Free Download Lease Option Course 2025 by William Bronchick – Here’s What You’ll Get Inside:

Lease Option Course 2025 by William Bronchick, Check Out the Full Course Contents:

Lease Option Course 2025 by William Bronchick, Quick Free Video for More Information:

Lease Option Course 2025 by William Bronchick, Check Your Free PDF Sample Here:

The idea behind lease options is elegantly simple: control today, decide later. With a lease/option you can lease a property now and secure the exclusive right—but not the obligation—to buy it in the future on agreed terms. That flexibility unlocks multiple ways to earn: up-front option consideration, monthly spread, and a back-end profit when your tenant/buyer exercises the option.

Lease Option Course 2025 by William Bronchick turns that concept into a precise, step-by-step operating system. Authored by a best-selling real-estate attorney and veteran investor, the program is designed for modern market conditions and emphasizes legality, ethics, and clear documentation—so you can operate confidently, even if you’re new.

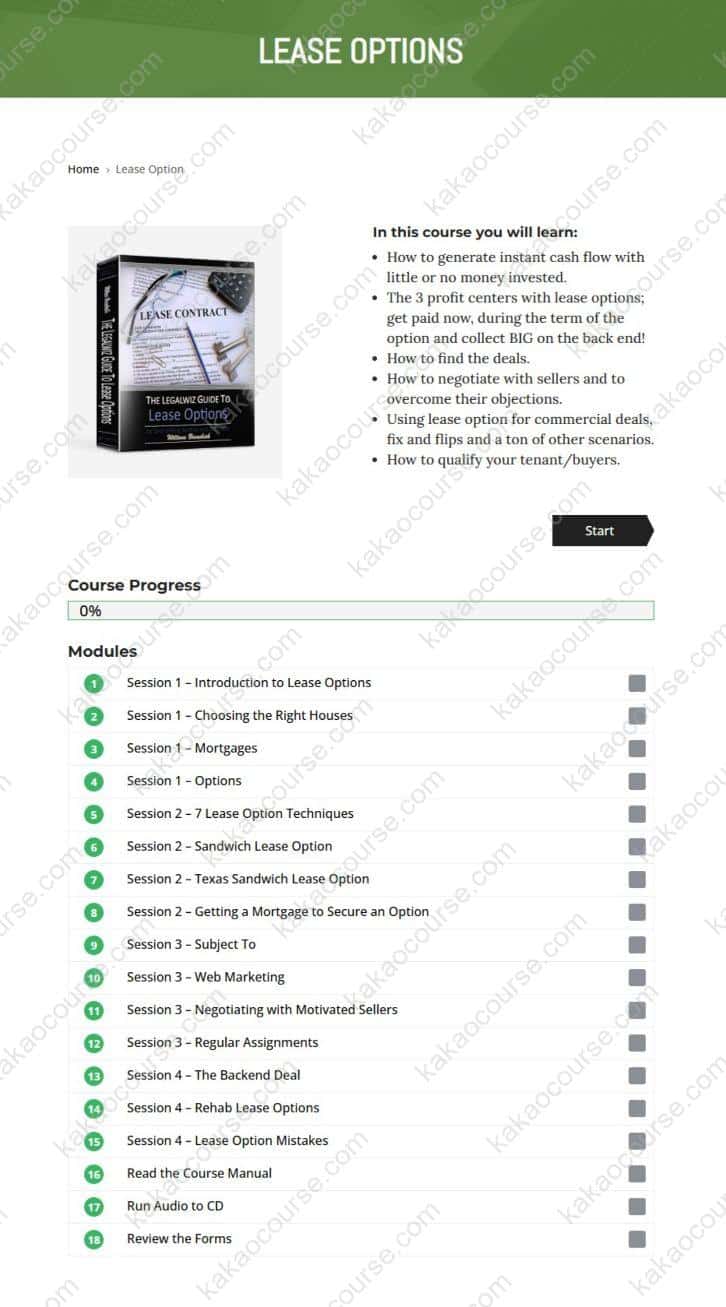

Overview this course

This course shows you how to find lease-option opportunities, structure offers that work for sellers and tenant/buyers, document the deal properly, and manage risk from first call to final transfer. You’ll learn both sides of the strategy:

-

Tenant/Buyer path (“try before you buy”)—rent the home now, lock in a future purchase price, and build a clear path to ownership.

-

Investor/Landlord path—control or own a property and place a qualified tenant/buyer with an option, creating immediate and ongoing cash flow with measured risk.

What sets this course apart is its practitioner focus. You’re not getting “rules of thumb” in a vacuum; you’re getting tested scripts, checklists, and forms you’ll actually use. The training is delivered in multiple formats—manual, videos, audio, and editable documents—so you can learn on the go and implement fast. Every module moves in a logical sequence: source → evaluate → negotiate → document → manage → exit.

Why should you choose this course?

-

Built for 2025 realities

Lending standards, underwriting, and consumer expectations evolve. The course reflects current practices so your structures, disclosures, and timelines align with today’s market—not last decade’s. -

Attorney-level clarity, investor-level practicality

William Bronchick has closed and advised on thousands of deals. You’ll understand both the mechanics and the guardrails, explained in plain English. -

Capital-efficient growth

Lease options emphasize control over ownership, enabling you to create cash flow with modest out-of-pocket costs while preserving capital for reserves and marketing. -

Seven-plus profit patterns

From classic “sandwich” structures to exit-ready options and rent-to-own placements, you’ll see where each method fits—and where it doesn’t. -

Ethical and transparent by design

You’ll master proper qualification, clear disclosures, and documentation that treat sellers and tenant/buyers fairly—because reputation compounds faster than any deal. -

Implementation tools included

A comprehensive manual, live-workshop videos, audio lessons, a full set of forms, and a working PowerPoint outline ensure you’re never guessing at the next step.

