Free Download High Probability Scalping by JR Romero – Here’s What You’ll Get Inside:

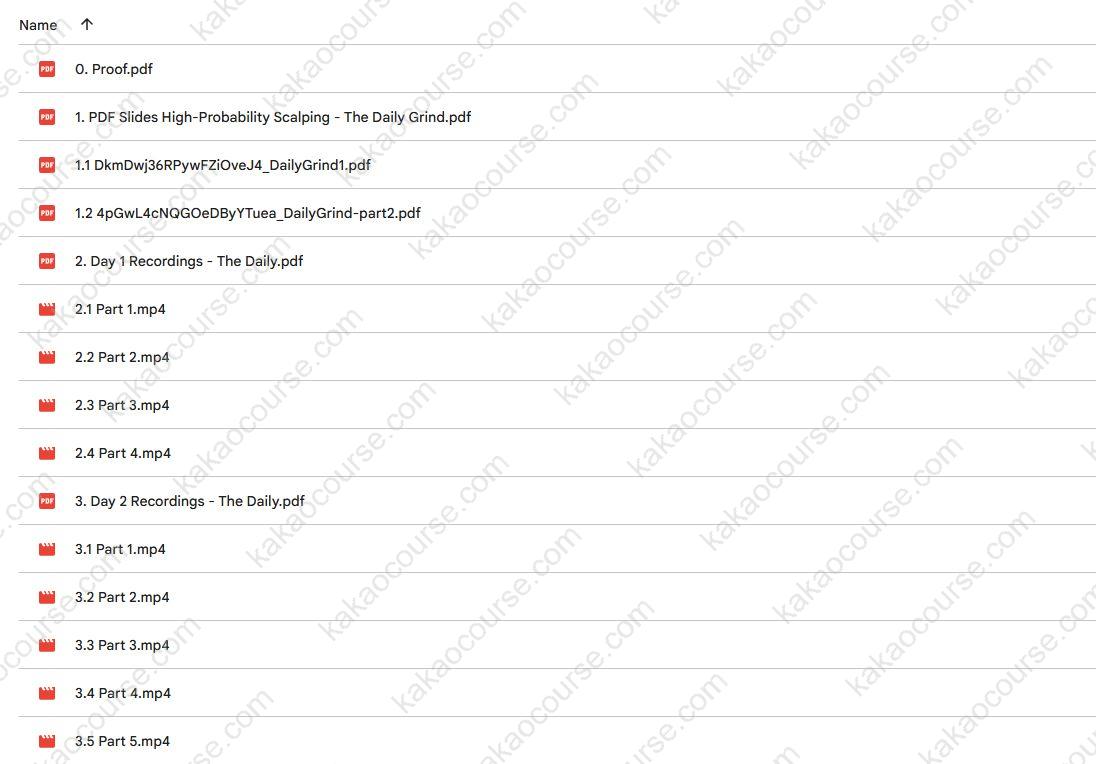

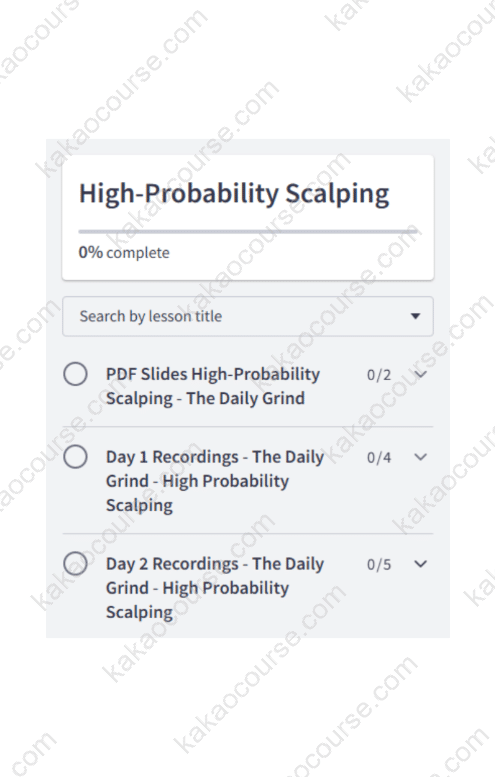

High Probability Scalping by JR Romero, Sneak Peek Inside The Course:

High Probability Scalping by JR Romero, Free PDF Preview Available Below:

Overview this course

High Probability Scalping by JR Romero is a deep-dive, price-action curriculum for traders who live on intraday charts and want a clean, rules-driven way to act fast without guessing. This program is not about long-term investing or swing trading. It’s a technical, no-fluff blueprint for reading short-term order flow, recognizing the psychology forming inside each bar, and executing with discipline on compressed time frames.

Across 13+ hours of on-demand training plus a 456-page desktop guide, JR breaks down how professional scalpers think, prepare, and pull the trigger: from gap plays and continuation structures to breakouts, liquidation breaks, and time-of-day nuances most courses never address. You’ll learn to move beyond generic “technical analysis” and toward the practical edge—when to engage, where your risk belongs, and how to measure your probability before you click buy or sell.

JR Romero—Leader of T3 Live’s Momentum Express VTF®, trader since 2001—teaches a method that blends chart structure, news flow awareness, and intermarket context to generate high-probability intraday ideas. The delivery is plain English, platform-agnostic, and designed for traders who want the why behind every rule. By the end, you’ll have a repeatable process: map the environment, select the play that matches it, execute with predefined risk, and log the outcome so your edge compounds.

Educational content only. All trading involves risk; no strategy can eliminate losses. Use sound risk management and make independent decisions.

Why should you choose this course?

