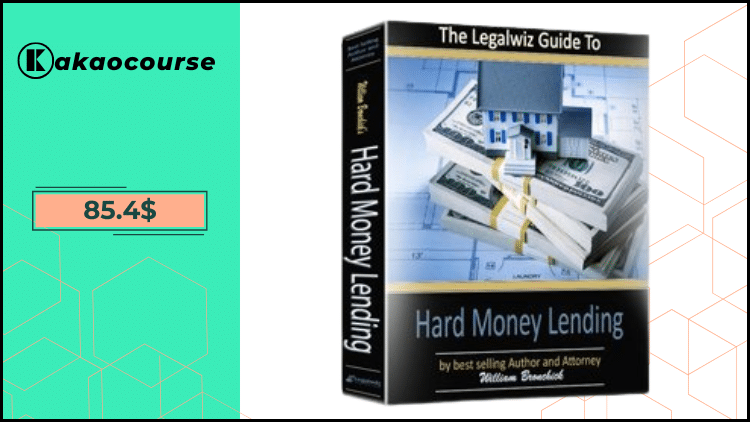

Free Download Hard Money Lending 2025 by William Bronchick – Includes Verified Content:

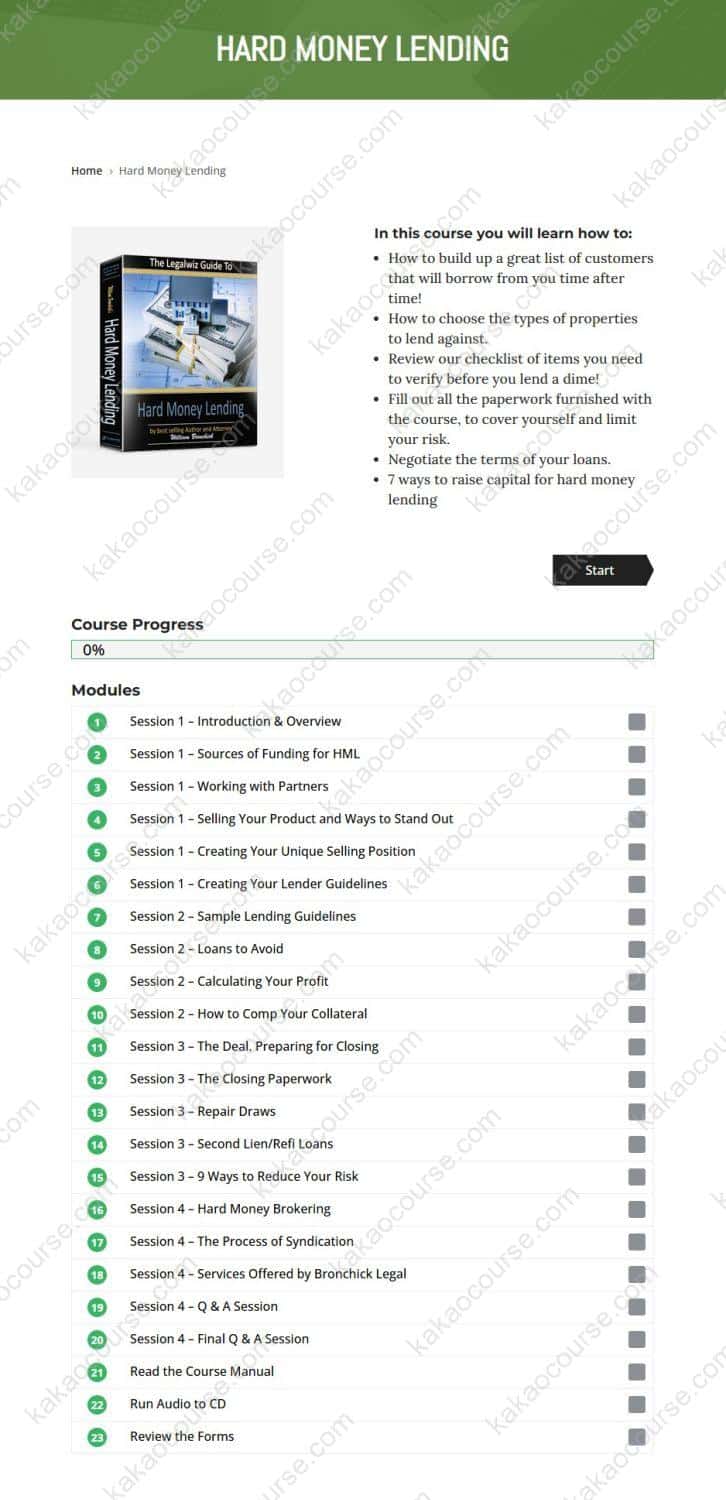

Hard Money Lending 2025 by William Bronchick, Sneak Peek Inside The Course:

