Instant Download Bulletproof Asset Protection Course 2025 by William Bronchick – Here’s What’s Inside This Package:

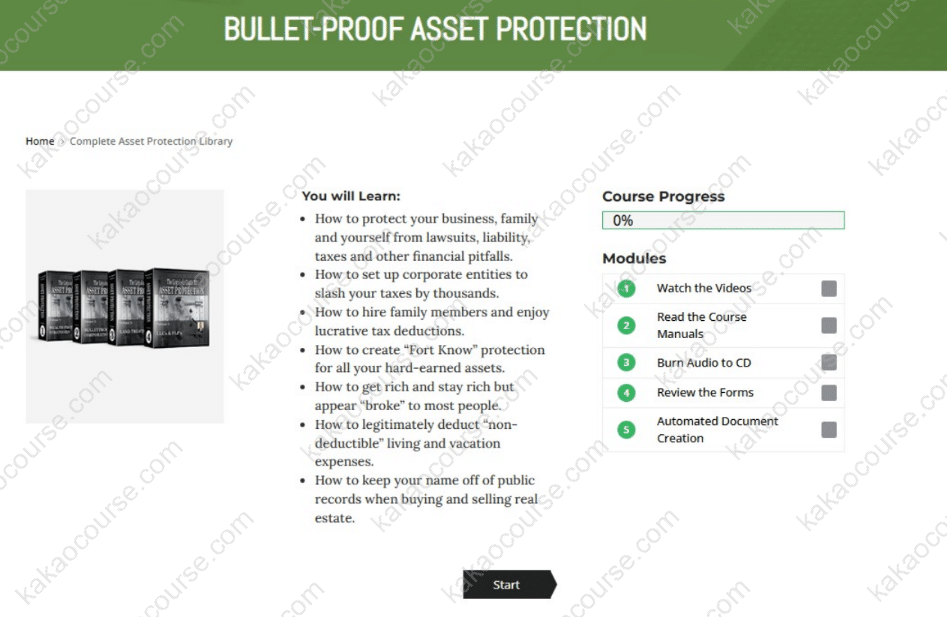

Bulletproof Asset Protection Course 2025 by William Bronchick, Sneak Peek Inside The Course:

Bulletproof Asset Protection Course 2025 by William Bronchick, Check Out This Free Video for Additional Information:

Bulletproof Asset Protection Course 2025 by William Bronchick, Grab Your Free PDF Sample Below:

In a world where wealth can grow quickly and risks move even faster, effective asset protection is no longer optional—it’s foundational. Bulletproof Asset Protection Course 2025 by William Bronchick, ESQ. is a comprehensive, practitioner-led program designed to help entrepreneurs, real-estate investors, and high-earning professionals structure their affairs responsibly, minimize exposure to litigation, and steward intergenerational wealth within the bounds of the law.

Overview this course

This course distills decades of legal and entrepreneurial experience into an accessible, step-by-step framework for building and safeguarding wealth. You’ll move from core concepts—like how liability actually arises in business and real estate—to advanced strategies involving entities, trusts, and recordkeeping. The emphasis is practical: you’ll learn what to set up, why it matters, and how to maintain it correctly so the plan you design today still functions five years from now.

Because students join us from around the world, the curriculum is written in clear, neutral language and focuses on first principles that translate across jurisdictions. Where laws differ by region or state, you’ll learn decision frameworks and due-diligence checklists you can use with your local advisors. The training also includes examples, model documents, and realistic case studies so you can see precisely how asset-protection choices play out in business operations, real-estate deals, and family planning.

The 2025 edition refines the learning path with updated modules on entity selection for mixed income streams, documentation that survives audits and discovery, and responsible planning around privacy. You’ll walk away with a structured playbook: how to separate assets, how to document transactions, how to design guardrails, and how to reduce avoidable risk without compromising growth.

Why should you choose this course?

-

Led by a seasoned practitioner

William Bronchick, ESQ. teaches the same frameworks he has used to educate entrepreneurs and investors for years—translating legal nuance into practical moves you can implement. -

Strategy plus execution

Beyond “what” to do, you’ll learn “how” to do it: draft minutes, keep books, document loans, memorialize capital contributions, and maintain formalities that matter in courtrooms and audits. -

Entity and trust literacy—made usable

Understand when corporations, LLCs, land trusts, and family limited partnerships fit (and when they don’t). Learn to combine structures thoughtfully instead of piling on complexity. -

Documentation that stands up to scrutiny

Build a clean paper trail with consistent procedures, internal resolutions, and supporting exhibits—so your intent is clear and your records are defensible. -

Designed for global professionals

Short, focused lessons; downloadable resources; and examples that apply whether you operate a local business, a real-estate portfolio, or a cross-border venture. -

Actionable assets

Templates, sample forms, and checklists help you operationalize learning immediately with your accountant, attorney, and team.

