Free Download Actionable Options Program by Dan Darrow – Includes Verified Content:

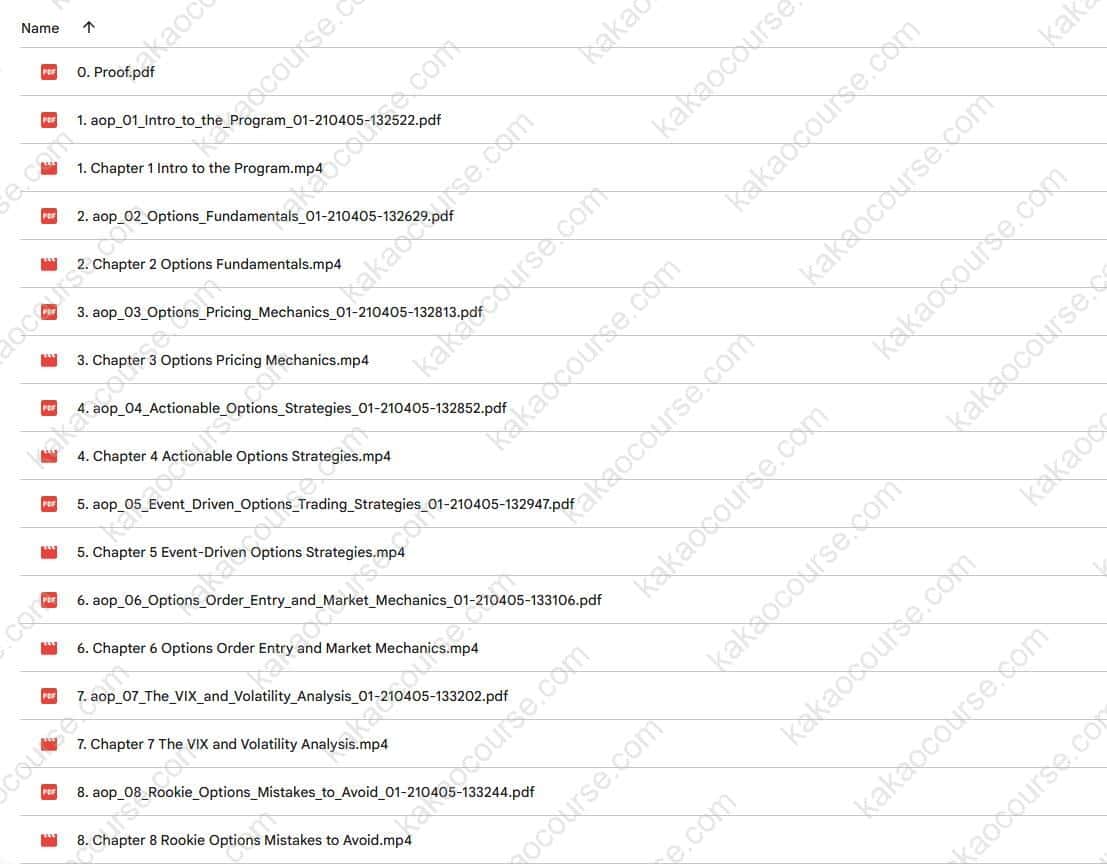

Actionable Options Program by Dan Darrow, Sneak Peek Inside The Course:

Actionable Options Program by Dan Darrow, Watch Our Free Video Sample to Find Out More:

Actionable Options Program by Dan Darrow, Free PDF Preview Available Below:

