approvals.

-

Lead-safe practices on pre-1978 homes and keeping a tidy compliance file from day one.

7) Financing, Cash Flow & Risk Management

-

Comparing hard-money, private lenders, and partners; balancing rate/points against speed and certainty.

-

Modeling true holding costs (interest, taxes, insurance, utilities, HOA) to avoid “invisible leaks.”

-

Insurance coverage: builder’s risk, liability, additional insured certificates, and documenting pre-existing conditions.

8) Cost-Saving Without Corner-Cutting

-

Standardizing finishes and vendor SKUs to reduce waste and speed turns.

-

Tactical cosmetic improvements that deliver outsized value: kitchens and baths (right-sized), lighting packages, curb appeal.

-

Where not to skimp: waterproofing, electrical safety, and anything that triggers re-work or inspection failures.

9) Marketing & Disposition Like a Pro

-

Pre-launch checklist: pro photos, accurate features list, renovation summary sheet, and neighborhood highlights.

-

Pricing strategy for speed vs. squeeze—reading micro-market signals, then adjusting decisively in week one.

-

Negotiation frameworks for inspection objections and appraisal gaps; backup-offer playbook to protect timelines.

10) Legal & Tax Building Blocks (Plain English)

-

Purchase agreements, addenda, disclosures, and close-out documents every flipper should know.

-

Entity basics and file hygiene so you can withstand diligence from buyers, lenders, and partners.

-

High-level tax considerations to review with pros (timing, basis, expense tracking)—so records stay clean and auditable.

11) KPIs & Scaling Beyond the First Deal

-

The numbers that run the business: response rate, contract-to-close duration, budget variance, punch-list cycle time, and net spread.

-

A lightweight dashboard so you catch slippage early and compound small operational wins.

-

Hiring help (transaction coordination, field runners, bookkeeping) only when metrics justify it.

12) Real-World Case Patterns

-

Tight cosmetic flips vs. heavy rehabs—how timelines and contingencies differ.

-

Neighborhood ceiling awareness: when “over-improving” quietly erases your margin.

-

Common pitfalls (permit surprises, contractor swaps mid-project) and the systems that keep them from sinking profits.

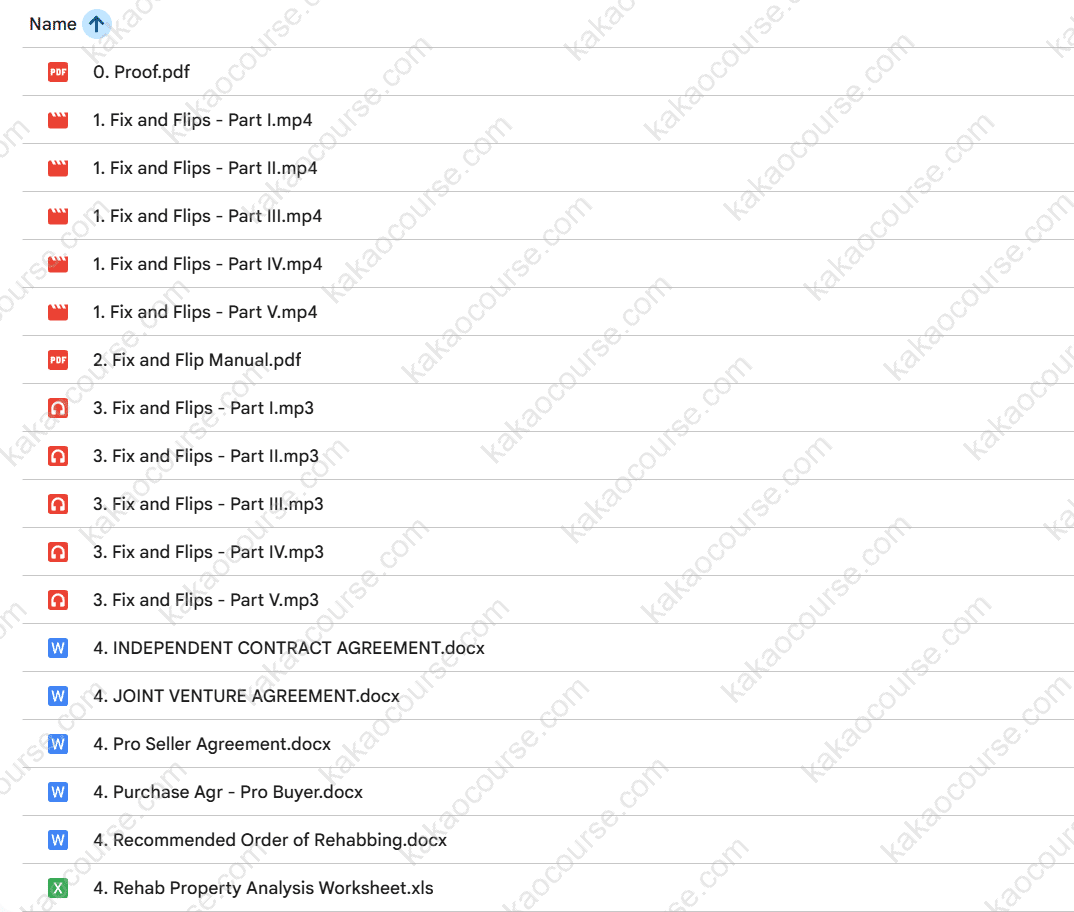

Included Materials

-

A detailed, searchable course manual with checklists and filled-out examples

-

Streaming video lessons recorded live for practical walkthroughs

-

Downloadable audio sessions for reinforcement on the go

-

Editable forms, scopes, change orders, lien waivers, and offer templates

-

Simple spreadsheets for deal analysis, budgets, and timeline planning

Who Should Take This Course?

-

New investors seeking a clear, ethical blueprint to pursue their first flip without guessing on numbers or documents.

-

Busy professionals who want a part-time path to larger cash infusions while maintaining a day job.

-

Landlords/BRRRR investors who need project discipline to stabilize properties and recycle capital faster.

-

Agents, wholesalers, and acquisition managers looking to capture deals that don’t fit retail buyers.

-

Small contractors/design-build pros ready to step from fee work into owner profits—with better paperwork and risk controls.

-

Analytical learners who prefer checklists, measurable milestones, and clean files over hype.

If you value transparency, documentation, and repeatable systems, this training turns fix-and-flip from “hope and hustle” into a deliberate business process.

Conclusion

Profit in flipping isn’t a mystery. It’s a math problem solved by disciplined acquisition, controlled execution, and a timely exit—supported by contracts, scopes, schedules, and compliance. The Ultimate Guide to Fix and Flips 2025 by William Bronchick teaches you each of those levers in order, with the templates and checklists to implement immediately. You’ll learn where real margins come from, how to protect them, and how to build a pipeline that generates meaningful cash when you need it most.

When you approach your next project with a documented plan, milestone payments, and a numbers-driven exit strategy, you don’t rely on luck—you rely on process.

Start today—line up your first leads, run the 7-minute screen, and make an offer you can defend with confidence.

Reviews

There are no reviews yet.