The Intelligent Investor Video Course by Stig Brodersen – Immediately Download

Benjamin Graham’s The Intelligent Investor is widely regarded as a foundational text for value investing, yet many first-time readers quickly discover a practical problem: the language can feel dense, technical, and difficult to translate into real-world decision-making. The Intelligent Investor Video Course by Stig Brodersen is built to bridge that gap—turning Graham’s core ideas into a clear, watchable learning path for people who want to invest with discipline, not guesswork.

This video program comes as an 812 MB package priced at $17.5, featuring 20 structured video lessons and more than 3 hours of teaching. If you want the principles behind long-term, rational investing—without getting lost in jargon—this course is designed to make the concepts approachable and usable.

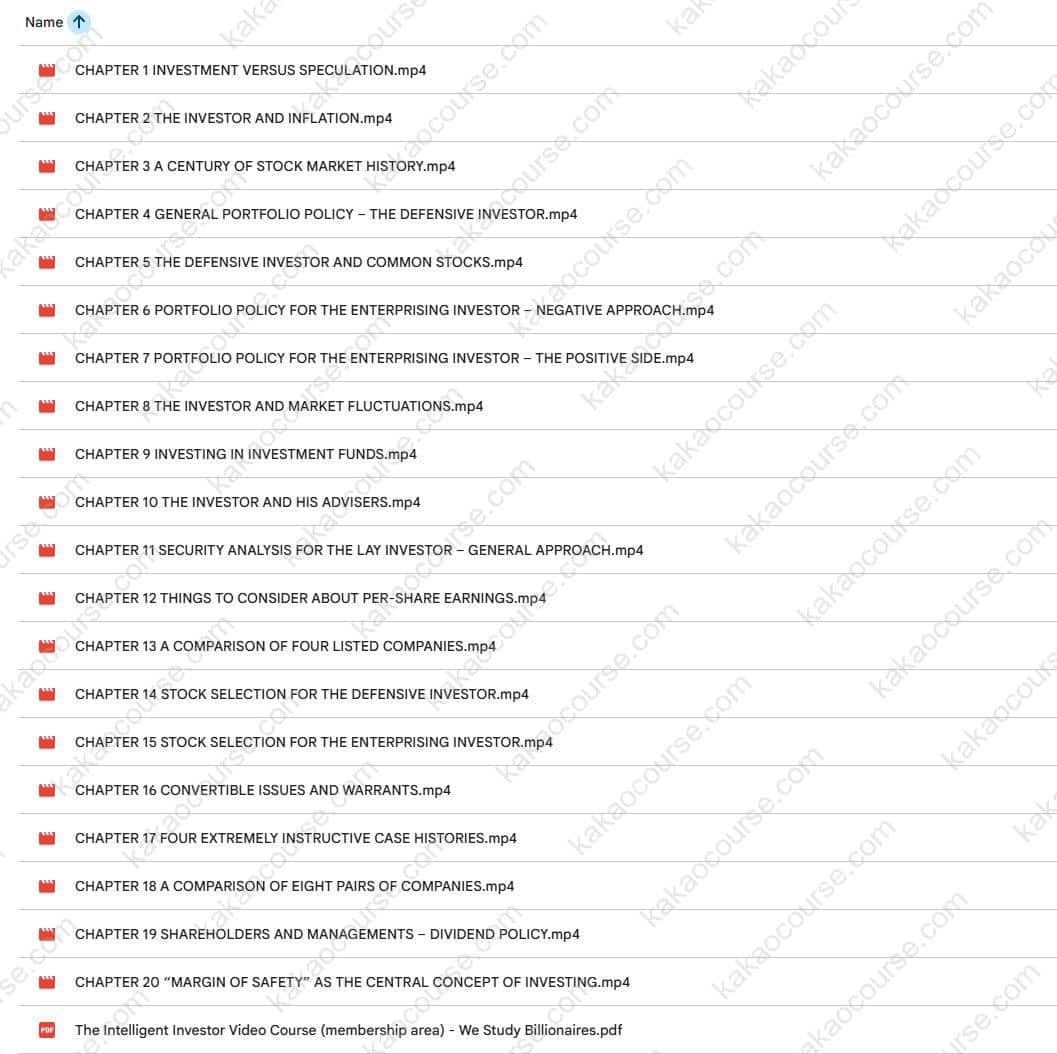

Free Download The Intelligent Investor Video Course by Stig Brodersen – Here’s What You’ll Get Inside:

