Immediately Download AI For Traders: A Professional Manual for Hedge‑Fund‑Level Alpha by Laurence Connors

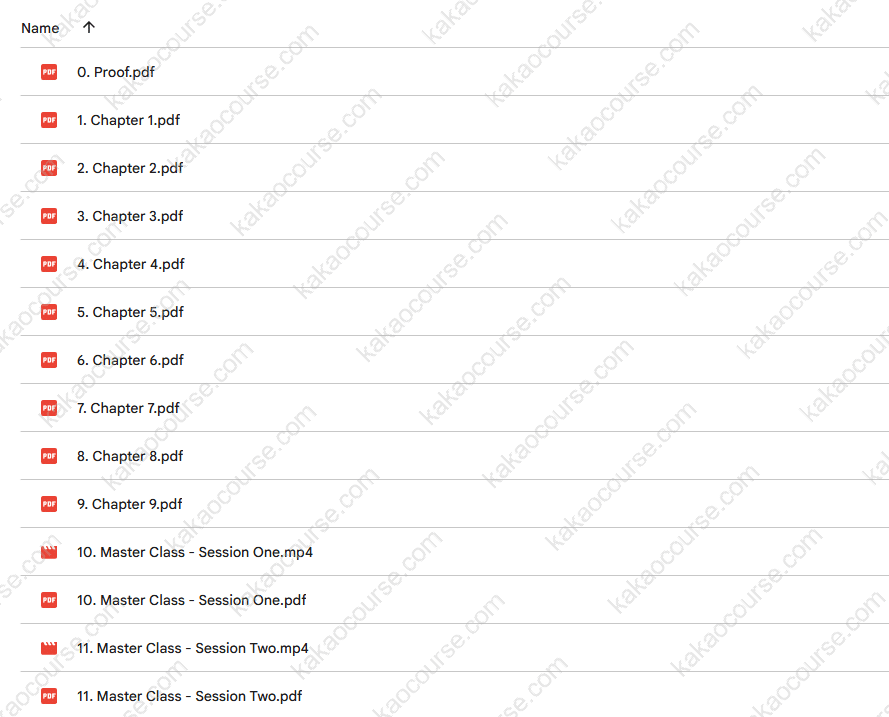

Check content proof, now:

AI For Traders: A Professional Manual for Hedge‑Fund‑Level Alpha by Laurence Connors, see what’s included in this course:

AI is The Greatest Source of Alpha in Market History

Larry Connors’ AI For Traders: A Professional Manual for Hedge-Fund-Level Alpha reveals how serious traders can extract Alpha—step by step, trade by trade.

Why Most Money Managers Fail to Beat the Market

The vast majority of fund managers (including top hedge funds) fail to outperform the benchmarks. Here’s why:

-

Fundamental Analysis: According to SPIVA, over the last 20 years, nearly 78% of large-cap managers underperformed the S&P 500. The edge disappeared long ago.

-

Technical Analysis: From Lo, Mamaysky & Wang (2000) through today, research has shown little statistical edge. As Euan Sinclair PhD once put it, “no hedge fund is building a Japanese candlestick department.”

-

Quantitative Analysis: Since 2021, the HFRI Quant-Systematic Index has produced only 2% annualized—barely above short-term T-bills. Crowding and HFT have killed the alpha.

Each method once worked. Today, they’re all scraping for scraps.

The Solution: Cognitive Analysis – The Final Frontier for Alpha

Cognitive Analysis fuses your trading expertise with the massive intelligence of AI. This is the “fourth and final” frontier for extracting real edge.

AI may hold more alpha than any other force in market history—but only for those who know how to systematically unlock it.

In AI For Traders, Larry Connors walks you through exactly how to do this, step by step. Within hours, you’ll know how to uncover vast amounts of AI-powered Alpha.

