Free Download Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge

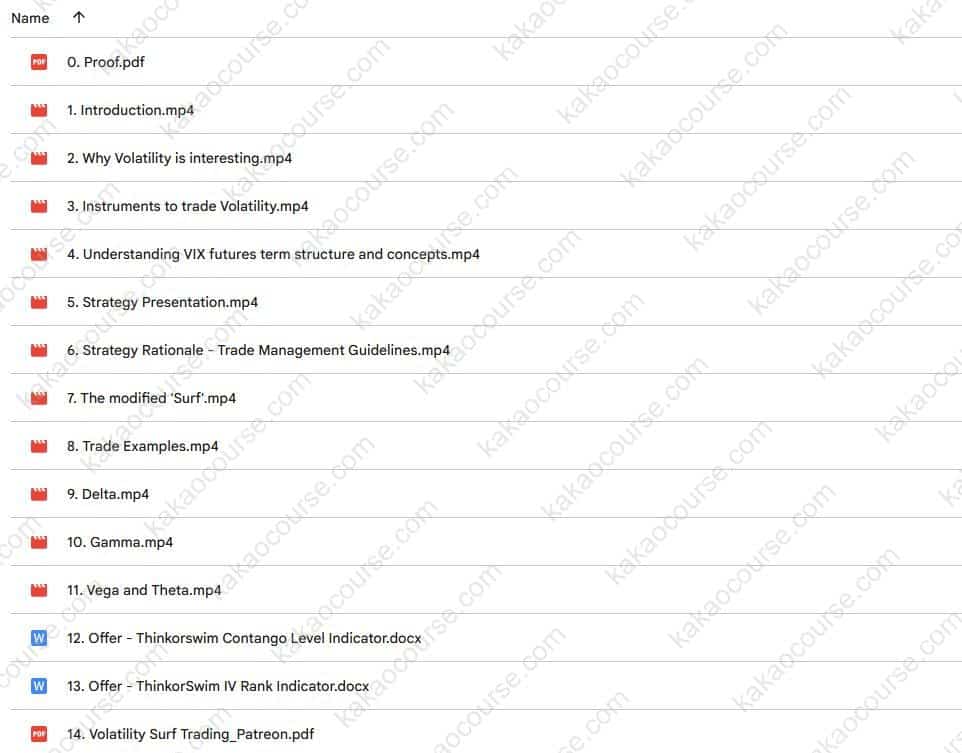

Check content proof, now:

Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge, see what’s included in this course:

Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge, Free Download Video Sample:

Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge, Free Download PNG Sample:

Stock & Options Strategy: Volatility Surf Trade (low risk)

A straightforward and highly rewarding stock and options method that leverages Volatility ETNs (VXX or UVXY).

Course description

Note: I personally trade this method and provide it inside the Full Membership access!

You should join this course if you:

-

… previously purchased an options program, but found it too theoretical and lacking a practical, tested strategy

-

… already know the basics of options and are looking for a strategy you can directly use in the markets

-

… struggle with consistency in trading stocks, forex, or even options (derivatives)

-

… find yourself unprofitable when scalping or swing trading stocks

-

… rely on technical analysis but are not seeing positive outcomes

-

… use indicators that often give false or losing signals

-

… experienced major losses when shorting volatility during sudden volatility spikes

-

… are ready to adopt a structured trading plan with strict entry/exit rules (fully mechanical)

This training reveals a system that combines both stocks and options to capture profits from the natural behavior of Volatility ETNs like VXX and UVXY. These products tend to lose value over time, and this approach takes advantage of that decline caused by contango and roll yield. My focus is entirely on volatility-based trading with options (and now stock combinations). I stopped trading single stocks, options on individual companies, and forex years ago, dedicating myself solely to volatility. I even published a book on this subject, The Volatility Trading Plan, available on Amazon.

Inside this course, you’ll learn a stock-and-options hybrid strategy (easy to grasp, beginner-friendly) that allows you to grow capital while using options as protection. It’s a time-tested system with a genuine market edge designed to boost portfolio performance.

The lessons begin with the foundations of volatility analysis (VIX Futures Curve concepts) and then guide you into the creation of this combined stock and options setup, along with the reasoning behind it. You’ll also get access to an advanced variation (with higher risk) built to profit from sudden volatility jumps. Both systems include precise, rule-based entries and exits that can be executed mechanically.

By the end, you’ll hold a consistent, highly profitable trading strategy that merges stocks with options!

This program outlines a complete investment approach, including the logic behind it, the expected results, and supporting backtests to prove its reliability. It also shows alternative test cases that validate the selection criteria.

This methodology can serve as an excellent enhancement to your Stock or ETF portfolio returns! If you’ve been scalping or trading stock options without success, it’s time to pivot toward volatility. Best of all, you don’t need technical analysis skills or indicators — just follow the step-by-step rules based on market signals.

Options are derivatives, often tied to stocks. In this case, we deal with volatility itself — effectively trading a derivative of a derivative!

All you need is a basic understanding of options and a brokerage account (either real or demo if you prefer to test first).

Course content:

My Background / Experience

Why Volatility investing is much more interesting

Volatility trading risks (and how to control them)

Instruments of Volatility Trading

VIX® futures Term Structure

Contango, Backwardation and Roll Yield

Strategy rationale

Trading Rules (Basic Surf Volatility Trade)

“Modified Surf ” trading rules

Trade Examples

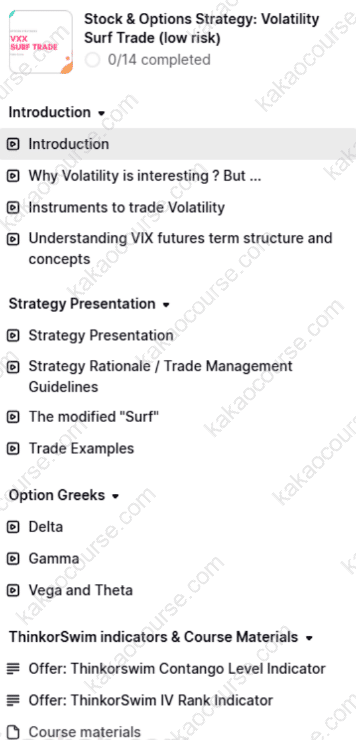

Contents

Introduction

- Introduction

- Why Volatility is interesting ? But …

- Instruments to trade Volatility

- Understanding VIX futures term structure and concepts

Strategy Presentation

- Strategy Presentation

- Strategy Rationale / Trade Management Guidelines

- The modified “Surf”

- Trade Examples

Option Greeks

- Delta

- Gamma

- Vega and Theta

ThinkorSwim indicators & Course Materials

- Offer: Thinkorswim Contango Level Indicator

- Offer: ThinkorSwim IV Rank Indicator

- Course materials

Reviews

There are no reviews yet.