Instant Download The No-BS Guide to Crypto Investing (Updated with 2025 Cycle Price Targets) by STRONGLAND Publishing – Here’s What You’ll Get Inside:

The No-BS Guide to Crypto Investing (Updated with 2025 Cycle Price Targets) by STRONGLAND Publishing, Sneak Peek Inside The Course:

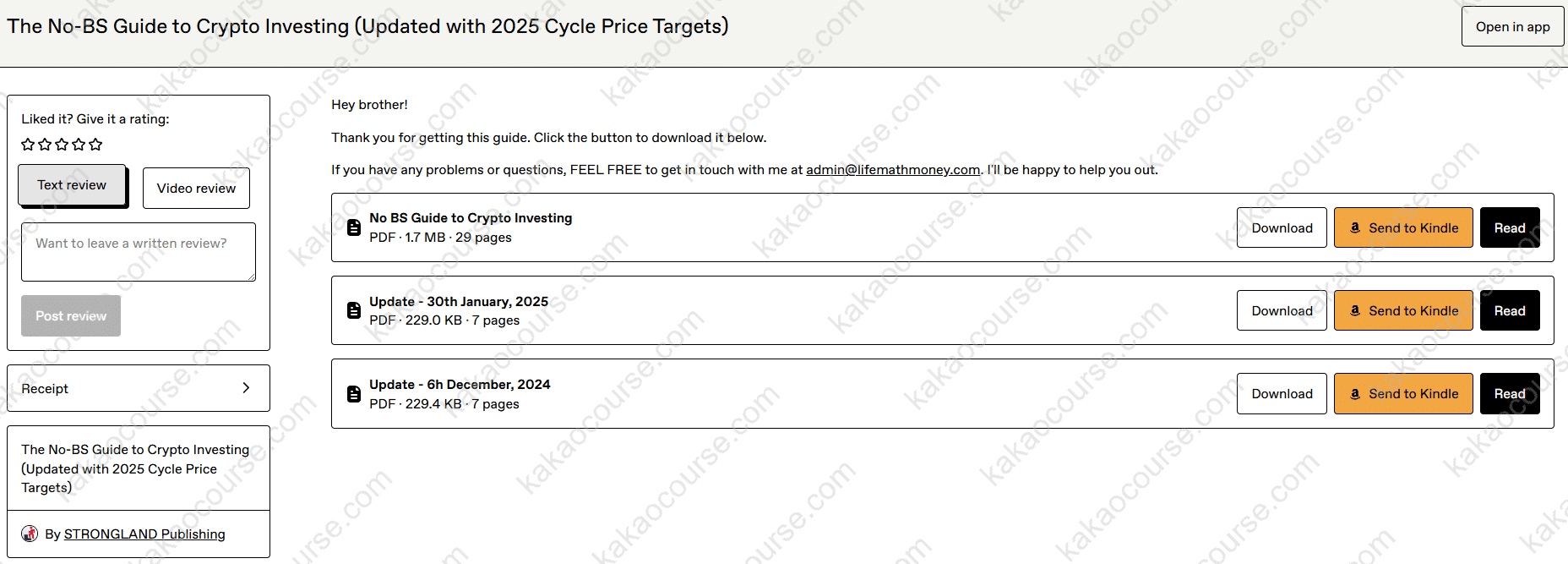

The No-BS Guide to Crypto Investing (Updated with 2025 Cycle Price Targets) by STRONGLAND Publishing, Free PDF Preview Available Below:

Overview This Course

The No‑BS Guide to Crypto Investing (Updated with 2025 Cycle Price Targets) by STRONGLAND Publishing is a pragmatic, risk‑first handbook for serious investors who want exposure to digital assets without getting trapped by hype cycles. Authored by Harsh Strongman—the creator behind Life Math Money and the writer of a widely read free primer on crypto technology—this guide translates hard‑won market lessons into a clear, repeatable approach you can apply immediately.

