Instant Download Creative Real Estate Financing Course 2025 by William Bronchick – Includes Verified Content:

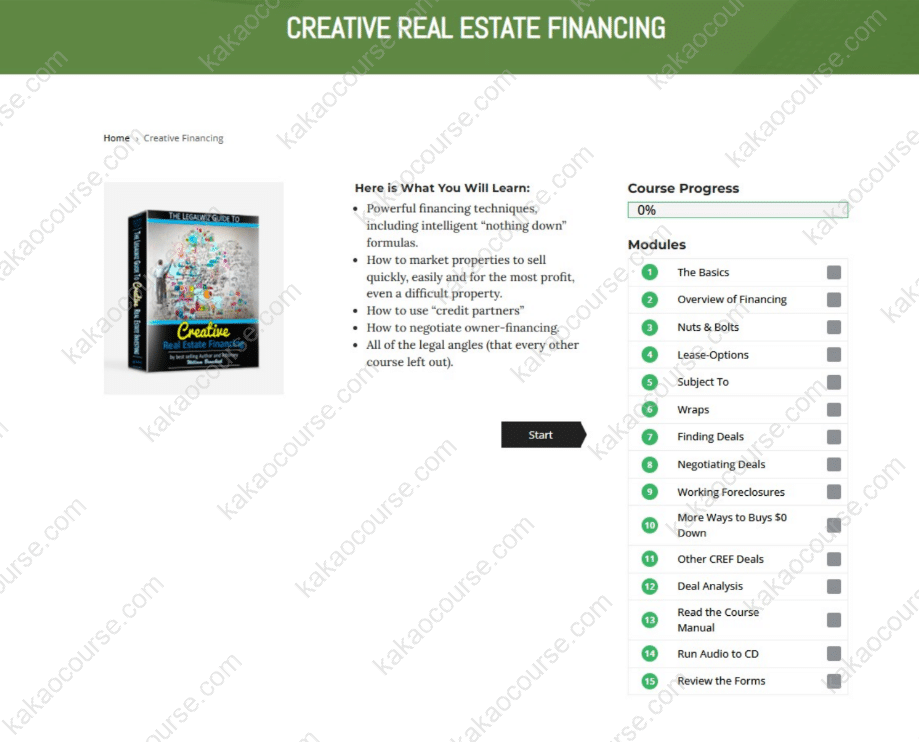

Creative Real Estate Financing Course 2025 by William Bronchick, Check Out the Full Course Contents:

Creative Real Estate Financing Course 2025 by William Bronchick, ListenThis Free Audio Sample to Learn More:

Creative Real Estate Financing Course 2025 by William Bronchick, Check Your Free PDF Sample Here:

Access to capital should never be the barrier between you and a good deal. Creative Real Estate Financing Course 2025 by William Bronchick is a practitioner-led program that teaches investors how to structure legal, ethical, win-win transactions when banks say “no” or when conventional loans are simply too slow. Drawing on decades of experience and over a thousand creatively financed closings, attorney and best-selling author William Bronchick translates complex techniques—lease/options, contracts for deed, wraparound mortgages, subject-to purchases, credit partnerships—into a clear, repeatable playbook.

This is not a teaser or a collection of buzzwords. It is a systems-driven curriculum with documents, calculators, and negotiation frameworks you can implement immediately. You will learn how to engineer terms that protect both sides, stay within regulatory lines, and still achieve outcomes that make sense in today’s market.

Overview this course

Traditional financing can be slow, document-heavy, and inflexible. Creative financing, by contrast, focuses on terms over taps—structuring timing, payment streams, contingencies, and security so that the deal works without relying on a one-size-fits-all bank loan. This course shows you, step by step, how to:

-

Find sellers open to terms and identify which tool fits their situation.

-

Draft clean, comprehensible paperwork that matches the structure you negotiate.

-

Navigate legal considerations with plain-English explanations and practical guardrails.

-

Analyze cash flow and risk realistically with spreadsheet models you can trust.

-

Market for opportunities and present offers that solve real problems.

Delivered through a comprehensive PDF manual, streaming videos, downloadable audio, editable MS Word forms, and Excel calculators, the program is designed so a committed beginner can move from reading to doing in weeks.

Why should you choose this course?

-

Led by a practitioner-attorney

William Bronchick has executed and advised on thousands of investor transactions. You benefit from both the investor’s eye for opportunity and the lawyer’s instinct for risk control. -

Built for the 2025 landscape

Deal flow, interest-rate environments, and compliance norms change. The training addresses current title practices, disclosures, and documentation so you’re operating with today’s expectations. -

From theory to implementation

You are not left to “figure it out later.” The course includes purchase addenda, option agreements, wrap riders, trust/land-contract templates, disclosures, and checklists—tools you can adapt with local counsel. -

Multiple paths to profit

Learn seven-plus structures—from sandwich lease/options to wraps and installment contracts—so you can match the right tool to each seller’s constraints. -

Ethical and transparent

The emphasis is on clear disclosures, written expectations, and fair dealing. Long-term reputation beats short-term extraction. -

Numbers first, then narrative

Spreadsheet calculators make pricing disciplined: you will see precisely how payment terms, balloon amounts, rate, and rent credits change yield and risk.

Note: Real-estate law is jurisdiction-specific. The course is educational; always coordinate structures and documents with qualified local professionals.

What You’ll Learn

1) Foundations of Creative Finance—Clarity Before Complexity

-

Core mechanics of lease with option vs. lease-purchase, contract for deed/installment land contract, wraparound mortgage/AITD, and subject-to acquisitions.

