Price Action and Orderflow Course By Young Tilopa – Immediately Download

Price Action and Orderflow Course by Young Tilopa is an advanced trading education program designed for traders who want to understand how markets truly move beneath the surface. Built from a series of live, in-depth webinars, this course translates professional trading concepts into a structured learning experience focused on price action, liquidity, and orderflow dynamics.

With a total digital size of 1.21 GB, the course delivers over 10 hours of video content that systematically guides learners through real market mechanics. Priced at USD 16.8, it offers strong value for traders seeking institutional-grade insights without reliance on indicators or automated systems.

This course is designed for an international audience trading Bitcoin and other financial markets, with concepts that remain applicable across instruments and market conditions.

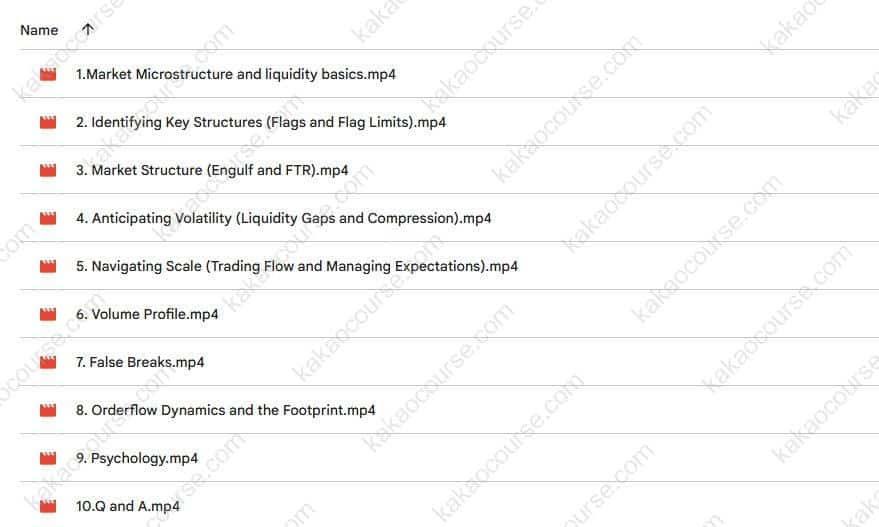

Free Download Price Action and Orderflow Course By Young Tilopa – Here’s What You’ll Get Inside:

Overview This Course

The Price Action and Orderflow Course presents a cohesive framework for understanding how price forms, moves, and reacts based on liquidity and participant behavior. Rather than focusing on predictive indicators, the course emphasizes context, structure, and execution logic derived directly from market activity.

The curriculum integrates three core dimensions:

-

Market microstructure and liquidity mechanics

-

Price action-based structural analysis

-

Orderflow interpretation and execution timing

Throughout the course, learners are trained to observe how large participants interact with liquidity, how volatility emerges, and how price responds around key structural levels. This approach enables traders to build a repeatable decision-making process grounded in market logic rather than hindsight.

All lessons are delivered through recorded live sessions, preserving the depth, nuance, and real-time explanations that are often missing from pre-scripted trading courses.

Why Should You Choose This Course?

This course is particularly well-suited for traders who want to move beyond surface-level chart reading and develop a professional market perspective.

Key reasons to choose this program include:

-

Orderflow-driven methodology

Learn how executed orders, liquidity gaps, and participation imbalances influence price movement. -

Price action without indicators

The course prioritizes clean charts and structural logic over lagging technical tools. -

Contextual trade selection

Emphasis is placed on when not to trade, improving selectivity and expectation management. -

Cross-market applicability

While Bitcoin is a primary reference, the principles apply across futures, crypto, and traditional markets. -

Real trader psychology integration

Psychological considerations are embedded into the trading process, not treated as an afterthought.

This is not an introductory trading overview, but a serious educational foundation for traders seeking long-term skill development.

What You’ll Learn

The course offers a progressive learning path that builds conceptual clarity before moving into application. Key learning outcomes include:

-

Market microstructure and liquidity basics

-

How liquidity enters and exits the market

-

Why price moves the way it does during high- and low-participation phases

-

-

Identifying key structures

-

Flags, flag limits, and their role in continuation and rotation

-

Structural boundaries that define high-probability areas

-

-

Market structure logic

-

Engulf patterns and Failure to Return (FTR) concepts

-

How structure reflects orderflow intent

-

-

Anticipating volatility

-

Liquidity gaps and compression zones

-

Conditions that precede expansion and displacement

-

-

Navigating scale and trading flow

-

Aligning expectations with timeframe and structure

-

Managing trades within broader market context

-

-

Volume profile analysis

-

Identifying acceptance and rejection zones

-

Using volume distribution to refine key levels

-

-

False breaks and traps

-

Recognizing engineered moves and liquidity sweeps

-

-

Orderflow dynamics and footprint charts

-

Interpreting executed volume and participation

-

Timing entries with greater precision

-

-

Trader psychology

-

Decision-making under uncertainty

-

Maintaining discipline within a rule-based framework

-

This integrated skill set enables traders to approach markets with greater clarity and consistency.

Core Benefits

Traders who complete the course gain several practical and strategic advantages:

-

Deeper market understanding

Learn how liquidity and participation drive price, rather than reacting to outcomes. -

Improved trade location and timing

Focus on high-quality areas instead of frequent, low-conviction trades. -

Stronger risk and expectation management

Align trade ideas with structure and volatility context. -

Reduced indicator dependency

Build confidence using raw market data and price behavior. -

Transferable professional framework

Apply the methodology across instruments, sessions, and market regimes.

These benefits support a more deliberate, analytical trading process aligned with professional standards.

Who Should Take This Course?

This course is suitable for:

-

Intermediate traders seeking deeper structural understanding

-

Crypto traders looking to refine Bitcoin execution and context

-

Traders transitioning from indicator-based strategies

-

Market participants interested in orderflow and footprint analysis

-

Self-directed learners aiming to build a rule-based trading framework

While beginners may find the material challenging, motivated learners with basic market familiarity will benefit significantly from the depth of instruction.

Conclusion

The Price Action and Orderflow Course by Young Tilopa provides a comprehensive and methodical exploration of how markets function at a structural and liquidity level.

With over 10 hours of educational content, a total size of 1.21 GB, and a price of USD 16.8, the course offers substantial value for traders committed to skill development rather than shortcuts. Its emphasis on price action, orderflow, and psychology creates a balanced framework suitable for long-term trading growth.

For traders serious about understanding the mechanics behind price movement, this course represents a strong educational investment.

Strengthen your market perspective and elevate your trading decisions by studying how price and orderflow truly interact in live market conditions.

Reviews

There are no reviews yet.