Instead of promising miracles or pushing speculation, the guide teaches you how crypto markets actually behave across cycles and how disciplined investors structure positions, manage volatility, and exit profitably. The 2025 update integrates fresh cycle insights and target frameworks so your decisions reflect the landscape as it is, not as it was several years ago. The result is a plan designed to protect capital during euphoric tops, redeploy intelligently after pullbacks, and compound gains over time—without day‑trading or relying on rumors.

This is not about chasing the loudest coin of the week. It’s about building a coherent, rules‑based system: portfolio architecture, entry/exit criteria, risk controls, and a cadence for reviewing your thesis as conditions change. Readable, direct, and tightly organized, the guide favors clarity over jargon and process over predictions.

Why Should You Choose This Course?

-

Strategy that prioritizes capital preservation. The core thesis is simple: losses are harder to recover than missed gains. You’ll learn to avoid the common trap of buying euphoria and holding through multi‑year drawdowns.

-

Cycle‑aware approach calibrated for 2025. Markets move in regimes. The updated playbooks help you think in cycles—accumulation, expansion, distribution, contraction—so you don’t mistake a topping structure for the “start of a new era.”

-

Opposite of FOMO. You’ll adopt objective criteria for entries and exits, replacing gut feel with pre‑defined triggers, position limits, and invalidation points.

-

Portfolio design you can explain to yourself. The guide offers a simple framework to separate long‑term convictions from tactical bets, along with rules for sizing, rebalancing, and taking profits.

-

Built by a practitioner. The methods come from years in the market and emphasize what endures: risk management, process discipline, and execution hygiene.

-

Written for meaningful portfolios. If you’re allocating real money, you want fewer moving parts and clearer heuristics. This guide keeps the noise minimal and the decisions high‑signal.

(Educational content only. Nothing here is financial advice; always assess your own risk tolerance and local regulations.)

What You’ll Learn

1) Understanding Crypto Market Structure

-

Cycle anatomy: How liquidity, narratives, and participation shift across phases—and why entries taken during late acceleration often have the worst risk/reward.

-

Trend vs. range logic: Reading momentum and exhaustion without pretending you can predict every wiggle.

-

Relative strength thinking: Why owning the strongest assets in strong phases matters more than perfect bottoms.

2) Portfolio Architecture that Survives Volatility

-

Core–satellite design:

-

Core: A small set of liquid, high‑conviction assets held with clear invalidation levels.

-

Satellite: Smaller, thesis‑driven positions with explicit risk caps and shorter holding periods.

-

-

Position sizing rules: Simple formulas to keep any single idea from threatening the whole portfolio.

-

Rebalancing cadence: When to rebalance vs. when to let winners run; how to harvest gains without dismantling your edge.

3) Entry and Exit Playbooks

-

Entries:

-

Add on strength early in expansions rather than “bargain hunting” in confirmed downtrends.

-

Use objective triggers (breakouts, higher‑low structures, moving‑average envelopes) as confirmations, not guarantees.

-

-

Exits:

-

Tiered profit‑taking: Lock in portions into strength; keep a runner only while trend conditions hold.

-

Invalidation rules: Pre‑commit to cutting losers; never average down without a fresh thesis and capped risk.

-

-

Avoiding bag‑holding: How to prevent the “I’ll just wait to break even” spiral with pre‑written contingency plans.

4) Risk Management as a Habit

-

Max drawdown limits: Set a portfolio‑level pain threshold that triggers de‑risking.

-

Per‑trade risk caps: Decide the dollar amount you’re willing to lose before entry—and automate the stop if possible.

-

Stablecoin and cash roles: Use non‑correlated dry powder to preserve optionality for future entries.

5) Behavioral Edge

-

FOMO antidotes: Checklists to slow down decisions during viral surges.

-

Discipline rituals: Journaling templates for entries/exits, rationale, and post‑mortems so you learn from your own data.

-

Information diet: Reduce exposure to low‑signal feeds that pressure you into impulse trades.

