ICT – Entry & Check List by Finastic – Immediately Download

Institutional-style trading is not about predicting the market—it is about executing a repeatable process. Many traders learn ICT Smart Money Concepts (SMC) but still struggle at the moment that matters most: the entry. They see liquidity, structure shifts, and imbalance, yet they hesitate—or enter too early, too late, or without a checklist.

ICT – Entry & Check List by Finastic is a compact, execution-focused guide built to solve that gap. It gives you structured ICT entry models plus a checklist mindset so your setups become clearer, more consistent, and easier to validate across markets.

-

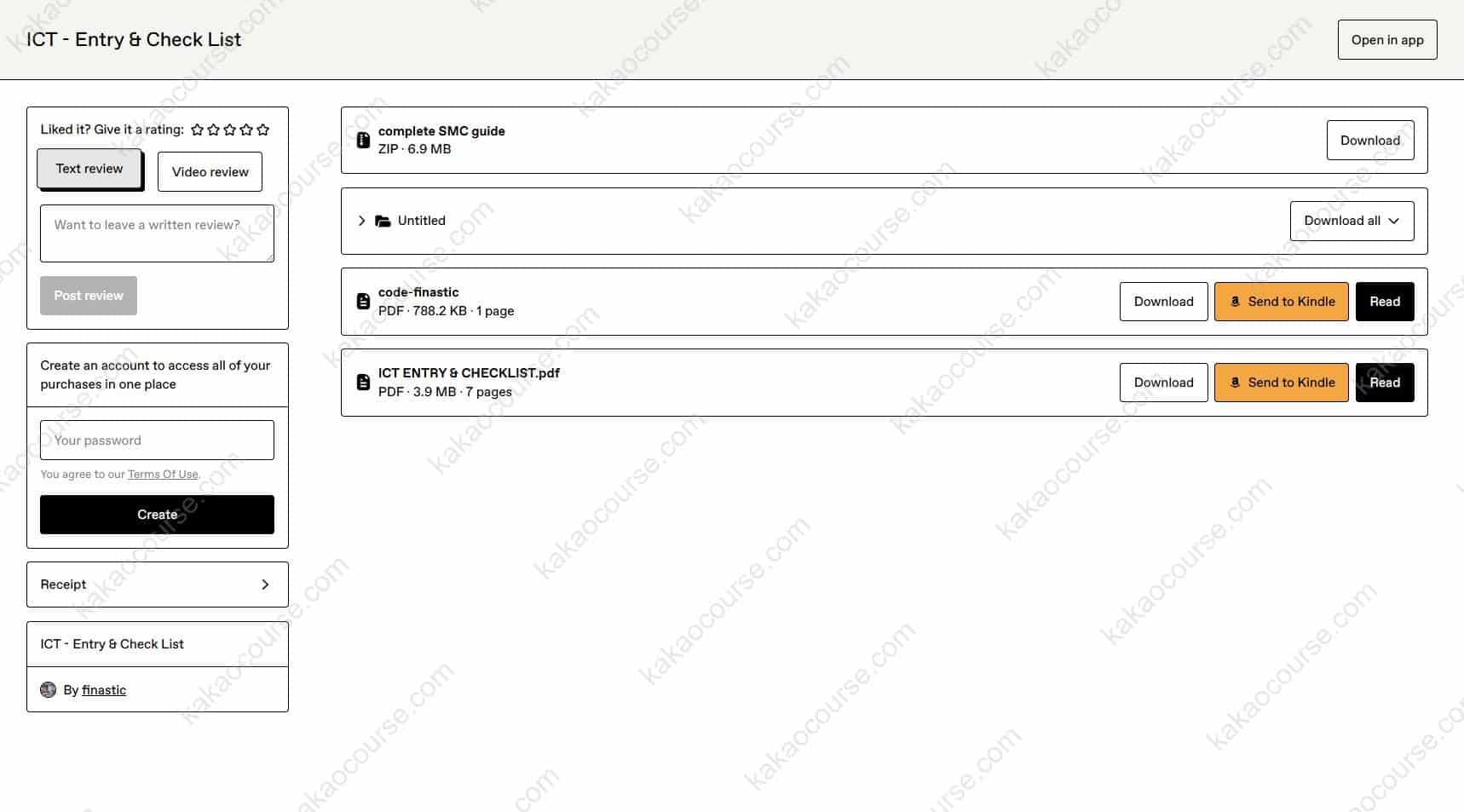

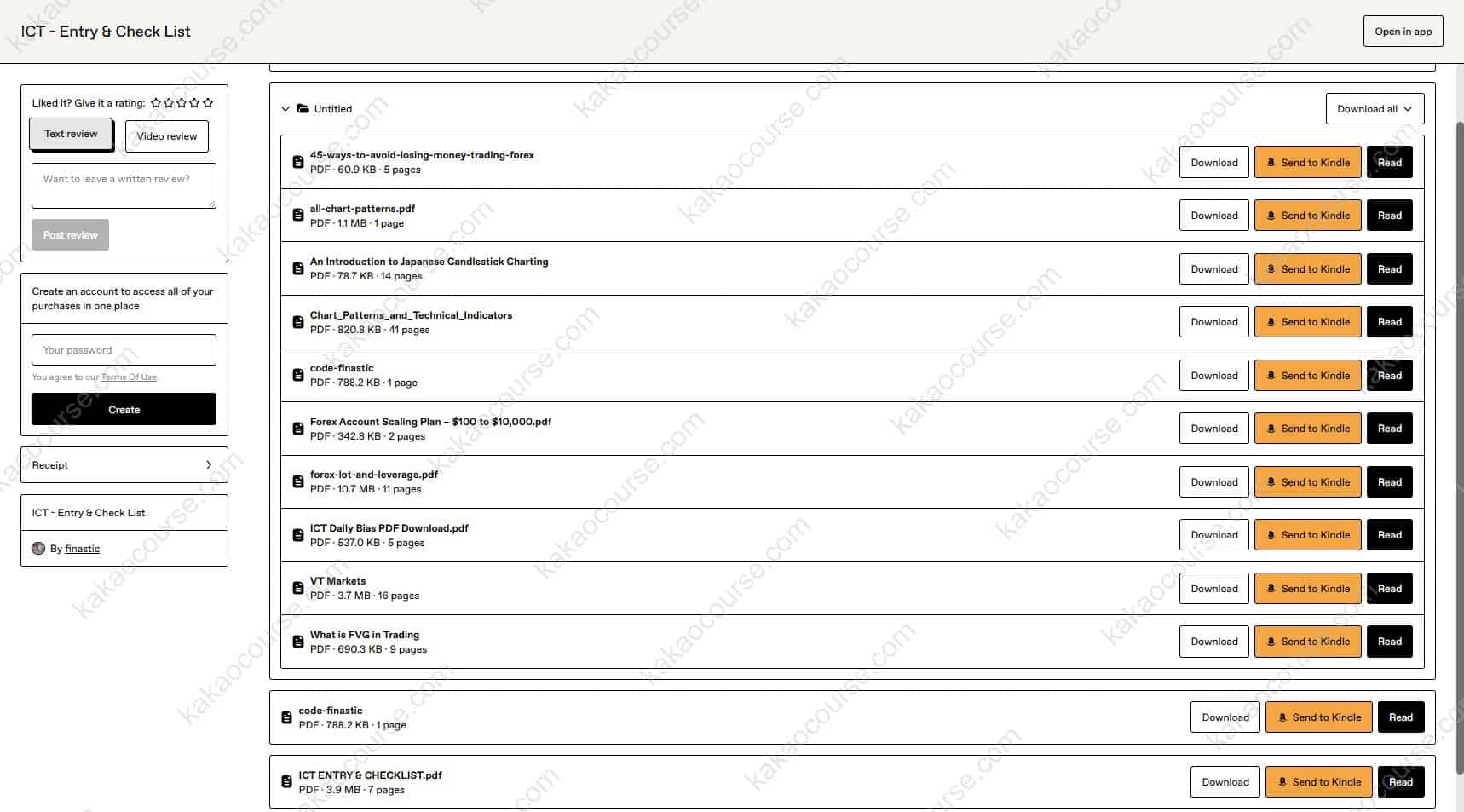

File size: 32.6 MB

-

Price: $15.4

Free Download ICT – Entry & Check List by Finastic – Here’s What You’ll Get Inside:

ICT – Entry & Check List by Finastic, Check Out the Full Course Contents:

ICT – Entry & Check List by Finastic, Free PDF Preview Available Below:

🧩 Overview This Course

ICT – Entry & Check List is a trading guide designed to help traders implement ICT Smart Money Concepts through high-probability entry models and a practical checklist workflow.

Instead of treating SMC as a collection of disconnected ideas, this guide organizes key components into structured models you can apply repeatedly:

-

Liquidity behavior and common traps

-

Market structure shifts and confirmation

-

Precision entries using imbalance and premium/discount logic

-

Higher-timeframe points of interest (institutional zones)

-

Entry refinement using Fibonacci-based optimal entry ranges

The goal is straightforward: reduce guesswork and improve execution quality by following defined entry frameworks rather than intuition.

