The Order Flow Edge Trading Course by Michael Valtos – Immediately Download

In modern electronic markets, price is not just a line on a chart—it is the outcome of aggressive buying and selling, liquidity shifts, and institutional positioning. For active traders who want to move beyond indicator-driven decisions, order flow analysis offers a disciplined way to interpret how transactions actually occur and why certain moves accelerate, stall, or reverse.

The Order Flow Edge Trading Course by Michael Valtos is designed to help you build that practical lens. The course is delivered as a digital package with a download size of 705 MB and is priced at $20.30. If you are looking for a structured learning path that connects microstructure concepts to real trading scenarios—without relying on vague “signals”—this course aims to provide a clearer framework for decision-making and execution.

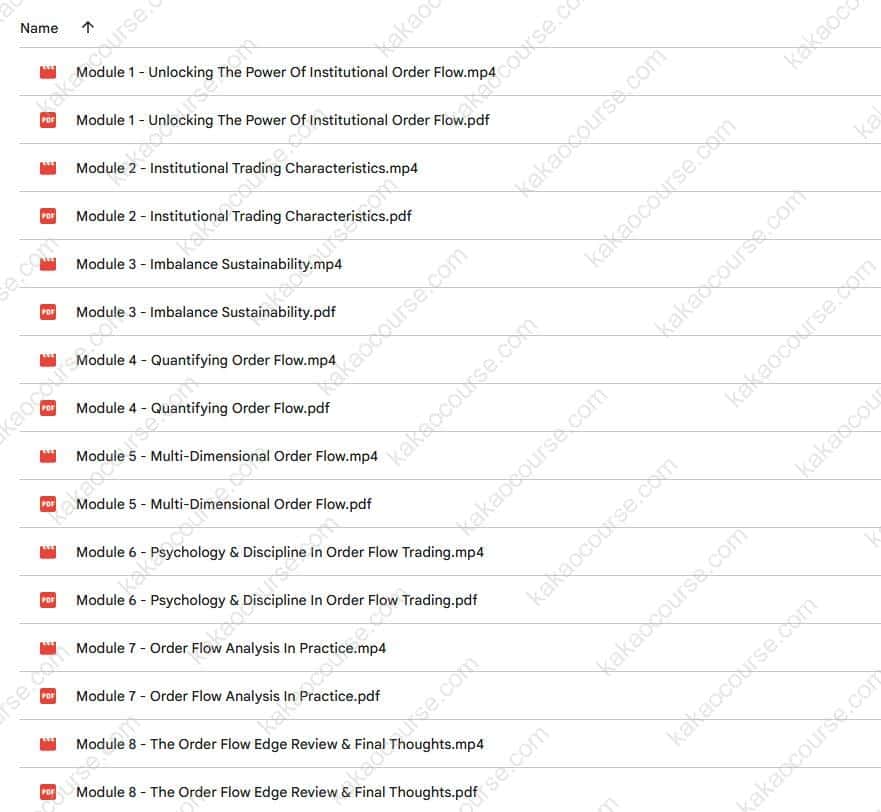

Free Download The Order Flow Edge Trading Course by Michael Valtos – Here’s What You’ll Get Inside:

The Order Flow Edge Trading Course by Michael Valtos, Free PDF Preview Available Below:

Overview This Course

The Order Flow Edge Trading Course by Michael Valtos is an eight-module program focused on institutional order flow—the footprint of large market participants as reflected through traded volume, imbalances, and the interaction between buyers and sellers at key price levels.

Rather than treating the market as a set of static patterns, the course frames trading as a dynamic auction process:

-

How liquidity forms and disappears

-

How institutions execute size without revealing intent too early

-

Why imbalances sometimes drive continuation and other times fail

-

How order flow context can support higher-quality trade selection

The curriculum is structured to progress from foundational concepts (what order flow is and what it measures) to more advanced analysis (multi-dimensional views and quantified assessment). It also includes a dedicated emphasis on psychology and discipline, recognizing that even strong analytical tools lose value without consistent execution.

Instructor-wise, the course is positioned around Michael Valtos’ institutional-market background and long-term specialization in order flow education and tooling, giving the program a perspective that aims to be closer to professional trading workflows than purely retail approaches.

Why Should You Choose This Course?

Many traders “learn order flow” in fragments—watching isolated videos, copying setups, or collecting terminology without a coherent model. This course is designed to reduce that fragmentation by offering a single, end-to-end learning arc that connects concept → interpretation → application.

Reasons international learners often look for a course like this include:

-

A clearer definition of “edge”

The program emphasizes what an edge actually means in practice: repeatable conditions, measurable logic, and disciplined execution—rather than hype or overconfidence. -

Institutional context, retail accessibility

The framing is anchored in how larger players participate in markets, but the learning goal remains actionable interpretation for an individual trader. -

Focus on reading participation, not predicting outcomes

Order flow work is often more about assessing probabilities and trade quality than forecasting exact targets. The course supports that mindset. -

From subjective impressions to structured evaluation

By addressing “imbalance sustainability” and “quantifying order flow,” the curriculum encourages a more methodical approach, which is especially useful when markets are noisy. -

Realistic integration with trading psychology

Many otherwise sound traders underperform due to execution drift. A dedicated module on discipline and mindset is a practical inclusion for long-term consistency.