Hard Money Lending 2025 by William Bronchick, Watch Our Free Video to Find Out More:

Hard Money Lending 2025 by William Bronchick, Grab Your Free PDF Sample Below:

Turning idle cash into consistent, secured returns doesn’t require flipping houses or managing tenants. Hard Money Lending 2025 by William Bronchick is an online course that shows you how to finance real estate investors safely and professionally—structuring short-term, asset-backed loans with protective documents, disciplined underwriting, and a repeatable process you can run from your desk.

Taught by William (“Bill”) Bronchick, Esq.—best-selling author, attorney, and active investor—the curriculum blends legal precision with field-tested lending workflows. You’ll learn how to source qualified borrowers, evaluate collateral, price risk, and close loans the way pros do: with clean files, enforceable agreements, and clear exit strategies. If you have access to capital (cash, credit lines, or self-directed retirement funds) and want a hands-off, systemized path to double-digit targets with controls, this program is built for you.

Overview this course

Hard money lending is simple in concept: you make a short-term loan secured by real estate, collect interest and fees, and get repaid when the borrower sells, refinances, or completes a project. In practice, success depends on process—how you qualify borrowers, underwrite the property and deal structure, document terms, manage closing, and monitor your position during the life of the loan.

This course walks you through the entire lifecycle:

-

Setting a lending box (markets, property types, LTV caps, term limits).

-

Building a borrower pipeline and screening quickly without missing red flags.

-

Completing diligence on title, value, scope of work, budget, and exit.

-

Drafting and executing notes, deeds of trust/mortgages, guarantees, and disclosures that keep you protected.

-

Coordinating with title/escrow so funds move only when your lien is perfected.

-

Servicing basics, extensions, draw controls, and foreclosure readiness (if ever needed).

You’ll also see how to deploy retirement capital via self-directed IRAs/401(k)s under non-recourse rules, with a compliance-first approach. The result is a realistic operating playbook you can implement immediately and scale over time.

Why should you choose this course?

-

Attorney-led, practice-driven training

You’re learning from a practitioner who has structured, supervised, or closed thousands of transactions. Legal guardrails are integrated into every step—so your lending is both profitable and defensible. -

Built for 2025 realities

Today’s valuations, draw schedules, title practices, and borrower expectations differ from a decade ago. The course reflects current norms, from appraisal alternatives to digital verifications and escrow workflows. -

Risk control at the core

You’ll internalize underwriting discipline—loan-to-value, ARV validation, contractor capacity, budget contingencies, exit analysis—so you lend on deals, not stories. -

Files that stand up

Professional documents (promissory note, security instrument, disclosures, lien waivers, closing instructions) and checklists reduce the chance of errors that cause expensive disputes. -

Multiple capital sources

Learn to deploy your own cash, pool investor capital compliantly in appropriate contexts, or use retirement funds in self-directed accounts—always within the rules and with clear paper trails. -

Operational simplicity

Templates, step-by-step checklists, and decision trees let you analyze a request in minutes, not days—so you move fast without skipping safeguards.

What You’ll Learn

1) Foundations of Private/Hard Money Lending

-

The economics of short-term, asset-based loans: interest, origination points, fees, and extensions.

-

Typical terms and structures (interest-only vs. amortizing; 6–12 month maturities; rehab budgets and draws).

-

Your “credit box”: geography, product type, borrower profile, and maximum exposure.

2) Building a Borrower Pipeline

-

Ethical, effective marketing to reach repeat borrowers (investor groups, local meetups, title company referrals, contractors, wholesalers, small developers).

-

Positioning yourself as a reliable lender: response times, documentation expectations, and clarity on funding conditions.

-

A pre-screening questionnaire that filters 80% of non-fits in five minutes.

3) Fast, Focused Underwriting

-

Nine must-check items before you issue terms: purchase contract, title report, valuation support, scope/budget, contractor credentials, permits, timeline, exit plan, and borrower liquidity.

-

Setting conservative LTV/LTC caps (purchase + rehab) and verifying true ARV with multiple data points.

-

Identifying property types to avoid (funky function, environmental risk, complex legal encumbrances).

-

The 7-minute deal screen: triage to “pass,” “price differently,” or “proceed to full diligence.”