The Intelligent Investor Video Course by Stig Brodersen, Watch Our Free Video Sample to Find Out More:

The Intelligent Investor Video Course by Stig Brodersen, Free PDF Preview Available Below:

Overview This Course

The Intelligent Investor Video Course by Stig Brodersen is a guided video-based walkthrough of the central themes in Graham-style investing, organized into a coherent sequence of lessons. Instead of expecting you to decode every term and concept on your own, the course breaks the book’s ideas into digestible sections that gradually build your understanding.

The course is especially relevant for international learners who may be new to formal finance vocabulary. The lesson structure progresses from core definitions (what “investing” actually means) to practical portfolio thinking, market psychology, stock selection logic, and risk control—ending with the principle that many investors treat as the bedrock of the entire philosophy: margin of safety.

What the format looks like in practice:

-

20 video lessons designed as a full learning roadmap

-

3+ hours of instruction, organized by topic rather than random “tips”

-

A progression from beginner-friendly foundations to more advanced analysis themes

Rather than pushing a trading style or “hot picks,” the course focuses on mental models and durable principles—useful across markets, regions, and different economic cycles.

Why Should You Choose This Course?

Many investing courses teach tactics first and principles second. That approach can produce confident beginners who know how to place trades but don’t understand the logic that protects them when markets become volatile. This course takes the opposite route: it starts by clarifying the difference between investing and speculation, then builds a disciplined framework for portfolio decisions.

You may choose this course because it is:

-

Beginner-accessible: It is intentionally designed for learners without formal finance training.

-

Jargon-translating: Complex terms are introduced in context and explained in plain language.

-

Principle-driven: The focus is on decision quality and risk discipline, not hype.

-

Structured and time-efficient: 20 lessons, clearly sequenced, in a compact 3+ hour format.

-

Universally relevant: Concepts such as inflation impact, diversification, market psychology, and valuation logic apply broadly—regardless of country or market.

If you have tried reading The Intelligent Investor and felt stuck, this course helps you convert “reading effort” into “investing understanding.” It is a practical companion for turning classic theory into a working mindset.

What You’ll Learn

The course is organized into lessons that cover the essential pillars of Graham-style investing. While you are learning ideas from a classic book, the objective is modern and practical: improve how you think, decide, and manage risk over time.

Key learning outcomes include:

-

Investing vs. speculation

-

Learn the defining traits that separate a true investor from a speculator.

-

Understand the difference between passive and active approaches—and what each requires.

-

-

Inflation and purchasing power

-

Build an intuitive grasp of inflation as a real threat to long-term wealth.

-

See how inflation interacts differently with bonds and equities.

-

-

Market history as context, not entertainment

-

Use historical stock market behavior to set realistic expectations.

-

Avoid drawing the wrong conclusions from short-term performance.

-

-

Portfolio policy for defensive and enterprising investors

-

Understand how risk tolerance and skill level should shape portfolio structure.

-

Learn the logic behind sensible asset allocation rather than copying trends.

-

-

How to think about common stock selection

-

Explore rule-based principles for selecting stocks without relying on narratives.

-

Learn why price matters and why “quality” must be assessed carefully.

-

-

What to avoid (negative approach) and what to pursue (positive approach)

-

Identify common traps that frequently damage long-term returns.

-

Learn why unpopular, financially sound companies can create opportunities—especially when priced rationally.

-

-

Market psychology and “Mr. Market”

-

Understand how emotional pricing can create volatility and mispricing.

-

Learn how to respond to fluctuations without panic or euphoria.

-

-

Funds, ETFs, and the role of simple vehicles

-

Clarify what mutual funds and ETFs are and when they may fit different investor profiles.

-

-

Advisers and “free advice”

-

Build skepticism and filtering skills when encountering stock tips and market commentary.

-

Improve your ability to evaluate information sources.

-

-

Security analysis for non-professionals

-

Learn the purpose of analysis and how a lay investor can think about fundamentals without overcomplication.

