Instant Download Amore Money by Andrea Crowder – Here’s What You’ll Get Inside:

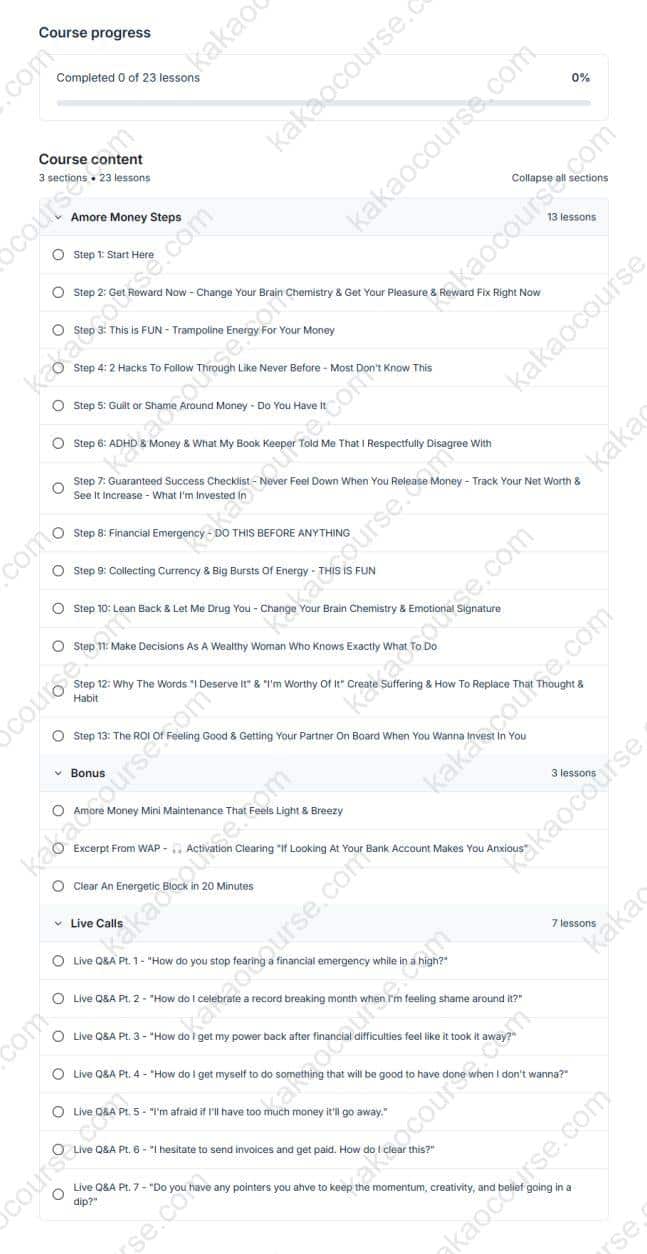

Amore Money by Andrea Crowder, A Peak into the Course:

Amore Money by Andrea Crowder, Quick Free Audio for More Information:

Amore Money by Andrea Crowder, Free PDF Preview Available Below:

Overview this course

Most money courses hand you spreadsheets and willpower. Amore Money by Andrea Crowder takes a different path: it helps you build a relationship with money that feels calm, intentional, and—yes—enjoyable ✨. Instead of pushing stricter budgets, you’ll learn how to want to be in the details, so daily actions happen naturally. The program blends two complementary layers: feminine energy (intuition, creativity, nurture) and masculine energy (information, structure, planning). Together, they create a practical, sustainable rhythm for earning, spending, saving, and investing that actually sticks.

Andrea approaches money as a behavior-change journey, not a lecture. You’ll use nervous-system–aware practices to lower anxiety, learn an “anti-budget” tracking method for real-life clarity, and adopt simple systems that make reviewing accounts feel safe and productive 💡. You’ll also get a bonus Business Money Blueprint from a professional CFO, translating your new motivation into straightforward structure—so you can organize accounts, plan cash flow, and make informed decisions without complexity.

Note: This program is educational and mindset-focused. It does not provide individualized financial, tax, or investment advice. Always verify rules in your country and consult qualified professionals when needed.

Why should you choose this course?

-

Behavior first, then numbers. If you know what to do but don’t do it, the bottleneck isn’t knowledge—it’s follow-through. Andrea shows you how to shift habits and emotions so your best practices become automatic.

-

Shame-free, pressure-free. No moralizing, no guilt trips. You’ll replace avoidance with small, repeatable wins that steadily build confidence.

-

A clear, calm system. The anti-budget approach keeps an aerial view of all accounts so you can see cash, obligations, and opportunities at a glance 🧭.

-

Real-world tools. From emergency steps to simple cash-flow planning, you’ll learn what to do first when things feel tight—and how to move strategically when you have a surplus.

-

Mindset + structure, together. Blend intuition and motivation with practical steps, templates, and the CFO’s blueprint—so your energy has a plan to run on.

-

ADHD-friendly delivery. Short, digestible lessons and playful reframes make it easier to stay engaged and finish what you start.

