Mastering VWAP: X-Ray Vision for Precision Profits by Verified Investing – Immediately Download

Precision in trading is rarely about “more indicators.” It is about having a reliable reference point that helps you read control, define value, and plan entries and exits with less noise. For many professional desks, VWAP (Volume Weighted Average Price) plays that role—especially when combined with a disciplined execution model and strong risk control.

Mastering VWAP: X-Ray Vision for Precision Profits by Verified Investing is a structured course led by Doctor B. that teaches you how to set up VWAP, interpret market control (bulls vs. bears), apply Anchored VWAP (AVWAP) for higher-precision opportunities, and integrate VWAP with Doctor B.’s 1-Minute Scalpel Methodology. The program is positioned for beginner-to-intermediate traders who want clearer entries, exits, and risk management rules.

-

Course size: 557 MB

-

Price: $53.9

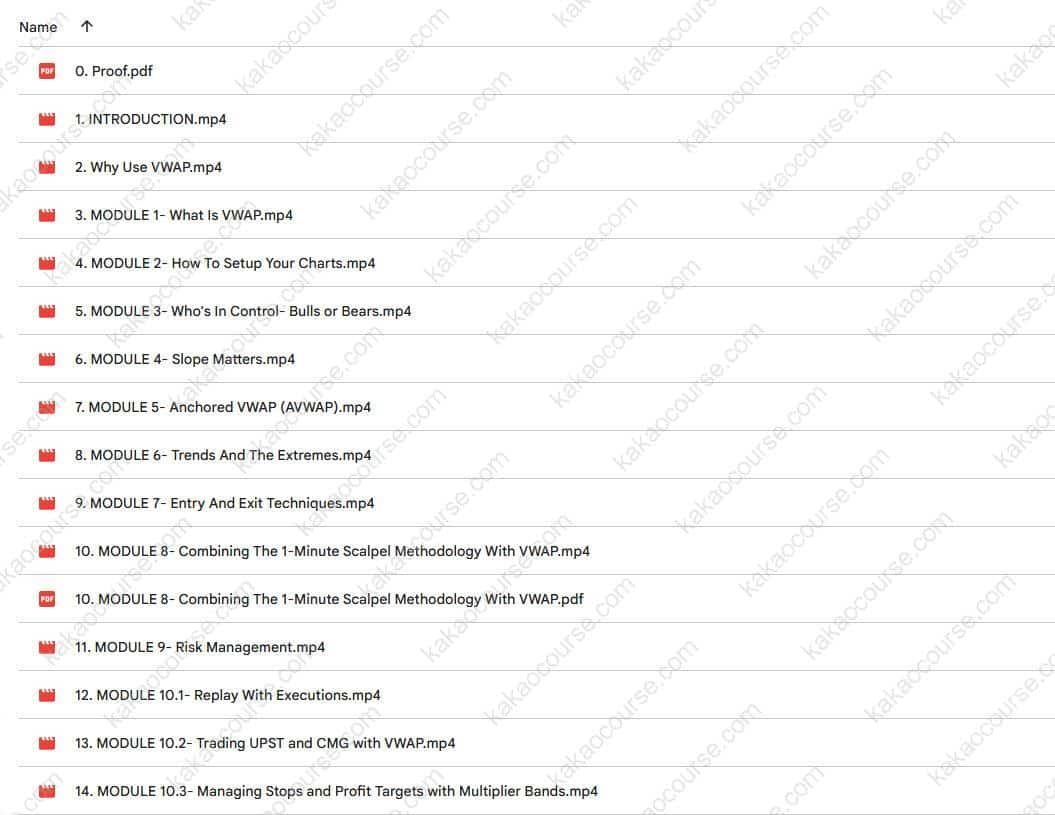

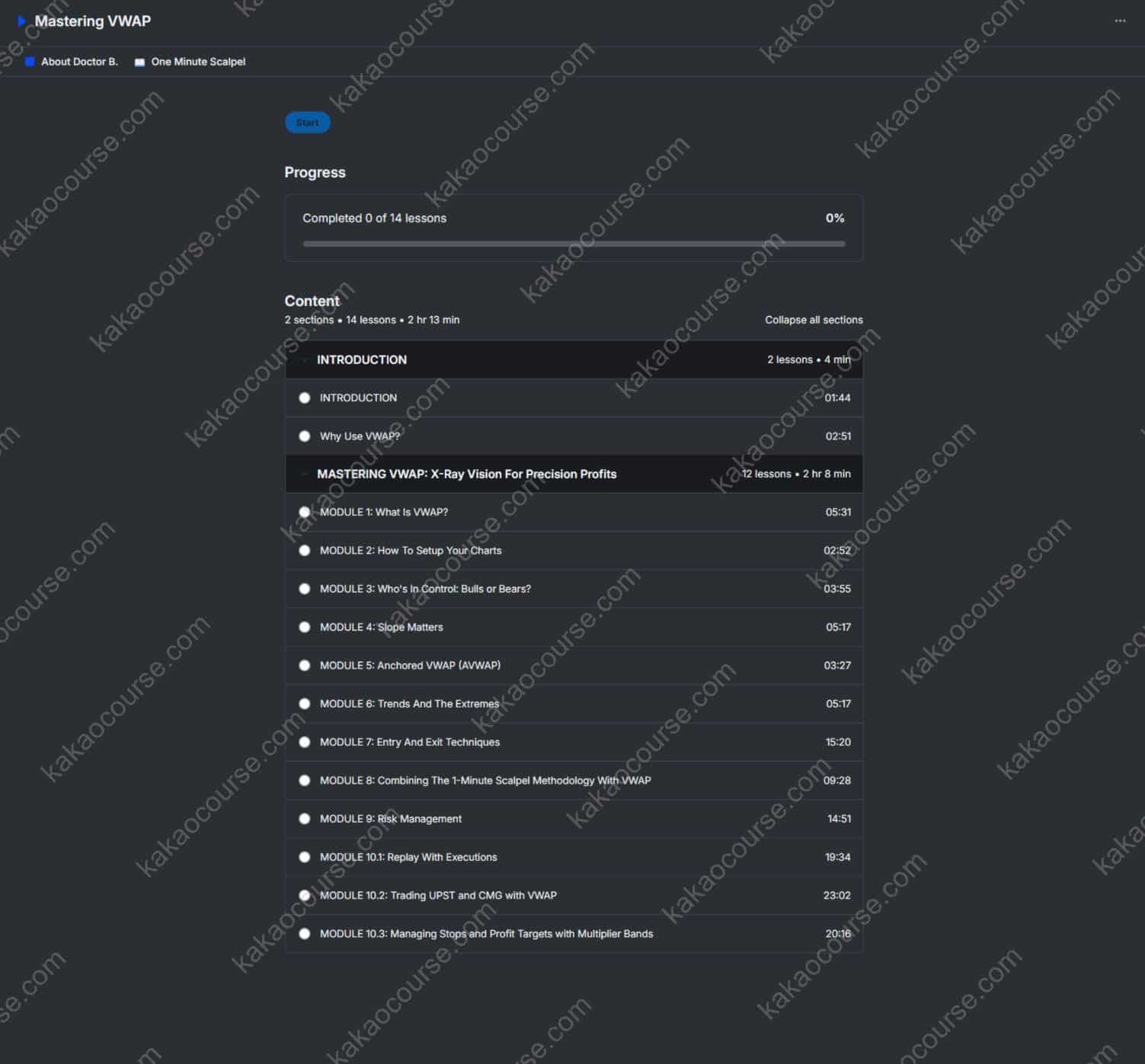

Free Download Mastering VWAP: X-Ray Vision for Precision Profits by Verified Investing – Here’s What You’ll Get Inside:

Mastering VWAP: X-Ray Vision for Precision Profits by Verified Investing, Check Out the Full Course Contents:

Mastering VWAP: X-Ray Vision for Precision Profits by Verified Investing, Watch Our Free Video Sample to Find Out More:

🔎 Overview This Course

