Advanced 1DTE Crash Course by Justin Kay – Immediately Download

Advanced options trading does not have to be mysterious or reserved only for institutions. If you already understand the basics of options and short-dated trades and now want a deeper, data-driven approach, the Advanced 1DTE Crash Course by Justin Kay is designed with you in mind.

This course delivers over four hours of structured video content in a compact 1.05 GB package, priced at just $69.3. For less than the cost of a single losing trade, you gain access to a robust framework for building, testing, and integrating advanced 1DTE and short-term options strategies into a coherent portfolio. 📈

Taught by an experienced trader and licensed finance and tax attorney, this program helps you move beyond ad-hoc trade ideas and toward a professional, mechanical, and backtest-driven approach to 1DTE trading.

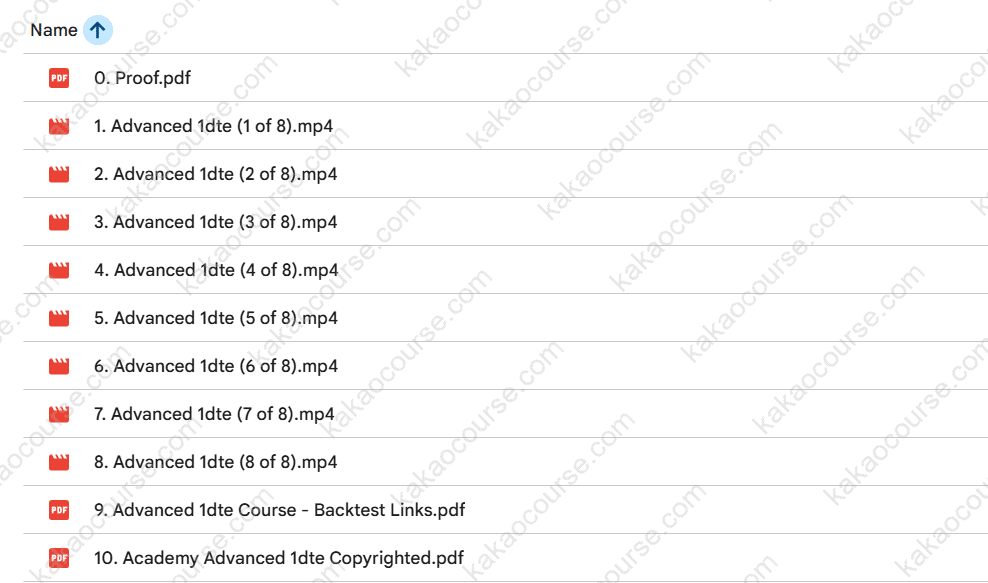

Free Download Advanced 1DTE Crash Course by Justin Kay – Here’s What You’ll Get Inside:

Advanced 1DTE Crash Course by Justin Kay, Sneak Peek Inside The Course:

Advanced 1DTE Crash Course by Justin Kay, Check Out This Free Video for Additional Information:

Advanced 1DTE Crash Course by Justin Kay, Free PDF Preview Available Below:

Overview This Course 📘

The Advanced 1DTE Crash Course by Justin Kay is an advanced-level program focused on ultra-short-term options strategies, especially those with one day to expiration (1DTE), alongside selected three-days-to-expiration (3DTE) trades.

Rather than offering a simple collection of “plug-and-play” setups, the course teaches you how to:

-

Formulate structured hypotheses about 1DTE and 3DTE trades

-

Utilize historical options price data to evaluate trade ideas

-

Design positive-expectancy debit spreads, butterflies, and calendarized positions

-

Integrate short-dated options strategies into a diversified portfolio

Across eight video lessons (over four hours of content), you will explore topics such as:

-

A deep dive into advanced 1DTE structures

-

Strategy previews and conceptual frameworks

-

3DTE opportunities, particularly around Friday expirations

-

The impact of overnight risk and price behavior

-

The role of longer-dated wings in shaping payoff profiles

-

Systematic strategy development from idea to backtest

-

Portfolio-level thinking and the use of a bespoke spreadsheet analyzer

-

Final reflections on implementation, discipline, and continuous improvement

By the end, you will not simply recognize trade patterns; you will understand how to construct, test, and refine them in a methodical way.

Why Should You Choose This Course? 🎯

This course distinguishes itself in a crowded education space through a combination of credibility, rigor, and practicality.

Some key reasons traders choose this course include:

-

Instructor with dual expertise

-

Justin Kay is a licensed finance and tax attorney with over 25 years of experience trading equities, options, and derivatives.

-

His professional background includes senior legal and financial roles, such as serving as Chief Legal Officer for a major U.S. charter airline, negotiating complex contracts and financial transactions.

-

-

Research-driven, not hype-driven

-

The course is built around mechanical, backtested strategies, not emotional narratives or unrealistic promises.

-

Concepts are always anchored in historical data, risk metrics, and portfolio impact, helping you avoid purely anecdotal decision-making.

-

-

Emphasis on robustness

-

Instead of searching for a single ideal parameter (the “perfect” entry minute or exact stop), the course explores ranges of times, stop levels, and profit targets.

-

This emphasis on robustness helps reduce the risk of curve-fitting and increases the likelihood that strategies can survive shifts in volatility and market regimes.

-

-

Integration of multiple strategy types

-

You will see how short and long 1DTE and 3DTE trades can be combined with credit-selling approaches from earlier learning.

-

The goal is not just to add more trades, but to construct a coherent, diversified options portfolio.

-

-

Practical tools for ongoing research

-

The included strategy analyzer spreadsheet allows you to compute additional metrics, compare variations, and fine-tune position sizing.