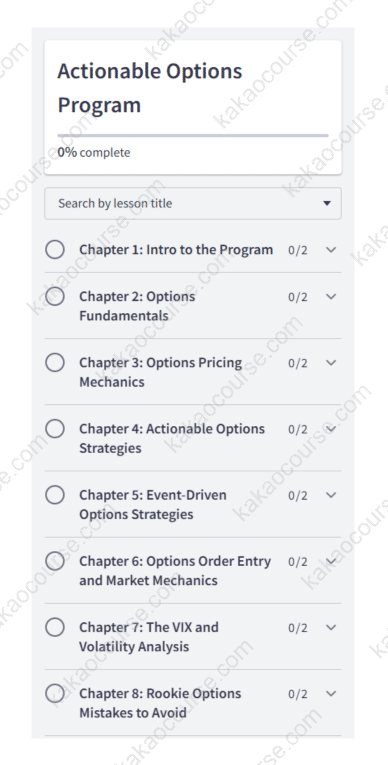

Overview this course

Actionable Options Program by Dan Darrow is a practical, plain-English pathway to trading options with clarity and control. Built by a professional proprietary trader active since 2006, this program strips away academic noise and focuses on the 1% of options theory that actually shapes real trades—how pricing behaves, how volatility moves, and how to select, enter, and manage positions with purpose. Instead of memorizing equations, you’ll learn a repeatable decision process you can apply across changing markets and scheduled events.

Across 3+ hours of tightly edited video and 8 companion PDFs (296 pages), you’ll build a foundation in options mechanics, then progress into 10 core strategies (from calls/puts and verticals to butterflies and iron condors) plus 4 event-driven frameworks designed for catalysts like earnings, Fed releases, or FDA decisions. You’ll also learn the details that most courses skip—how to place orders intelligently, how to adapt to fast markets, and how to read volatility beyond a single VIX print.

The curriculum is intentionally accessible for an international audience. You’ll see key ideas explained in clear language with trading examples, order-entry guidance, and checklists you can keep by your desk. By the end, you’ll know how to build trades that fit your view and risk tolerance, not the other way around—so you can stop guessing and start acting with a plan.

Educational use only. Options involve risk and are not suitable for all investors. No strategy guarantees profits. Always evaluate your own financial situation and risk tolerance.

Why should you choose this course?

-

Professional, not performative

Learn from Dan Darrow, a full-time options and equity trader since 2006, known for event-driven ideas and disciplined execution. -

Clarity over complexity

The program keeps the essential 1% of theory (implied volatility, time decay, intrinsic vs. time value) and discards the rest—so you can trade, not cram. -

Built for real catalysts

Go beyond generic spreads with 4 event-driven strategies tailored to earnings, macro prints, and regulatory decisions. -

A complete playbook

14 actionable strategies to navigate different market regimes—trending, range-bound, volatile, or quiet. -

Order entry like a pro

Learn how to stage, route, and adjust orders so slippage doesn’t eat your edge before the trade even starts. -

Volatility that makes sense

Move past “VIX = high/low” oversimplifications; understand term structure and how to align strategy with vol conditions. -

Designed for speed and safety

Smart risk frameworks, position sizing, and adjustment tactics help you trade confidently—especially into and out of events. -

Desk-side reference

Eight PDFs (296 pages) summarize lessons, setups, and checklists for fast recall during market hours. -

Beginner-friendly, growth-ready

If you’re new, the fundamentals bring you up to speed; if you’re experienced, the event module and order-entry detail sharpen your edge.

What You’ll Learn

Options Fundamentals (the plain-English core)

-

The building blocks: calls, puts, intrinsic vs. time value, moneyness—and why these matter when you’re choosing strikes.

-

The real-world meaning of theta (decay), implied volatility (IV), and extrinsic value—and how they change before and after catalysts.

-

How to align a trade structure to your thesis: directional, range-bound, or volatility-focused.

Pricing Mechanics & Greeks (without the math marathon)

-

The single question behind every trade: What do I believe about direction, magnitude, and timing compared to what’s already priced in?

-

Delta, gamma, theta, vega explained in trader terms, with quick rules for selecting expirations and strikes.

-

Why IV “crush” happens after events—and how to plan for it.

Actionable Options Strategies (10 core plays)

-

Long calls/puts with rules for selective use (when leverage beats stock).