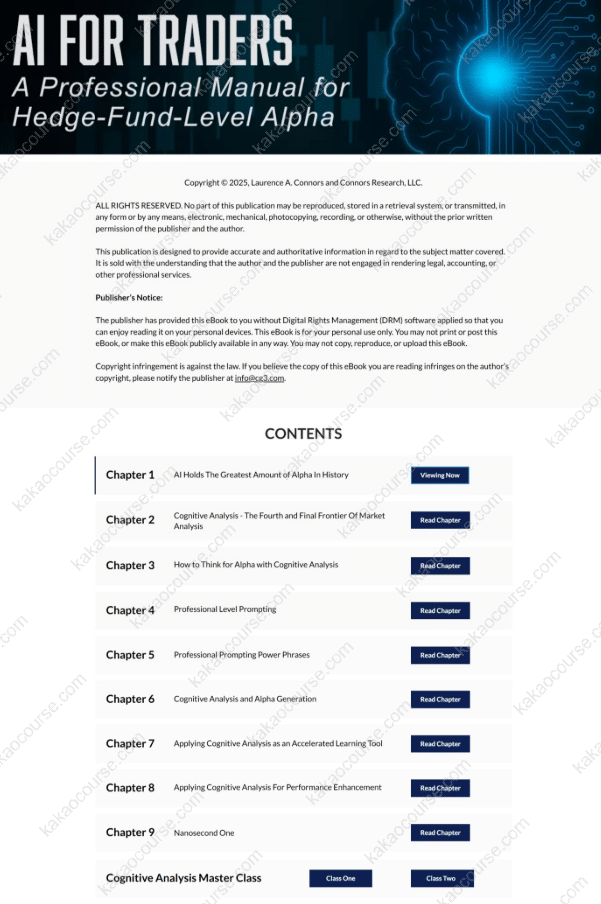

Every Chapter Builds Your Edge – Here’s What You’ll Learn

Free Download PDF Sample Below:

Chapter One: AI Holds the Greatest Amount of Alpha in History

-

How to compress 6 weeks of research into 20 minutes with AI workflows.

-

Why traditional edges have disappeared and how AI uncovers fresh inefficiencies.

-

Gain an institutional-grade AI playbook that puts you ahead of slower desks.

➡️ Try tonight: run the 20-minute workflow on your top three positions and open tomorrow with an AI-ranked, trade-ready plan.

Chapter Two: Cognitive Analysis – The Fourth and Final Frontier

-

See hard data proving FA, TA, and QA are obsolete.

-

Map exactly how edges migrated away and into Cognitive Analysis.

-

A blueprint for reallocating your time and capital into AI-driven workflows.

➡️ Drop your weakest screen today and apply CA to the same tickers tomorrow.

Chapter Three: How to Think for Alpha with Cognitive Analysis

-

Learn second- and third-order thinking to spot hidden shifts.

-

Use a 3-question reasoning checklist to cut weak trades and highlight asymmetric ones.

-

Walk through a real-world trade from headline to execution.

➡️ Apply the checklist to tonight’s news and uncover trades others won’t see.

Chapter Four: Professional-Level Prompting – The Three-Step Blueprint

-

Ask once, get hedge-fund clarity.

-

Replace hours of digging with one optimized prompt.

-

Create scalable prompts so your entire team gets pro-level answers.

➡️ Use the three-step prompt and get a data-rich trade setup in seconds.

Chapter Five: Five Prompt Amplifiers – Upgrade Every AI Response

-

Use precision “power phrases” to steer AI straight to alpha.

-

Cut research time by 80% while boosting insight quality.

-

Apply them across all assets, timeframes, and research tasks.

➡️ Insert one power phrase into your next prompt and watch results multiply.

Chapter Six: Turning Cognitive Analysis Into Repeatable Alpha

-

Spot disruptive sectors a year before Wall Street (like Quantum Computing).

-

Convert book quotes or short news blurbs into trading strategies.

-

Reverse-engineer strategies from hedge fund legends like Seth Klarman.

Chapter Seven: Compressing Weeks of Learning Into Hours

-

CALC, the Cognitive Analysis Learning Center, creates adaptive lessons.

-

Learn faster with quizzes, live insights, and event-driven training.

-

What once took weeks, you’ll master in just hours.

Chapter Eight: Trading Psychology Enhanced by AI

-

24/7 AI-powered coaching modeled on the best trading mentors.

-

A 48-question test builds your personalized behavioral blueprint.

-

Execution protocols keep you disciplined under stress.

➡️ Take the test tonight—start trading with a tailored roadmap tomorrow.

Chapter Nine: Embedding Cognitive Analysis Into Daily Workflow

-

Convert CA into a simple, 15-minute daily habit.

-

Scale your workflow across your team for exponential output.

-

Built-in updates protect your edge as markets evolve.

➡️ Use the CA daily-review checklist today to lock in a repeatable process.

BONUS: Larry Connors’ 7-Hour Master Class

Along with the manual, you’ll get immediate access to Connors’ private 7-hour Master Class—packed with proprietary trading strategies, professional AI workflows, and hedge-fund-level insights.

About the Author

Larry Connors

Larry Connors brings 44 years of professional trading experience to the AI era. He was one of the first Wall Street educators to show portfolio managers how to design institution-grade strategies with large language models through his in-depth course How to Build High-Performing Trading Strategies with AI.

Connors’ work has shaped modern short-term trading. In the 1990s he published the first statistically driven mean-reversion studies, followed by early research on VIX behaviour. In 2003 he adapted Welles Wilder’s RSI into the now-standard 2- and 4-period signals still referenced by institutional desks.

He has written fourteen trading books, widely translated and used by professionals worldwide, and earned the Charles H. Dow Award for original research. His insights have appeared in The Wall Street Journal, The New York Times, and Bloomberg. Connors also founded TradingMarkets and Connors Research, firms dedicated to delivering evidence-based, AI-enhanced strategies to sophisticated traders.

Reviews

There are no reviews yet.