Mastering VWAP is built around a single premise: if you can consistently identify “value” and “control” in real time, you can trade with more structure and less emotional decision-making. VWAP is used in this course as an institutional-style anchor—helping you evaluate whether price is trading at value, extended away from value, or transitioning between control regimes.

The course covers both foundational and advanced VWAP applications:

-

Standard VWAP setup and interpretation across timeframes

-

“Who’s in control” analysis using price action relative to VWAP

-

The importance of VWAP slope as a strength/weakness cue

-

Anchored VWAP techniques to isolate key opportunity zones around meaningful pivots

-

A practical integration layer: combining VWAP with the 1-Minute Scalpel methodology for refined execution

-

A strong risk management module focused on protecting downside and improving trade longevity

The module design indicates a clear progression: learn what VWAP is, set it up correctly, interpret it with context (control, slope, trends, extremes), then apply execution frameworks and risk discipline—ending with replay-style examples to translate rules into decisions.

✅ Why Should You Choose This Course?

A VWAP course is valuable only if it does more than define VWAP. This one is positioned around actionable implementation, which matters for international customers who want a clean, repeatable framework rather than theory-heavy content.

1) A professional reference point that reduces noise

VWAP provides a consistent lens for reading value and control. The course focuses on how institutions and “smart money” use VWAP concepts for precision—aiming to make your entries and exits less subjective.