-

This transforms the course from a one-time learning event into a repeatable research process you can apply long after you finish the videos.

-

What You’ll Learn 📊

Throughout the Advanced 1DTE Crash Course by Justin Kay, you will acquire both conceptual understanding and practical techniques. Key learning outcomes include:

-

Advanced 1DTE structures

-

How to design debit spreads with attractive risk/reward and positive expectancy.

-

How to use butterfly configurations for both directional and non-directional market views.

-

-

3DTE and Friday-focused opportunities

-

How and why certain 3DTE trades, especially those initiated on Fridays, can complement 1DTE strategies.

-

How to think about weekly cycles, expiration dynamics, and event-driven setups.

-

-

Use of historical options data

-

How to interpret and utilize historical options pricing to validate your hypotheses.

-

Ways to identify parameter ranges that appear robust across different time periods.

-

-

Overnight and longer-dated effects

-

How overnight risk and price behavior affect short-dated trades.

-

The role of longer-dated wings in shaping payoff diagrams and smoothing risk profiles.

-

-

Calendarized and long-delta structures

-

How to incorporate calendarized long-delta trades into your toolbox.

-

How these longer-duration components can interact with 1DTE credit and debit positions.

-

-

Risk, costs, and implementation details

-

How to think realistically about slippage, commissions, and fees.

-

How to factor these frictions into backtests so you avoid overly optimistic expectations.

-

-

Portfolio and process design

-

How to integrate multiple strategies into a cohesive portfolio, rather than trading them in isolation.

-

How to use the strategy analyzer spreadsheet to:

-

Evaluate trade frequency and drawdown patterns

-

Adjust position sizing to fit your account and risk tolerance

-

Compare alternative rule sets and select more robust variants

-

-

By the end of the course, you will have a repeatable checklist-style workflow for turning trade ideas into thoroughly tested, rule-based strategies.

Core Benefits 💡

Enrolling in this course offers more than additional knowledge; it supports a fundamental shift in the way you approach 1DTE and short-term options trading.

Some of the core benefits include:

-

Greater analytical confidence

-

You will be able to justify your trades with data, not just intuition.

-

You gain clarity about when and why strategies tend to perform well or struggle.

-

-

Improved risk discipline

-

You learn to define risk per trade, per strategy, and at the portfolio level.

-

Slippage and fees are treated as structural components, not afterthoughts.

-

-

More robust rule sets

-

By testing ranges rather than single points, you reduce dependence on fragile configurations.

-

This can help your strategies remain viable across different volatility environments.

-

-

Portfolio-level thinking

-

You see how 1DTE, 3DTE, and longer-dated elements can complement one another.

-

This supports a more balanced, less emotionally driven trading experience.

-

-

Reusable tools and frameworks

-

The course equips you with templates and a spreadsheet-based analyzer that you can apply to new ideas.

-

Your learning compounds over time as you build your own library of tested strategies.

-

-

Efficient learning at accessible cost

-

The 1.05 GB course structure and over four hours of content are organized for efficient, focused learning.

-

At $69.3, the course is priced to deliver substantial educational value relative to the potential cost of untested, discretionary trades. 📈

-

Who Should Take This Course? 👨💻👩💻

The Advanced 1DTE Crash Course by Justin Kay is particularly suitable for traders who already possess foundational knowledge and are ready to deepen their practice. You are likely an ideal participant if you are:

-

An intermediate or advanced options trader

-

You understand basic concepts such as calls, puts, spreads, and the Greeks.

-

You want to move beyond introductory strategies into more nuanced 1DTE and 3DTE structures.

-

-

A data-oriented or systematic trader

-

You appreciate the value of backtesting and evidence-based decisions.

-

You are interested in building mechanical strategies rather than relying solely on gut feeling.

-

-

Focused on short-term opportunities

-

You are attracted to the flexibility and capital efficiency of short-dated options.

-

You want a structured playbook for trading products with frequent expirations.

-

-

Building a diversified options portfolio

-

You may already trade credit spreads, iron condors, or longer-dated positions.

-

You want to understand how advanced 1DTE trades can fill specific roles within your broader portfolio.

-

-

A busy professional seeking structured education

-

You value concise, logically organized lessons from an instructor with both market and professional expertise.

-

You prefer a single, coherent curriculum instead of scattered online videos.

-

If you see yourself in these descriptions, this course offers a natural and meaningful next step toward a more professional approach to options trading.

Conclusion 🔍

The Advanced 1DTE Crash Course by Justin Kay is a comprehensive, research-driven training program for traders who want to take short-dated options trading seriously. With more than four hours of focused video content bundled into a 1.05 GB course package, you gain a structured deep dive into advanced 1DTE and 3DTE strategies, overnight and longer-dated effects, and portfolio construction principles.

At an accessible price of $69.3, the course provides a level of insight and structure that reflects over two decades of practical trading experience and a strong foundation in finance and law. You are not simply given trade ideas; you are shown how to design, test, and refine your own mechanical strategies with an emphasis on robustness, risk management, and real-world execution.

For traders around the world who aim to transition from reactive, discretionary trading to a disciplined, data-driven process, this course offers a clear and powerful framework. It helps you treat your trading less like a series of isolated decisions and more like a professional, continuously improving research operation.

If you are ready to strengthen your edge in 1DTE and short-term options trading, now is the time to take the next step and enroll in the Advanced 1DTE Crash Course by Justin Kay so you can start building a more robust, evidence-based strategy portfolio. 🚀

Reviews

There are no reviews yet.