Trading Index Profitably by Modit Massey – Immediately Download

Index trading is one of the cleanest ways to participate in equity markets because you are trading the market’s direction rather than trying to pick individual winners. But “simple” does not mean “easy”—especially when you add options, volatility, and fast-moving sessions into the mix.

Trading Index Profitably by Modit Massey is a focused course built around trading India’s most-followed index benchmarks—Nifty and Bank Nifty—with a practical blend of technical reading and derivatives-based execution. The training is delivered as a compact video package that is easy to consume and revisit.

-

Course size: 834 MB

-

Price: $77.70

If you want a structured starting point for understanding index behavior, building option-based trade plans, and improving consistency through a repeatable workflow, this course offers a clear, time-efficient pathway at an accessible price point.

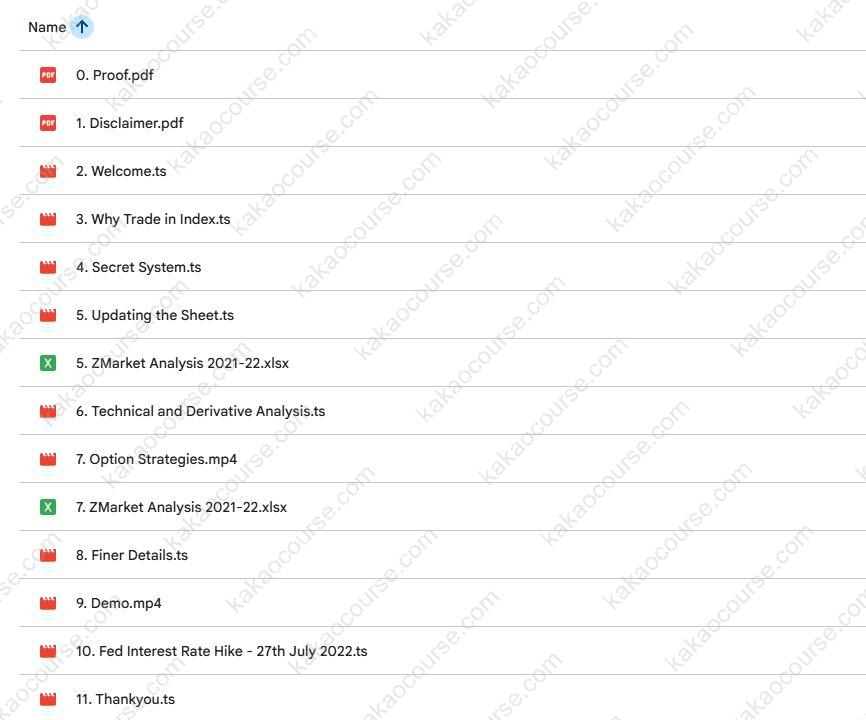

Free Download Trading Index Profitably by Modit Massey – Includes Verified Content:

Trading Index Profitably by Modit Massey, Check Out the Full Course Contents:

Trading Index Profitably by Modit Massey, Watch Our Free Video Sample to Find Out More:

📈 Overview This Course

Trading Index Profitably is designed to teach a step-by-step approach to trading index markets—specifically Nifty and Bank Nifty—using a combination of:

-

Index-specific reasoning (why indices behave differently from single stocks)

-

Technical analysis foundations (how to read trend, structure, and momentum)

-

Derivative analysis (how options and positioning influence movement)

-

Practical option strategies (how to express a market view with defined risk)

-

Demonstrations and real-world framing (including an event-based market example)

The curriculum is concise and intentionally staged. It begins by explaining why indices are traded, then introduces a “system” for decision-making, followed by the analytical toolkit (technical + derivatives), and finally moves into option strategy application and a demo to connect concepts to execution.

This is not positioned as a “one setup for all markets” program. Instead, it teaches how to approach index trading as a process—where the goal is to improve clarity, discipline, and repeatability.

⭐ Why Should You Choose This Course?

International learners often underestimate how useful index trading can be as a training ground. Indices reduce company-specific noise and can make it easier to focus on price behavior, volatility, and risk management. This course is relevant if you want a guided introduction that stays practical.

Key reasons this course can be worth choosing:

-

It is index-first, not stock-first

Many traders learn on individual stocks and later struggle to translate that into index behavior. This course begins with the logic of index trading—helping you build the right mental model from day one. -

It connects technical analysis to derivatives execution ✅

Technical analysis alone can leave traders with an opinion but no high-quality expression of that view. By pairing technical and derivative analysis, you learn how trades can be structured with options rather than relying only on directional entries. -

It is structured as a fast, practical learning loop

The curriculum moves from concept → system → tools → strategies → demo, which supports implementation rather than endless theory. -

It is taught by a market educator with training experience 🌍

The instructor describes a background in coaching and training, including work with major Indian institutions and extensive learner reach across multiple countries. For many students, an instructor’s ability to teach clearly is just as important as the strategy itself. -

It stays focused on Nifty and Bank Nifty

Specialization matters. These instruments have their own liquidity profile, option activity, and behavioral patterns. A course that is designed around them helps reduce generic, unhelpful advice.