2) A complete execution path: setup → interpretation → execution → review

Many traders learn indicators but never learn sequencing. The modules show a full pipeline: chart setup, control identification, slope logic, anchored VWAP application, entry/exit tactics, then replay with executions.

3) Anchored VWAP for higher precision opportunities

Standard VWAP is useful, but anchored VWAP can add context by tying “value” to key pivots (highs/lows). This can help you frame trades around meaningful decision areas rather than arbitrary levels.

4) Risk management is treated as core, not optional

This course explicitly includes a dedicated risk management module and integrates stop management within entry/exit techniques. That’s essential because VWAP-based trading can still fail without consistent risk rules.

5) Combining VWAP with a short-term methodology

The integration with Doctor B.’s 1-Minute Scalpel method suggests the course aims to solve a common trader problem: “I see the level, but I don’t know how to execute cleanly.” A multi-factor approach can help reduce premature entries.

📚 What You’ll Learn

By completing the course, you should be able to apply VWAP and AVWAP with a structured, repeatable decision framework. Key outcomes include:

-

VWAP chart setup for practical trading use

-

Configure VWAP correctly on your platform

-

Choose settings that match your timeframe and market context

-

-

Determine market control with VWAP

-

Identify when bulls or bears appear to be in control

-

Read price behavior relative to VWAP to support bias and trade selection

-

-

Use VWAP slope to interpret strength

-

Understand how upsloping, downsloping, or flat VWAP can guide expectations

-

Avoid misreading “chop” conditions as trend conditions

-

-

Apply Anchored VWAP (AVWAP) for precision

-

Anchor VWAP to pivotal highs/lows for higher-context value zones

-

Use AVWAP to plan entries and exits around more meaningful reference points

-

-

Trade trends and extremes more intelligently

-

Learn how VWAP interacts with trending conditions and overextension

-

Reduce common errors at highs/lows by using a structured reference

-

-

Entry and exit techniques with defined logic

-

Develop clearer rules for entering and exiting

-

Improve stop placement and trade management behavior

-

-

Combine VWAP with the 1-Minute Scalpel methodology

-

Build multi-factor setups for more precise execution

-

Use shorter-timeframe triggers while staying aligned with VWAP context

-

-

Risk management mastery

-

Control losses systematically

-

Let winners run within a defined risk framework rather than hope-based holding

-

-

Replay-based learning with executions

-

Watch recent trade replays showing how the rules are applied

-

Learn decision-making under realistic conditions (entries, exits, risk adjustments)

-

🎯 Core Benefits

This course’s value proposition centers on precision and structure—two qualities that tend to improve consistency for beginner-to-intermediate traders.

-

More consistent trade framing

-

VWAP gives you a stable “value lens” to reduce random entries

-

-

Clearer entry/exit planning

-

The course is explicitly designed to teach exact entry and exit strategies

-

-

Higher-quality opportunity selection

-

Control analysis (bulls vs. bears) can help filter trades that fight the market

-

-

Improved risk discipline

-

Risk management is positioned as a core skill that protects capital and confidence

-

-

Better execution through methodology integration

-

Combining VWAP context with a short-term trigger method can improve timing and reduce chasing

-

-

Skill transfer across markets

-

VWAP/AVWAP concepts often generalize across stocks, ETFs, and other liquid instruments, supporting broad applicability for international learners

-

👥 Who Should Take This Course?

Mastering VWAP is best suited for traders who want a structured indicator-based framework that remains grounded in execution and risk control.

This course is a strong fit if you are:

-

A beginner to intermediate trader who wants to understand how VWAP is used in institutional-style decision making

-

A trader who struggles with precise entries and exits and wants clearer rules

-

An investor/trader who wants to strengthen risk management and confidence

-

Someone interested in Anchored VWAP and wants a guided, practical approach

-

A trader who wants to integrate VWAP context with a faster trigger method (1-Minute Scalpel)

This may be less suitable if you:

-

Prefer long-horizon investing without tactical entries/exits

-

Want a broad trading encyclopedia rather than a VWAP-focused system

-

Dislike rules-based execution and review processes

🧾 Conclusion

Mastering VWAP: X-Ray Vision for Precision Profits by Verified Investing is a VWAP-focused training program designed to help you trade with more structure: setting up VWAP correctly, reading market control, using slope for strength cues, applying Anchored VWAP for precision opportunities, and combining VWAP with Doctor B.’s 1-Minute Scalpel methodology for execution refinement. The curriculum is rounded out with a dedicated risk management module and replay-based executions to translate concepts into real decisions.

-

Course size: 557 MB

-

Price: $53.9

For traders who want a practical, institutional-style lens to improve entries, exits, and risk discipline, this course offers a clear, process-driven path.

Strengthen your VWAP execution framework today and start applying a more precise, risk-aware trading routine the next time you open your charts.

Reviews

There are no reviews yet.