-

Price action, demystified

You’ll learn to read bars and sequences as the visible record of crowd behavior—so you’re reacting to facts, not feelings. -

A framework for time of day

The open, mid-morning, midday, and late session each behave differently. You’ll get patterns and expectations calibrated to those rhythms. -

From “technical analysis” to trading edge

JR distinguishes chart study from money-making process: selection → timing → execution → review. -

Dozens of entries—organized, not overwhelming

Gaps, continuations, breakouts, liquidation breaks, and more—grouped by market condition and session context so you know when to use what. -

Wyckoff on lower time frames

Apply accumulation/distribution concepts to 1–5 minute charts without turning your screen into spaghetti. -

Market internals & catalysts

Read the backdrop so you’re not forcing longs into risk-off or shorting into strong risk-on—context first, setup second. -

Performance engineering

Workstation layout, multi-monitor logic, and hotkeys that reduce friction and let you act when milliseconds matter. -

A serious reference library

The 456-page PDF is built as a flip-to-the-page desk guide—entries, stops, invalidations, and examples at your fingertips. -

International & platform-agnostic

The method is built on price, time, and volume—universal elements you can access anywhere.

What You’ll Learn

Foundation: what makes a trading edge

-

Why chart reading ≠ profitability, and how to bridge the gap with selection criteria, risk placement, and expectancy.

-

The five phases and three trends that short-term charts cycle through—and how to adjust tactics accordingly.

-

“Merchant” mindset vs. “predictor” mindset: inventory, location, and probability instead of opinions and hope.

Price action, properly structured

-

Bar-by-bar psychology: who’s trapped, who’s in control, and what that implies for the next bars.

-

Continuation logic: flags, micro-bases, and orderly pullbacks that resolve with momentum—and the tells that a pattern is decaying.

-

Breakouts done right: building energy, locating real liquidity, and placing stops beyond structure, not arbitrary round numbers.

-

Liquidation breaks: spotting forced exits and fading exhaustion with risk defined.

Wyckoff for scalpers

-

Condensing accumulation/distribution into intraday sequences you can recognize at a glance.

-

Springs, upthrusts, and tests—how to avoid the first trap and trade the confirmation.

-

Aligning wave counts and effort vs. result (volume/range) for higher-confidence entries.

Gaps & the open

-

Which gaps deserve attention (pro vs. novice, ignition vs. exhaustion).

-

Fast entries for gap-and-go, first pullback, and flip plays (red-to-green/green-to-red).

-

When to step aside: wide-range chaos, imbalanced opens, and “30-second wonders.”

Time-of-day playbook

-

Opening drive: momentum structures and how to manage slippage risk.

-

Mid-morning: pullbacks, first retests, and ORB confirmations.

-

Midday: mean-reversion edges and why you trade less, not more.

-

Late session: power-hour continuity, VWAP reclaims/failures, and closing range dynamics.

Market internals & catalysts

-

How to incorporate the broader environment—index tone, sector strength, and scheduled news—so your micro setup doesn’t fight the macro tape.

-

Catalysts vs. noise: differentiating a tradeable spark from a headline that fades.

Balancing tools without clutter

-

Candlesticks, patterns, and a small set of indicators used as context (not crutches).

-

Creating a minimal, repeatable chart layout that supports rapid recognition.

Risk, sizing, and expectancy

-

Calculating R, win rate, and payoff ratio; why small losses are tuition and outlier wins pay for the grind.

-

Sizing rules so a single loss never defines your day.

-

Scaling out into structure, trailing appropriately, and ending the trade when the reason is gone.

Cognitive discipline: winning the “Apophenian War”

-

Avoiding pattern-seeing where none exists; codifying if/then statements to reduce bias.

-

Pre- and post-market routines: checklist at the open, review at the close, and a tagging system that sharpens selection over time.

Workstation & execution speed

-

Screen layout for scanning, execution, and monitoring without scatter.

-

Hotkeys that cut reaction time and reduce mis-clicks in fast markets.

-

Logging trades without losing the live moment.

Your intraday operating system

-

Scan → shortlist → scenario plan → entry/stop/targets → execute → document → debrief.

-

Daily guardrails: max loss, trade count, and “walk-away” triggers that protect your equity and your focus.

What you get (and how to use it)

-

13+ hours of segmented video lessons: watch, practice, rewatch for edge retention.

-

456-page PDF with one-page sheets for each setup (criteria, trigger, invalidation, management).

-

A step-by-step approach to testing plays in sim, then sizing in live markets responsibly.

Who Should Take This Course?

-

Dedicated day traders who want a comprehensive, rules-based scalping framework rather than scattered tips.

-

Intraday technicians hungry for granular detail on bar-by-bar logic, not vague generalities.

-

Momentum and news-flow traders seeking structure to balance speed with risk control.

-

Process-driven learners who value checklists, journaling, and measurable improvement.

-

Not ideal for long-term investors, position traders, or absolute beginners; the material assumes comfort with charts and fast execution.

If you eat, sleep, and breathe short-term charts—and you want to turn that passion into disciplined process—this program meets you at that level.

Conclusion

Scalping is not about predicting the future; it’s about reading the present precisely enough to define risk and press probability—over and over—without drama. High Probability Scalping gives you the full stack to do that: context, setups, time-of-day rules, workstation design, and the mindset to fight bias and execute cleanly. With a serious video curriculum and a hefty desk manual, you’ll replace improvisation with a proven playbook and a daily routine you can trust.

As you apply the system, your screen time starts feeling different: fewer forced trades, clearer entries, faster exits when wrong, and steadier performance metrics. You won’t “know” what any stock will do next—no one does—but you will know what to do when your conditions appear, and that’s how consistency is built.

Ready to turn short-term chaos into a rules-based edge? Enroll in High Probability Scalping today and start trading intraday price action with clarity, speed, and discipline.

Reviews

There are no reviews yet.