What You’ll Learn

Core Foundations

-

Risk mapping and liability basics: Identify where liability originates (operations, contracts, premises, professional services) and how to isolate it with structure and process.

-

Separating economic activity: Apply the principle of “boxes and walls”—separating operating risk from valuable assets and personal holdings.

Entity Strategy & Governance

-

Corporations (C and S elections): When each structure fits, how distributions work, and how to keep minutes, resolutions, and ledgers that demonstrate real corporate behavior.

-

Limited Liability Companies (LLCs): Operating agreements, manager vs. member management, and coordinated planning when an LLC elects to be taxed as an S corporation.

-

Family Limited Partnerships (FLPs): Governance, limited vs. general partner roles, and thoughtful use in family wealth and succession planning.

-

Multiple-entity architectures: Using holding companies, special-purpose entities for real estate, and project-level LLCs to ring-fence risk without unnecessary reporting burdens.

Trusts & Privacy-Aware Planning

-

Land trusts: How they are used in property transactions and when privacy and separation objectives are advanced by holding title in trust.

-

Personal-property trusts: Principles for managing non-real-estate assets, account titling, and documentation.

-

Trust mechanics: Roles (grantor, trustee, beneficiary), funding, and the practical realities of administration and compliance.

Real-Estate-Focused Protections

-

Landlord exposure and mitigation: Liability hotspots in leasing, vendor management, and maintenance—and how entity, lease, and insurance choices interact.

-

Acquisitions and transfers: Title strategies, due-diligence files, and paper trails that support clean transactions and reduce disputes.

-

Portfolio design: Deciding when to separate properties and how to manage inter-company agreements and service arrangements.

Documentation & Paper Trails

-

Minutes, resolutions, and agreements: Drafting practices that clarify business purpose, record approvals, and allocate responsibilities.

-

Loan and capital documentation: Board approvals, promissory notes, collateral descriptions, and repayment evidence that align with accounting.

-

Audit and discovery preparedness: Building files that are complete, consistent, and discoverable without exposing unrelated assets.

Tax-Aware Structuring (within the law)

-

Coordinating with tax rules: Entity choices and elections that support operational goals and legitimate tax efficiency.

-

Compensation and benefits planning: How owner compensation, fringe benefits, and accountable plans must be documented.

-

Estate and succession considerations: Tools for orderly transition and intergenerational planning, with sensitivity to regional rules.

Operational Excellence

-

Formalities that actually matter: Calendars for meetings, signature authority, document retention, and change-management.

-

Vendor and contractor agreements: Indemnities, insurance certificates, and scopes of work that align with your risk posture.

-

Guardrails for growth: Decision records, cross-entity service agreements, and written policies that scale without adding chaos.

Ethics, Compliance & Responsible Practice

-

Doing it right: Why transparency, fair dealing, and compliance are not only ethical but also strengthen your defenses.

-

Common errors to avoid: Commingling funds, undocumented transfers, and “form without substance.”

-

Collaboration with advisors: How to brief your CPA and attorney efficiently and create a cadence for ongoing reviews.

Learning Format & Resources

-

Downloadable manuals for quick reference, structured into progressive modules.

-

Streaming video and audio so you can learn on any device, anywhere.

-

Editable templates and sample forms (e.g., minutes, resolutions, operating-agreement excerpts) to accelerate implementation.

-

Case studies and exercises that let you practice evaluation and documentation before you apply them to live deals.

Who Should Take This Course?

-

Entrepreneurs and small-business owners who want to scale revenue while reducing avoidable personal exposure.

-

Real-estate investors and landlords seeking a clear framework for property-level protection, financing documentation, and privacy-conscious ownership.

-

High-earning professionals and consultants who contract with multiple clients and need formal structures and policies.

-

Family offices and wealth builders preparing for orderly succession and intergenerational stewardship.

-

Aspiring investors who want to start with the right foundation, not retrofit later at greater cost.

-

International participants who need globally applicable principles and rigorous checklists to use alongside local counsel.

Prerequisites

-

A working understanding of your business or investing model.

-

Willingness to document and maintain processes.

-

Openness to coordinate with qualified local advisors when jurisdiction-specific questions arise.

Conclusion

Asset protection is not a single document or an exotic vehicle; it is an operating system. The Bulletproof Asset Protection Course 2025 gives you the mental models and practical tools to design that system carefully, operate it consistently, and adapt it as your business and life evolve. By learning how liability really arises, where records fail, and which structures support your goals, you build a durable edge—one that protects your time, your focus, and the wealth you create.

This program is intentionally pragmatic. You’ll learn to separate risk from value, to keep clean books and minutes, to document decisions, and to coordinate with advisors in a way that is efficient rather than overwhelming. Most importantly, you’ll gain the clarity to make confident choices—choosing what to own where, what to disclose, and how to sustain protections through growth and succession.

Ready to build a stronger foundation for everything you’re creating? Secure your seat today and start implementing your asset-protection blueprint.

Reviews

There are no reviews yet.