🎯 Why Should You Choose This Course?

Most traders do not fail because they never learn concepts. They fail because they cannot translate concepts into a reliable decision sequence. This guide is built around that real-world problem.

Reasons this guide stands out:

-

It turns ICT theory into entry structure.

You get defined models that combine multiple confirmations into a coherent “if-this-then-that” approach. -

It emphasizes probability, not excitement.

The checklist format encourages selectivity, helping you avoid low-quality trades that look attractive but lack confirmation. -

It supports cross-market application.

The models are positioned to work across major instruments—Forex, indices, crypto, and stocks—by focusing on universal market mechanics (liquidity, structure, imbalance). -

It strengthens discipline and risk thinking.

A checklist naturally improves consistency: you stop “hoping” a setup works and start verifying it.

If you want to trade more like a systematic operator—rather than reacting emotionally—this is the type of guide that supports that shift.

✅ What You’ll Learn

This guide is structured around key ICT Smart Money Concepts and how to combine them into actionable entries. You will learn how to identify and execute setups using:

-

Liquidity Grab

-

Where stops tend to cluster

-

How “smart money” can sweep liquidity before a directional move

-

-

Break of Structure (BOS)

-

How to interpret structure breaks as potential trend shifts

-

How BOS can serve as confirmation rather than prediction

-

-

Fair Value Gaps (FVG)

-

How market imbalance can provide precise entry zones

-

How to use inefficiencies for cleaner execution

-

-

Order Blocks / HTF POI (Higher-Timeframe Points of Interest)

-

How to locate institutional zones on higher timeframes

-

How HTF context can filter out weak trades

-

-

Optimal Trade Entry (OTE)

-

How Fibonacci ranges (commonly 0.62–0.79) can refine entries

-

How to avoid chasing moves by letting price come to you

-

The key learning outcome is not just “knowing” these concepts—it is learning how to sequence them into a trade plan.

🔍 Core Benefits

Here is what traders typically gain when they adopt structured entry models with checklist validation:

-

Clearer entries with fewer impulsive trades

-

Models reduce overtrading by requiring defined conditions

-

-

Higher-quality setup selection

-

You learn to wait for confluence (structure + liquidity + imbalance)

-

-

Improved execution confidence

-

Confidence comes from a repeatable process, not from one winning trade

-

-

Better risk-to-reward alignment

-

Precision entries tend to support tighter invalidation and cleaner trade logic

-

-

Applicable across instruments and timeframes

-

Designed for Forex but adaptable to indices, crypto, and stocks

-

📌 Practically, the checklist approach helps answer:

“What is my confirmation?” “Where is my invalidation?” “Is this entry justified—or just tempting?”

🧠 5 Structured ICT Entry Models

The guide includes five entry frameworks that combine ICT components into high-probability execution pathways. While each model has its own emphasis, they share a common philosophy: context first, confirmation second, entry precision last.

Model themes you will work with:

-

HTF POI + BOS + FVG for foundational institutional entries

-

Integration of internal liquidity (IDM) to strengthen confirmation

-

Adding OTE to refine entries into more precise zones

-

A consolidation “box” approach for breakout-style execution

This model-based layout is helpful because it prevents “concept hopping.” You stop mixing tools randomly and instead follow a defined entry architecture.

👥 Who Should Take This Course?

This guide is a strong fit if you are:

-

A trader learning ICT / Smart Money Concepts and struggling with entry timing

-

Someone who understands liquidity and structure but lacks a consistent execution plan

-

A discretionary trader who wants a more systematic, checklist-driven process

-

A Forex trader seeking institutional-style confirmation frameworks

-

An intermediate learner who wants practical structure, not scattered theory

This may be less suitable if you are:

-

A complete beginner who has not learned basic market structure terminology yet

-

Looking for a generic “signals” product rather than a skill-building framework

🎯 Ideal user profile: someone who wants to execute fewer trades, but with higher selectivity and clearer confirmation.

🧾 Conclusion

ICT – Entry & Check List by Finastic is designed for traders who want to translate ICT Smart Money Concepts into repeatable, high-probability entries. With structured models and checklist thinking, it helps reduce guesswork, improve consistency, and strengthen decision discipline—key traits of institutional-style execution.

-

File size: 32.6 MB

-

Price: $15.4

If you’re ready to stop improvising entries and start trading with a clearer framework, this guide gives you a practical system for validating setups before you commit capital.

Start applying a checklist-driven ICT entry process today and turn your market knowledge into cleaner, more confident executions.

Reviews

There are no reviews yet.