Squeeze Playbook for Growth: Trade high-growth momentum stocks with confidence by Willonacci – Immediately Download

High-growth momentum stocks can deliver exceptional moves—but they can also punish traders who rely on hype, late entries, or inconsistent rules. The challenge is not finding “exciting” tickers; it is building a disciplined process to identify squeezes, confirm leadership, and time entries with intention rather than emotion.

Squeeze Playbook for Growth: Trade high-growth momentum stocks with confidence by Willonacci is built for traders who want structure. It combines a practical playbook with a live walkthrough component and ready-to-use tools—so you can go from “I think this might run” to “I can justify this trade with a checklist.”

-

Package size: 296 MB

-

Price: $30.8

Free Download Squeeze Playbook for Growth: Trade high-growth momentum stocks with confidence by Willonacci – Here’s What You’ll Get Inside:

Squeeze Playbook for Growth: Trade high-growth momentum stocks with confidence by Willonacci, Sneak Peek Inside The Course:

Squeeze Playbook for Growth: Trade high-growth momentum stocks with confidence by Willonacci, Free PDF Preview Available Below:

📘 Overview This Course

Squeeze Playbook for Growth is a trading education bundle focused on high-growth momentum stocks and TTM Squeeze-style setups—the market condition where volatility compresses, then expands, often producing powerful directional moves when momentum returns.

Rather than presenting squeezes as a shortcut to profit, the playbook frames them as a repeatable workflow:

-

Identify compression and potential energy building in price action

-

Filter for momentum leaders (stocks showing relative strength and growth characteristics)

-

Confirm broader context using institutional flow proxies such as sector/industry behavior and ETFs

-

Execute entries with timing rules designed to reduce “chasing” after the crowd piles in

What you receive is positioned as a practical system—not just theory:

-

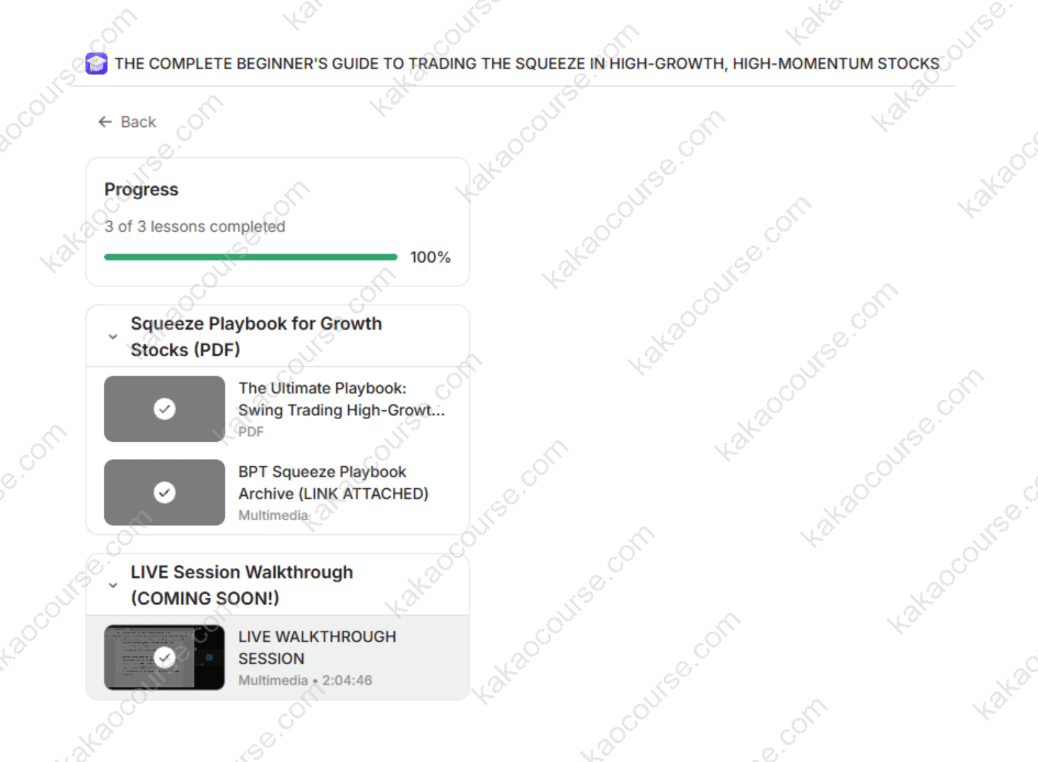

A PDF Playbook that explains the approach and how to apply it consistently

-

A Live Video Walkthrough to see real examples and decision-making in action

-

Bonus scans & watchlists to speed up your idea generation and preparation

This course is especially relevant for traders who want a structured way to participate in growth-driven breakouts while minimizing impulsive entries.