6) Due Diligence Without Paralysis

-

Thesis compression: Fit your reasoning on one page: problem, solution, token mechanics, adoption path, key risks.

-

Red‑flag scanner: Liquidity traps, opaque token unlocks, governance centralization, or shifting roadmaps.

-

Source hierarchy: Weigh on‑chain data, official docs, and credible researchers above promotional threads.

7) 2025 Cycle Price Target Frameworks

-

Target ranges, not single numbers: Learn to work with zones derived from prior cycle behavior, breadth, and realized liquidity—not magical thinking.

-

Dynamic updates: How to adjust your targets when new data (macro, regulation, flows) materially changes the risk/return profile.

-

Distribution planning: Convert targets into practical exit ladders so realized P&L matches your strategy—not hindsight.

8) Practical Execution and Tooling

-

Account structure basics: Segregate long‑term holdings from tactical accounts to avoid accidental churn.

-

Order hygiene: Limit vs. market orders, slippage awareness, and not “hiding” from exits you don’t want to take.

-

Security fundamentals: Hardware wallet hygiene, 2FA, and backups—because operational errors can erase good investing.

-

Dashboards and alerts: Minimalist trackers for price, trend health, and portfolio exposure so you act on data, not panic.

9) Pathway to Consistency: 30/60/90 Day Milestones

-

Day 1–30:

-

Define risk budget, choose your core assets, set invalidations.

-

Write your do‑not‑do list (no chasing, no adding to losers, no impulse alt rotations).

-

-

Day 31–60:

-

Deploy satellites with tight risk caps; start tiered profit‑taking rules.

-

Weekly review ritual: trend health, exposure, and whether targets need adjusting.

-

-

Day 61–90:

-

Scale what’s working; cut what isn’t.

-

Codify your personal playbook into checklists and automate as much as possible.

-

10) Common Pitfalls (and How to Avoid Them)

-

Buying tops because “this time is different.” Learn to recognize late‑cycle tells and step aside.

-

Over‑diversification into illiquid names. Concentrate within your circle of competence.

-

No exit plan. Pre‑write profit and loss scenarios and follow them.

-

Confusing activity for progress. Fewer, better decisions beat constant tinkering.

11) Ethics, Compliance, and Personal Constraints

-

Know your boundaries: Time commitment, stress tolerance, and jurisdictional rules.

-

Documentation discipline: Keep records of decisions and rationale for accountability and learning.

-

Long‑term view: Your edge is surviving multiple cycles; shortcuts tend to be expensive.

Who Should Take This Course?

-

Investors allocating meaningful capital who seek high returns without taking reckless risks. If you want a durable process rather than a stream of coin tips, this is for you.

-

Professionals and business owners who value time‑efficient systems: a few high‑quality decisions per month, not constant screen‑watching.

-

Serious beginners who prefer a structured introduction grounded in risk management and cycle literacy.

-

Experienced participants who made money in bull phases but struggled to keep it; you’ll learn to institutionalize profit‑taking and protect downside.

This guide is about method, not memes. It assumes you respect volatility and prefer rules you can follow under pressure. It’s especially relevant if your portfolio is large enough that “winging it” is no longer acceptable.

Conclusion

The hardest part of crypto investing isn’t finding a narrative—it’s sticking to a rational plan when volatility tests your patience. The No‑BS Guide to Crypto Investing (Updated with 2025 Cycle Price Targets) gives you that plan: a cycle‑aware framework, a sensible portfolio structure, precise entry and exit playbooks, and practical risk controls that help you keep what you earn. Instead of waiting years just to break even, you’ll learn how to avoid late‑cycle traps, capture upside with intent, and step away when the math stops working.

Clear, direct, and focused on execution, this guide replaces guesswork with process—so you can make fewer mistakes, compound more intelligently, and stay in the game long enough for your edge to matter.

Make the upgrade from hopeful to deliberate—study the framework today and put a disciplined strategy between your capital and the market’s mood swings.

Reviews

There are no reviews yet.