4) Collateral Valuation and Verification

-

When a full appraisal makes sense vs. broker price opinions and in-house models.

-

Reconciling comps, adjusting for condition, and sanity-checking ARV against neighborhood ceilings.

-

Title work essentials: liens, encumbrances, easements, taxes, HOA status, and required endorsements.

5) Structuring the Loan

-

Pricing for risk: balancing rate, points, and fees with LTV, experience, and project complexity.

-

First vs. second liens: when junior positions are worth it and how to reduce exposure.

-

Cross-collateralization, guarantees, and interest reserves—how and why they’re used.

-

Draw schedules that match construction critical paths, with photo/video proofs and lien waivers.

6) Documentation That Protects You

-

Core instruments: promissory note, deed of trust/mortgage, personal or entity guarantees (where appropriate), assignment of rents, UCC filings (if applicable).

-

Plain-English clauses that matter: default triggers, late fees, cure periods, inspection rights, insurance requirements (additional insured/loss payee), and transfer restrictions.

-

Closing instructions to escrow: funding conditions, pro-rations, recording order, and disbursement controls.

-

Compliance overview for private lenders, including advertising cautions and state-specific commercial lending considerations (consult local counsel).

7) Managing the Loan After Closing

-

Servicing: payment collection, escrow/impounds, inspection cadence, and progress tracking.

-

Handling changes: extensions, approved budget reallocations, and documented change orders.

-

Early-warning signals of default and how to intervene professionally and lawfully.

8) Default Remedies & Exit Strategies

-

Knowing your rights: notice of default, acceleration, deed in lieu, judicial vs. non-judicial foreclosure timelines (jurisdiction-dependent).

-

Cost-benefit analysis of workouts vs. enforcement—and how to document each step to preserve recoveries.

-

Disposition planning if you take title: vendor lists, property preservation, and resale options.

9) Using Retirement Accounts to Lend

-

Self-directed IRA/Solo 401(k) basics; how non-recourse lending works inside a plan.

-

Avoiding prohibited transactions and keeping all income/expenses flowing through the plan.

-

Recordkeeping your custodian (or checkbook entity) will expect on every loan.

10) Raising Capital the Right Way

-

Seven avenues to expand lending capacity—private relationships, partnerships, institutional participation—paired with a sober overview of regulatory boundaries.

-

Packaging your track record: pipeline, process, performance metrics, and risk controls investors care about.

-

Co-lending and participation agreements: aligning interests and documenting waterfall mechanics.

11) Advanced Topics to Sharpen Your Edge

-

Second-position loans without losing your shirt: intercreditor agreements, combined LTV tests, and exit buffers.

-

Underwriting flips vs. wholetails vs. small value-add multis—what changes in your model.

-

“What you don’t know you don’t know”: hidden liens, contractor affidavits, occupancy misreps, insurance gaps—and how your checklist catches them.

12) Your Ready-to-Use Toolkit

-

Course manual (72 pages) with step-by-step workflows and examples.

-

Audio from the live training for on-the-go reinforcement.

-

Slide deck (PDF) to review key decision trees before calls.

-

Legal forms & checklists: notes, deeds of trust/mortgages, disclosures, diligence and closing checklists—editable for counsel to localize.

Education first, execution second: you’ll use these tools with guidance from qualified professionals in your jurisdiction.

Who Should Take This Course?

-

Capital holders with cash, lines of credit, or retirement funds seeking passive, secured yields.

-

Active real-estate investors ready to diversify from flips/landlording into lending with systems and controls.

-

Professionals (agents, contractors, developers) who understand projects and want to monetize that insight by funding them.

-

Family offices and high-income earners looking for collateralized, short-duration opportunities with documented downside management.

-

Analytical beginners who prefer checklists, legal clarity, and measured risk over speculation and hype.

If you appreciate disciplined underwriting, clean paperwork, and predictable timelines, this program gives you a lender’s operating system you can trust.

Conclusion

Sustainable lending is not about chasing the highest rate; it’s about buying risk correctly—at the right LTV, on the right collateral, with the right borrower, documented the right way. Hard Money Lending 2025 by William Bronchick replaces guesswork with structure: a borrower pipeline you can build, an underwriting model you can defend, and a closing process that safeguards your capital from day one. With templates, checklists, and legal insights at your fingertips, you’ll move quickly, protect your downside, and position yourself for repeat deals with reliable operators.

Take the driver’s seat and put your money to work on your terms—enroll now and start funding your first secured loan with professional confidence.

Reviews

There are no reviews yet.