-

How title, possession, and risk of loss shift under each method—and what that means for insurance, taxes, and disclosures.

-

The role of third parties: escrow, servicers, title companies, and when to use each.

2) Finding Motivated Sellers and the Right Scenarios

-

Ten proven channels to source owner-financed and lease/option opportunities (tired landlords, inherited property, job relocations, long-DOM listings, small-balance equity).

-

Reading motivation signals quickly so you don’t force a structure where it doesn’t fit.

-

Simple, ethical marketing messages and a conversation flow that builds trust.

3) Negotiation Frameworks That Create Win-Wins

-

How to uncover timing, payment, and tax priorities and translate them into terms.

-

Price-vs-terms trade-offs: when higher price with great terms beats lower price with bank financing.

-

The “Killer Telephone Script”: question sequences that surface deal-making information without pressure.

-

Handling common objections calmly (“What if you don’t buy?” “Can I still deduct interest?” “What happens if you’re late?”).

4) Paperwork and Documentation—Forms That Protect You

-

Matching document sets to deal types:

-

Lease + Option Agreement with clear option consideration, term, and rent-credit rules.

-

Installment Land Contract and wrap riders with payment schedules, default clauses, and disclosure language.

-

Subject-To purchase agreements with performance security (e.g., performance mortgage/deed of trust addendum) and communication protocols with the servicer.

-

-

How to organize files so lenders, title, and future buyers can verify the chain of documents.

-

Using memoranda (e.g., memorandum of option) judiciously to protect your position.

5) Due-On-Sale, Dodd-Frank, and SAFE Act—Operating Within Guardrails

-

Practical discussion of the due-on-sale clause: what it is, why it exists, business-level risk management, and when to avoid certain structures.

-

Consumer-protection considerations when selling with financing: when federal and state rules may apply and how to keep lending-style compliance in view (e.g., RMLO involvement where required).

-

Documentation and third-party servicing practices that reduce misunderstandings.

6) Seven Ways to Profit with Lease/Options and Terms

-

Classic lease-option placement for consistent monthly spread + back-end.

-

Sandwich lease-option to monetize control when you don’t take title immediately.

-

Wraparound notes for interest income instead of tenant headaches.

-

Contract for deed to manage transfer timing and reduce closing friction.

-

Option assignments to capture value at the contract level.

-

Master lease for commercial/small-multifamily (with or without option) to stabilize before refinance.

-

Credit-partner structures that borrow strength responsibly without over-promising.

7) Foreclosures and Over-Financed Properties—Opportunity with Care

-

How to analyze “over-encumbered” scenarios where terms, not price, create value.

-

Ethical approaches to owners in distress: clarity on obligations, timelines, and alternatives.

-

When a creative path helps—and when to step back.

8) The Math Behind the Magic—Calculators and Case Work

-

Pricing an option and strike responsibly (market drift vs. speculation).

-

Modeling wrap yield, amortization spread, and balloon sensitivity.

-

Stress tests: vacancies, repair surprises, rate shifts, and exit delays.

-

Case studies with full numbers: what worked, what didn’t, and why.

9) Risk Controls That Separate Pros from Dabblers

-

Five “airtight” protections: performance security, insurance alignment, escrowed taxes/insurance, written cure periods, and independent servicing.

-

Preventing claims of “equitable interest” from defaulting occupants: consistent documentation and conduct.

-

Title hygiene: liens, HOA status, taxes, due-diligence checklists before anyone signs.

10) Using Retirement Accounts for Terms Deals

-

Self-directed IRA/Solo 401(k) basics in the context of notes and options; prohibited-transaction awareness; why non-recourse matters.

-

Clean money flow: income/expenses paid by the plan, not by you personally.

11) Marketing, Disposition, and Velocity

-

Creating buyer pools for terms offerings with accurate, compliant messaging.

-

How to package a property for fast movement: renovation summary, payment schedule, and disclosure packet.

-

When to keep vs. assign: thinking like a portfolio manager, not a tourist.

12) What’s Included (and How to Use It Right Away)

-

200+ page searchable manual with step-by-step instructions and examples.

-

Streaming video (~5 hours) taken from live training for context and nuance.

-

Downloadable audio for reinforcement on the go.

-

Hundreds of editable forms (leases, options, wraps, disclosures, addenda, land-trust docs, calculators, marketing templates) so you never stare at a blank page again.

-

Excel models (“cash-cow-culator,” option/lease calculators) to price confidently in minutes.

Who Should Take This Course?

-

Committed beginners with limited capital who want a responsible, document-driven entry into real estate.

-

Active investors seeking alternatives when bank financing is slow, uncertain, or misaligned with the deal.

-

Landlords and small operators aiming to convert dead leads into profitable terms transactions.

-

Agents and acquisition managers who want credible, compliant solutions for sellers and buyers outside the conventional box.

-

Analytical learners who value checklists, clear language, and repeatable processes over hype.

If you appreciate ethics, documentation, and measurable outcomes, this course provides the frameworks and forms that turn creativity into a professional edge.

Conclusion

Creative financing is not a loophole—it’s a discipline. When you understand the mechanics, respect the rules, and document precisely, you can unlock transactions others can’t touch: sellers relieved, buyers served, and investors paid for structuring solutions rather than pushing products. Creative Real Estate Financing Course 2025 by William Bronchick gives you the vocabulary, the forms, the math, and the negotiation patterns to operate at that level—so you can build steady cash flow today and a durable portfolio for tomorrow.

Put a real system behind your next terms deal—start now and craft an offer that solves a seller’s problem while protecting your downside.

Reviews

There are no reviews yet.