🎯 Why Should You Choose This Course?

Many trading resources teach indicators without teaching execution. This playbook is compelling because it concentrates on process quality—the core driver of long-run performance.

Key reasons traders choose this course:

-

It transforms “TTM Squeeze” from a concept into a workflow.

The value is not merely identifying compression; it is learning how to select the right names and time participation with intent. -

It prioritizes leadership and context, not random signals.

High-growth momentum trading is heavily dependent on where institutional attention is flowing. By emphasizing ETFs, sector leaders, and momentum ranking, the playbook aims to keep you aligned with stronger market narratives. -

It improves execution discipline.

In momentum trading, the difference between a professional entry and a retail chase is often just a few decisions: confirmation criteria, entry triggers, and risk planning. The playbook pushes toward repeatability. -

It includes tools that reduce friction.

Scans and watchlists are not glamorous, but they are operationally important. They help you spend less time searching and more time evaluating the right setups.

✅ If you are building a momentum strategy, this kind of playbook is useful because it connects selection, timing, and preparation into one coherent system.

🔍 What You’ll Learn

The learning outcomes revolve around building a high-growth momentum pipeline—from spotting candidates to executing with clarity.

You should expect to learn:

-

How to identify TTM Squeeze-style conditions

-

Recognize volatility compression and the conditions that often precede expansion

-

Understand why squeezes can be more powerful when aligned with trend and leadership

-

-

How to find momentum leaders with stronger breakout potential

-

Identify stocks showing relative strength, strong demand, and growth characteristics

-

Focus your attention on candidates that are more likely to attract follow-through buying

-

-

How to time entries before the crowd

-

Learn practical timing logic to reduce late entries

-

Build a “ready vs. not ready” decision framework instead of reacting to headlines

-

-

How to read institutional flow through ETFs and sector leaders

-

Use sector/industry behavior as a context filter for stock selection

-

Align trades with broader momentum rather than fighting the tape

-

-

How to execute with confidence and discipline

-

Develop consistent pre-trade preparation habits

-

Improve consistency by defining what you need to see before entering

-

📌 A well-designed squeeze plan should help you answer:

“What exactly am I trading, why now, and what would invalidate this idea?”

✅ Core Benefits

This playbook is designed to support traders who want structure in a market style that is often emotionally demanding.

Core benefits include:

-

Less guesswork, more repeatability

-

You replace “maybe” trades with a defined framework for confirmation and timing

-

-

Cleaner opportunity selection

-

By focusing on momentum leaders and sector/ETF context, you reduce exposure to low-quality breakouts

-

-

Faster preparation through scans and watchlists

-

Pre-built tools can streamline your daily workflow, especially if you trade part-time

-

-

More disciplined execution

-

A framework encourages consistency in entries and helps reduce impulsive chasing

-

-

Better alignment with growth and momentum behavior

-

Growth names often move in bursts; being early and selective matters

-

This course is structured to help you recognize those windows

-

🧠 Notably, “confidence” in trading is rarely about certainty—it is about having a process you can trust, refine, and repeat.

🧩 Who Should Take This Course?

Squeeze Playbook for Growth is best suited for traders who are serious about momentum but want more structure than social-media tips.

This course is a fit if you are:

-

A trader focused on high-growth momentum stocks and breakout-style opportunities

-

Someone who understands basic charting but wants a clearer system for setup selection + timing

-

A learner who wants real examples via walkthroughs—not just static theory

-

A trader seeking tools (scans/watchlists) to reduce prep time and improve consistency

-

An intermediate trader who wants to improve discipline and reduce “late entry” behavior

This may be less suitable if you are:

-

Strictly a long-term investor who does not use technical timing

-

Looking for a “signal service” rather than an educational framework

-

Unwilling to follow a rules-based workflow (momentum trading requires structure)

✅ For international customers, the content is especially attractive if you trade US equities or growth-led markets where momentum and sector rotation are highly visible.

📌 Conclusion

Squeeze Playbook for Growth by Willonacci is a focused, execution-oriented resource for trading high-growth momentum stocks using a structured squeeze framework. By combining a PDF playbook, a live walkthrough learning format, and practical scans/watchlists, it aims to help you spot compression early, identify true momentum leadership, and execute with more discipline—before the crowd turns a good setup into a late chase.

-

Package size: 296 MB

-

Price: $30.8

If your goal is to trade growth momentum with clearer rules, stronger preparation, and more consistent timing, this playbook provides a practical foundation to build and refine your approach.

Add Squeeze Playbook for Growth to your trading toolkit today and start executing high-growth squeeze setups with a more structured, confident process.

Reviews

There are no reviews yet.