Important note for clarity: markets are uncertain by nature. This course is best viewed as skill development in analysis and decision-making, not as a promise of outcomes.

What You’ll Learn

The course is organized into eight modules, each built around a capability that supports order flow-based decision-making. While the exact teaching style and examples may vary, the learning objectives can be summarized as follows:

1) Institutional Order Flow Foundations

-

Understand what “institutional order flow” means in practical terms

-

Learn how large participation can influence short-term price behavior

-

Build a baseline vocabulary for interpreting buying/selling pressure

2) Recognizing Institutional Trading Behavior

-

Identify common characteristics of professional execution

-

Interpret signs of absorption, urgency, and liquidity-taking behavior

-

Improve your ability to distinguish noise from meaningful activity

3) Assessing Imbalance Sustainability

-

Learn how to judge whether an imbalance is likely to persist or fade

-

Separate short-lived spikes from more durable pressure

-

Develop criteria that support better filtering of trade candidates

4) Quantifying Order Flow

-

Move from “I feel buying is strong” to a more structured evaluation

-

Measure and compare pressure across levels or sessions

-

Use quantification to reduce overtrading and improve selectivity

5) Multi-Dimensional Order Flow Analysis

-

Learn how order flow changes across timeframes and contexts

-

Combine multiple perspectives to improve situational awareness

-

Build a more holistic model of participation and market response

6) Psychology And Discipline For Order Flow Trading

-

Strengthen execution discipline under uncertainty

-

Reduce impulsive entries and late exits driven by emotion

-

Build routines that support consistency and risk awareness

7) Practical Application Through Examples

-

Translate concepts into concrete decision processes

-

Study how signals and context interact in live-like scenarios

-

Refine interpretation skills through applied case work

8) Consolidation And Personal Integration

-

Review core concepts and connect them into a unified workflow

-

Identify personal strengths/weaknesses in execution

-

Outline an action plan for integrating order flow into your approach

By the end, you should have a clearer sense of how to interpret order flow as evidence—and how to use that evidence to support trade selection, timing, and management choices.

Core Benefits

The value of an order flow course is not in memorizing definitions, but in building a practical framework you can repeatedly apply. This course is positioned to deliver benefits in three core areas: analysis quality, decision structure, and execution discipline.

Analytical Benefits

-

Stronger understanding of who is participating and how aggressively

-

Better identification of key zones where liquidity and pressure interact

-

Improved ability to interpret continuation vs. exhaustion conditions

Decision-Making Benefits

-

A more systematic process for screening trades and avoiding low-quality setups

-

Clearer criteria to support entries and invalidate bias when conditions change

-

Reduced dependence on lagging indicators as primary decision drivers

Execution And Risk Benefits

-

Increased consistency through routines that reinforce discipline

-

Better alignment between analysis and actual trade management

-

More realistic expectation-setting: working with probabilities, not certainty

For many traders, the practical impact of these benefits is not “more trades,” but fewer, higher-quality decisions—a shift that often improves performance stability over time.

Who Should Take This Course?

This course is best suited for traders who want to develop a more evidence-based understanding of market behavior and are willing to practice observation and interpretation.

A strong fit for:

-

Active traders who want to incorporate order flow and institutional behavior into their process

-

Intermediate traders who feel stuck with indicators and want a deeper market model

-

Futures, index, or intraday traders who benefit from understanding liquidity and participation

-

Traders building a professional-style workflow and seeking more structured evaluation

Also relevant for:

-

Technical analysts who want to complement charts with participation data

-

Systematic-minded learners who value frameworks and measurable logic

-

Traders who want to improve discipline and reduce emotional execution errors

Less ideal if:

-

You want a “single perfect setup” without study or practice

-

You prefer fully automated signals without contextual interpretation

-

You are not prepared to spend time reviewing charts and practicing pattern recognition

Order flow skill development is cumulative. The course is most effective when paired with deliberate practice and careful risk management.

Conclusion

The Order Flow Edge Trading Course by Michael Valtos offers an eight-module pathway into institutional order flow thinking—covering foundational concepts, sustainability of imbalances, quantification, multi-dimensional analysis, and the practical psychology required to execute consistently. It is designed for traders who want a clearer framework for interpreting participation and making more disciplined decisions under uncertainty.

Download size: 705 MB

Price: $20.30

If you want to strengthen your market-read skills and build a more structured order flow workflow, The Order Flow Edge Trading Course is a practical starting point that can support your progression from “chart watching” to evidence-based decision-making.

Start learning with The Order Flow Edge Trading Course by Michael Valtos today and begin applying a more institutional lens to your trade selection and execution.

Reviews

There are no reviews yet.