-

-

Per-share earnings and interpretive caution

-

Understand why EPS can be misleading if used blindly.

-

Learn to look past the headline number and ask better questions.

-

-

Practical comparison frameworks

-

Practice evaluating companies through structured comparison, rather than impressions.

-

Learn how to examine “similar-looking” firms and detect meaningful differences.

-

-

Stock selection methods and screening logic

-

Explore different selection approaches for defensive vs. enterprising styles.

-

Understand why screening is a tool—useful when paired with sound judgment.

-

-

Convertible issues, warrants, and complexity

-

Learn what convertibles are and why complexity should be treated with caution.

-

Build a framework for thinking about “optional” features in securities.

-

-

Case-based learning and real-world failures

-

Understand how misalignment between price and value can persist.

-

Learn how debt, governance issues, and financial behaviors affect outcomes.

-

-

Dividends, management, and shareholder alignment

-

Clarify how dividend policy relates to shareholder return and corporate priorities.

-

-

Margin of safety as the central concept

-

Learn why intelligent investing is ultimately about building a buffer against being wrong.

-

Internalize the discipline of buying with sufficient downside protection.

-

Core Benefits

This course is valuable not because it promises a shortcut, but because it strengthens the “operating system” behind your decisions. For international learners especially, the benefit often shows up as clarity: you stop feeling overwhelmed by terminology and start seeing a coherent structure.

Core benefits you can expect:

-

Clarity without oversimplification

-

Concepts become understandable without being reduced to slogans.

-

You gain mental models you can apply beyond a single market cycle.

-

-

A stronger risk framework

-

You learn to prioritize downside protection through margin of safety thinking.

-

You become less vulnerable to overconfidence and market noise.

-

-

Better decision discipline during volatility

-

Market fluctuations become inputs—not emotional triggers.

-

You learn how to respond rationally when prices move sharply.

-

-

Portfolio thinking that matches your profile

-

You understand what a “defensive” approach implies (simplicity, robustness).

-

You learn what an “enterprising” approach demands (work, discipline, selectivity).

-

-

More intelligent evaluation of advice

-

You learn how to filter stock tips and “free” opinions.

-

You develop a healthier relationship with commentary, headlines, and hype.

-

-

Practical analysis habits

-

You gain structured ways to compare companies and interpret earnings.

-

You reduce the urge to invest based on stories rather than evidence.

-

This is not a course about chasing extraordinary returns; it is a course about building a rational process that can survive real markets.

Who Should Take This Course?

The Intelligent Investor Video Course by Stig Brodersen is built for people who want to learn investing principles in a way that is accessible, structured, and internationally relevant.

This course is a strong fit for:

-

New investors who own (or plan to read) The Intelligent Investor but feel blocked by jargon

-

Self-taught learners without formal finance education who want a clear framework

-

Busy professionals who want a compact, well-organized learning path (3+ hours)

-

Long-term investors who want to strengthen their thinking around:

-

risk control

-

portfolio policy

-

valuation discipline

-

market psychology

-

It is especially useful if you:

-

Prefer step-by-step instruction over dense textbooks

-

Want principles you can apply across different countries and market environments

-

Are tired of “hot picks” and want a durable investing philosophy

Less ideal if you are:

-

Looking for day-trading tactics, signals, or short-term speculation frameworks

-

Expecting a course to provide specific stock recommendations

Conclusion

The Intelligent Investor Video Course by Stig Brodersen is a practical, beginner-friendly pathway into Graham-style investing—designed for learners who want to understand classic value investing ideas without getting stuck in terminology. Through 20 video lessons and more than 3 hours of content, the course builds a structured understanding of investing versus speculation, portfolio policy for different investor profiles, inflation awareness, market psychology, analysis fundamentals, and the risk-buffering discipline of margin of safety.

For international customers seeking an affordable and accessible companion to The Intelligent Investor, this course offers a compact, organized learning experience that prioritizes clarity and decision quality. The program is delivered as an 812 MB package priced at $17.5, making it a cost-effective way to turn a famous investing book into actionable understanding.

Start the 20-lesson video course today and build a disciplined investing framework you can apply confidently across market cycles.

Reviews

There are no reviews yet.