A practical reminder: trading involves risk, and “profitably” should be understood as an objective that requires skill development, disciplined execution, and consistent risk control—not a promise.

🧠 What You’ll Learn

This course is designed to strengthen both market understanding and execution structure for index trading. Based on the curriculum, you can expect to build competency in the following areas:

-

Why index trading is a core skill

-

How indices can offer cleaner directional opportunities than many single names

-

Why index liquidity and participation often make them suitable for structured plans

-

-

A repeatable trading “system” mindset

-

How to approach trading with rules and workflow rather than impulse

-

How to reduce randomness by using the same decision checkpoints every session

-

-

Technical analysis applied to index behavior

-

Reading trend and market direction with higher confidence

-

Identifying key zones and levels that often matter in index movement

-

Understanding the “finer details” that can separate a plan from a guess 📌

-

-

Derivative analysis that supports better trade planning

-

How options thinking can change the way you interpret market conditions

-

How to align an index view with an options-based structure

-

-

Options strategies for Nifty and Bank Nifty

-

How different option approaches can fit different market conditions

-

How to select a strategy based on your market read rather than habit

-

How to think in probabilities, scenarios, and defined outcomes (not all-or-nothing)

-

-

Demonstration and real-world framing

-

How an approach translates into an actual workflow

-

How to interpret a market event example and place it within a trading plan

-

Because this is a compact course, the best way to maximize learning is to apply each lesson to charts immediately—take notes, rewrite rules in your own words, and build your personal checklist as you progress.

✅ Core Benefits

This program’s benefits are most visible when you care about building trading structure rather than collecting more signals.

1) Clearer decision-making for index trading

You are guided to think in terms of process:

-

What is the market context?

-

What is my directional bias (or range expectation)?

-

What would confirm the idea?

-

What would invalidate it?

-

Which options structure best expresses the thesis with controlled exposure?

That logic makes index trading more systematic and less emotional.

2) A bridge between chart reading and execution mechanics

Many traders can identify a trend but struggle to place an intelligent trade around it. By combining technical analysis with derivative thinking, you gain a more complete toolbox for expressing a view.

3) More disciplined risk framing through options logic 🛡️

Options strategies—when used responsibly—can encourage more deliberate planning:

-

Pre-defining scenarios

-

Avoiding impulsive “all-in” decisions

-

Thinking in terms of structured outcomes rather than perfect prediction

This course supports that mindset by explicitly including option strategies and derivative analysis.

4) Practical learning that supports faster implementation

The curriculum includes a demo and a concise set of topics. That reduces friction for learners who want to apply concepts quickly and refine through repetition.

5) Useful even if you are not India-based 🌍

If you trade global indices (e.g., US or European benchmarks), the exact instruments differ, but the skills—technical reading, market context, and options-based structuring—remain transferable. You can adopt the workflow principles even if you later trade different index products.

👥 Who Should Take This Course?

This course is best suited for learners who want a practical entry point into index-focused trading with a derivatives-aware approach.

A strong fit if you are:

-

A newer trader who wants a structured introduction to index trading (Nifty/Bank Nifty)

-

A trader who understands basic charts but lacks a repeatable process

-

Someone interested in options who wants strategies anchored to market context

-

A learner who prefers concise, applied training rather than overly long theory

Potentially not ideal if you are:

-

Looking for guaranteed results, signals, or “hands-free” trade alerts

-

Unwilling to practice, journal decisions, and review execution errors

-

Not prepared for the realities of market risk or the learning curve of options

🧾 Conclusion

Trading Index Profitably by Modit Massey is a compact, structured program focused on trading Nifty and Bank Nifty through a blend of technical analysis, derivative reasoning, and options strategy selection. Its value lies in helping learners build a repeatable workflow—from understanding why indices are traded, to developing a “system,” to applying option strategies with clearer execution discipline.

For purchase clarity:

-

Course size: 834 MB

-

Price: $77.70

If you want a practical, index-focused course that helps you move from chart-watching to structured trade planning, this program is a cost-efficient way to build your foundation and start practicing with purpose. 🚀

Start with the “Why Index” and “System” lessons, then apply each concept to recent charts the same day so your learning immediately becomes a repeatable process.

Reviews

There are no reviews yet.