-

Vertical spreads (debit/credit) to target zones while controlling risk and cost.

-

Butterflies & iron butterflies to define risk and focus on price areas.

-

Condors & iron condors for range-bound markets with clear adjustment tactics.

-

Calendars & diagonals to position around time and volatility differences.

-

Protective hedges: when (and when not) to insure a portfolio, plus pitfalls to avoid.

Event-Driven Options Strategies (4 specialized frameworks)

-

A step-by-step system for earnings trades (including Dan’s “Earnings Combo”) built around expected move, IV levels, and historical behavior.

-

Structuring trades for macro/Fed days when intraday ranges and IV can expand rapidly.

-

Approaches for regulatory catalysts (e.g., FDA) with asymmetric payoffs and strict risk controls.

-

Position staging, scaling, and exit logic so you’re not guessing once the headline hits.

Order Entry & Market Mechanics (the hidden edge)

-

Limit vs. mid vs. marketable limit orders—and how to work a spread without chasing fills.

-

Liquidity checks: open interest, bid/ask dynamics, and time-of-day considerations.

-

Managing fast markets: how to reduce slippage, avoid illiquid wings, and keep costs in check.

Volatility Analysis (beyond a single index)

-

Reading VIX term structure (contango/backwardation) and what it implies for spread selection.

-

Matching strategies to vol states: when condors thrive, when calendars shine, and when simple verticals are best.

-

Using expected move to frame risk, target selection, and probability.

Risk, Sizing, and Trade Management

-

Position sizing by max loss and probability so a single trade never defines your month.

-

Adjustment decision trees: roll, reduce, convert, or close—based on thesis and time remaining.

-

Post-event playbooks: capturing second-day opportunities without paying twice for volatility.

Rookie Mistakes to Avoid (and how this course prevents them)

-

Overpaying for lottery tickets, trading illiquid options, ignoring IV crush, picking expirations too tight or too far—each addressed with rules and checklists.

-

Why “more legs” ≠ “better trade” and how to simplify without losing the edge.

-

The mindset shift from prediction to probability management.

What’s Included

-

3+ hours of video across 8 chapters that walk you from foundation to execution.

-

8 PDF guides (296 pages)—keep them printed beside your keyboard for quick reference.

-

14 strategies summarized into one-page cheat sheets: what the market must believe, which risks you own, and how to exit.

Who Should Take This Course?

-

Stock traders adding options who want defined risk, smarter leverage, and event-driven plays that stock alone can’t express.

-

Options beginners seeking a structured, jargon-free start that emphasizes what actually moves P&L.

-

Busy professionals who need concise lessons, desk-side checklists, and clear rules to act fast.

-

Active investors looking to hedge portfolios, generate income in range-bound markets, or express views with limited capital at risk.

-

Event-focused traders who want a professional framework for earnings, macro, and regulatory catalysts.

-

International learners who need concepts that travel across brokers, regions, and market hours.

If you value process over hype—and want a clean playbook you can run again and again—this program is built for you.

Conclusion

Options reward clarity: clear thesis, clear structure, clear exits. Actionable Options Program gives you that clarity in a professional yet approachable format. You’ll learn the essentials that matter, master 14 strategies you can mix and match by market condition, and adopt event-driven tactics that respect volatility and probability. Most importantly, you’ll refine the parts of trading that move results in the real world—order entry, sizing, risk, and post-event management—so your edge isn’t left on the whiteboard.

Whether you’re positioning for an earnings season, balancing a portfolio into macro announcements, or simply aiming to trade with more intention, this program helps you act with confidence and avoid the expensive mistakes most beginners make. Print the guides, keep the checklists nearby, and bring a learner’s discipline. Your next trade plan can be clearer than your last—and your process stronger with every iteration.

Start the Actionable Options Program today and build a professional, event-ready options workflow you can trust in any market.

Reviews

There are no reviews yet.