What You’ll Learn

1) Lease-Option Fundamentals, Without the Jargon

-

The difference between lease with option vs. lease-purchase—and why that wording matters.

-

How consideration, option term, strike price, rent credit, and maintenance expectations fit together.

-

The roles and responsibilities of owner, optionee, tenant/buyer, and any intermediary.

2) Finding Deals in Your Backyard (and Beyond)

-

Off-market channels that surface motivated owners: expired listings, for-rent-by-owner, life-event leads, tired landlords, probate/relocation scenarios.

-

How to scan online ads and public data to spot instant lease-option candidates.

-

A weekly outreach rhythm (targets, numbers, follow-up cadence) that builds a steady pipeline.

3) Negotiation Frameworks That Win Cooperation

-

How to speak to a “cash-only” seller without turning the conversation adversarial.

-

Positioning a lease-option as a solution—stability, reduced turnover, faster carry relief, and a defined exit.

-

Scripts to handle common objections (“What if you don’t buy?”, “Who fixes what?”, “How soon do we close?”).

-

“Magic questions” that surface true needs: timing, payment pressure, equity goals, and risk tolerance.

4) Underwriting the Numbers (So the Math Works in Real Life)

-

Setting an option price grounded in comps and projected market drift—without speculative promises.

-

Establishing the monthly spread and rent credits that make sense for both sides.

-

Determining an ethical, market-appropriate option consideration.

-

Sensitivity checks (vacancy, repairs, exit timing) and when to say “pass.”

5) Qualifying Tenant/Buyers Professionally

-

Income, stability, and credit patterns that indicate a realistic path to purchase.

-

Verifying capacity (down payment accumulation, credit-repair plan, lender consultation).

-

Clear house rules: upkeep, minor repairs, and communication.

-

Documentation that confirms expectations in writing and protects everyone involved.

6) Documentation & Compliance (Plain-English, Step by Step)

-

Core documents you’ll use:

-

Residential lease with investor-friendly but fair terms

-

Option agreement with price, term, consideration, and conditions

-

Disclosures tailored to your jurisdiction

-

Receipt/acknowledgment forms for consideration and notices

-

-

How to align lease language with option terms so the two agreements don’t conflict.

-

When to involve local counsel or a compliance-savvy title/escrow company.

-

Practical notes on federal and state rules (including how Dodd-Frank may intersect with certain structures) so you operate within the lines.

7) Seven Ways to Profit with Lease Options

-

Classic lease-option placement—control or own → place a qualified tenant/buyer.

-

Sandwich lease-option—control from owner, then sub-lease with an option to a tenant/buyer for spread + back-end.

-

Assignment of option—create value in the contract, then assign for a fee when appropriate.

-

Lease-purchase exit—when a binding purchase timeline better fits the parties’ goals.

-

Commercial and small multifamily adaptations—where the logic still works and what to modify.

-

Fix-and-option hybrid—light improvements paired with a near-term option exercise.

-

Equity-build programs—structuring rent credits responsibly to align incentives.

8) Funding, Retirement Accounts & OPM

-

Using self-directed IRAs/401(k)s for certain roles in lease-option deals (with custodian and prohibited-transaction awareness).

-

Where outside capital or partners make sense—and how to document expectations.

9) Marketing & Lead Management

-

Compliant advertising for tenant/buyers: clarity first, hype never.

-

List-building and follow-up that converts inquiries into qualified appointments.

-

How to present your opportunity to lenders early, so your tenant/buyer’s path to financing is real.

10) Case Studies & Pattern Recognition

-

Real-world examples from the instructor and successful students: the setup, the sticking points, the paperwork, and the outcomes.

-

Checklists that help you recognize repeatable patterns—and red flags to avoid.

11) What’s Included in the Course

-

169-page, searchable course manual with step-by-step instructions and examples.

-

Four HD videos from a live workshop that expand each major topic.

-

Downloadable audio files for on-the-go reinforcement.

-

PowerPoint outline for quick review before calls and appointments.

-

Complete forms library (leases, options, disclosures, acknowledgments) in editable MS Word—ready to tailor with your local attorney.

Note: Real-estate law is location-specific. The course shows you the structure; always adapt documents and procedures with qualified local professionals.

Who Should Take This Course?

-

Beginners with limited capital who want a smart, structured entry into real estate without chasing bank financing on day one.

-

Active landlords who prefer a defined exit path and a resident invested in upkeep.

-

Agents and acquisition specialists seeking ethical ways to monetize leads that don’t fit conventional financing.

-

Investors in competitive markets who need creative offers to solve seller problems and secure control.

-

Planners building steady cash flow who value documentation, disclosures, and repeatable processes over speculation.

-

Anyone who appreciates “control first, then own” as a disciplined way to grow.

If you’ve ever said, “I want consistent cash flow with measured risk,” this course gives you the blueprint, the words, and the paperwork to make that a reality.

Conclusion

Lease options are not a loophole; they are a structured, transparent agreement that aligns incentives when used correctly. Lease Option Course 2025 by William Bronchick compresses years of field experience into a practical playbook: how to attract the right sellers, qualify the right tenant/buyers, price and document deals responsibly, and manage the process from first call to successful exit. The emphasis on ethics, compliance, and clear communication ensures you build a durable reputation—while your systems create durable income.

Put a professional framework around your next move, shorten the learning curve, and operate with confidence in any market cycle.

Secure your seat today and start structuring your first lease-option deal with clarity and confidence.

Reviews

There are no reviews yet.