-

For any starting point. Whether your balance is negative or comfortable, you’ll get a path to clarity and momentum—without extreme rules or rigid budgets.

-

Ethical, authentic messaging. Learn to communicate about money (with partners, teams, and yourself) in ways that reduce friction and increase cooperation 📌.

What You’ll Learn

1) Repair your relationship with money (nervous-system aware)

-

Gentle practices to reduce “bank app dread” and turn check-ins into low-stress rituals.

-

Reframes that dissolve common energy leaks: numbers that fluctuate, bills that trigger stress, the story you tell yourself about debt.

-

How to make decisions from clarity, not fear—using a simple pause-and-check process before “yes” or “no.”

2) The “Anti-Budget” Tracking Method

-

A practical, big-picture system for monitoring accounts without micromanaging every category.

-

How to keep an aerial view so decisions consider income, expenses, savings, and upcoming obligations in one place.

-

A weekly rhythm to review balances, plan moves, and feel in control—without hours of admin.

3) Decision-making like a “Wealthy Woman”

-

A simple framework to choose from values, time horizon, and real constraints (not impulse).

-

Prevent “spending regret” by pre-committing to criteria that define a good purchase for you.

-

Goal-setting that finally works: smaller inputs you can track, instead of vague outcomes that feel far away.

4) Clear the fear: from avoidance to action

-

Tools (including RRT-style prompts) to reduce anxiety about checking balances and facing numbers.

-

A first-steps protocol for financial hiccups or emergencies—priorities to stabilize quickly and thoughtfully 🛟.

-

How to rebuild trust with yourself after past money mistakes.

5) Power Money Moves (when you have a surplus)

-

Ways to channel extra cash into savings, buffers, or investments—aligned with your stage and risk comfort.

-

How to celebrate progress without losing momentum; the “one small upgrade” rule that compounds over time.

-

Partner alignment: scripts and practices to get on the same page without pressure or blame.

6) Taxes, seasons, and planning without dread

-

Reframing tax season so you prepare with calm and clarity (especially helpful for entrepreneurs).

-

Checklists to reduce surprises: receipts, estimates, and simple habits that make filing straightforward.

-

Why rules change—and how to stay flexible and informed without obsessing.

7) Investing literacy (mindset + simple structure)

-

Andrea shares what she did (e.g., stocks/crypto exposure) for educational context—so you can explore ideas responsibly.

-

Principles for starting small, understanding risk, and focusing on long-term behavior over quick wins.

-

How to notice when excitement turns into overreach—and pull back with care.

8) Automations & AI as your assistant

-

The low-lift automations Andrea uses (payments, savings, reminders) to reduce mental load.

-

How to use AI to summarize statements, track patterns, and prep questions for your accountant—while protecting privacy 🛡️.

-

A “set and sanity-check” routine: automate, then review briefly each week.

9) When expert advice conflicts

-

How to evaluate suggestions from bookkeepers or advisors against your values, cash-flow reality, and season of life.

-

A simple second-opinion checklist so you can disagree respectfully—and choose your path with confidence.

10) The Business Money BLUEPRINT (bonus with CFO support)

-

Build or refine your money map: accounts, transfers, buffers, and an owner’s pay system.

-

Structure for taxes, team, and recurring costs—so growth doesn’t outpace your foundation.

-

A quarterly planning cadence that connects revenue goals to concrete, trackable inputs 📈.

11) Motivation that lasts

-

The “feel good, do good” loop: why positive emotion improves follow-through and ROI of your time.

-

Celebrations that reinforce identity (“I’m someone who takes care of my money”) without encouraging overspending.

-

How to keep momentum when numbers aren’t yet where you want them—progress markers beyond the balance.

Who Should Take This Course?

-

Entrepreneurs and creators who want their business to support life—not swallow it—by installing calm, repeatable money practices.

-

Professionals who feel anxious around numbers and need a friendly, nonjudgmental path to clarity.

-

ADHD-prone or easily overwhelmed learners who want short lessons, playful energy, and a system that doesn’t rely on perfection.

-

Couples or collaborators looking for shared language and simple rituals to reduce money friction.

-

Anyone starting from “less than zero” who wants step-one stability, then growth—without shame or extreme austerity.

-

Those with decent income but inconsistent results, ready to pair structure with motivation so earnings become wealth.

Conclusion

You don’t need another rigid budget or a 700-page finance tome. You need a relationship with money that feels safe, engaging, and aligned—so you naturally show up for the details. Amore Money weaves mindset and structure into one experience: calm your nervous system, adopt an aerial view of your accounts, make values-based decisions, and install light automations that keep progress steady. Pair that with the Business Money Blueprint and you’ll have both the will and the way to move from pressure → pleasure → power with your finances. Small steps compound; confidence grows; the numbers begin to reflect your new habits 🌱.

Ready to start?

Open your accounts for a five-minute check-in today, install the anti-budget view, and take the first gentle step toward a calmer, more empowered relationship with your money—one everyday action at a time 🚀.

Reviews

There are no reviews yet.