Free Download Mastering The Overnight Trade – The Sleeper Hold by Drew Dosek – Includes Verified Content:

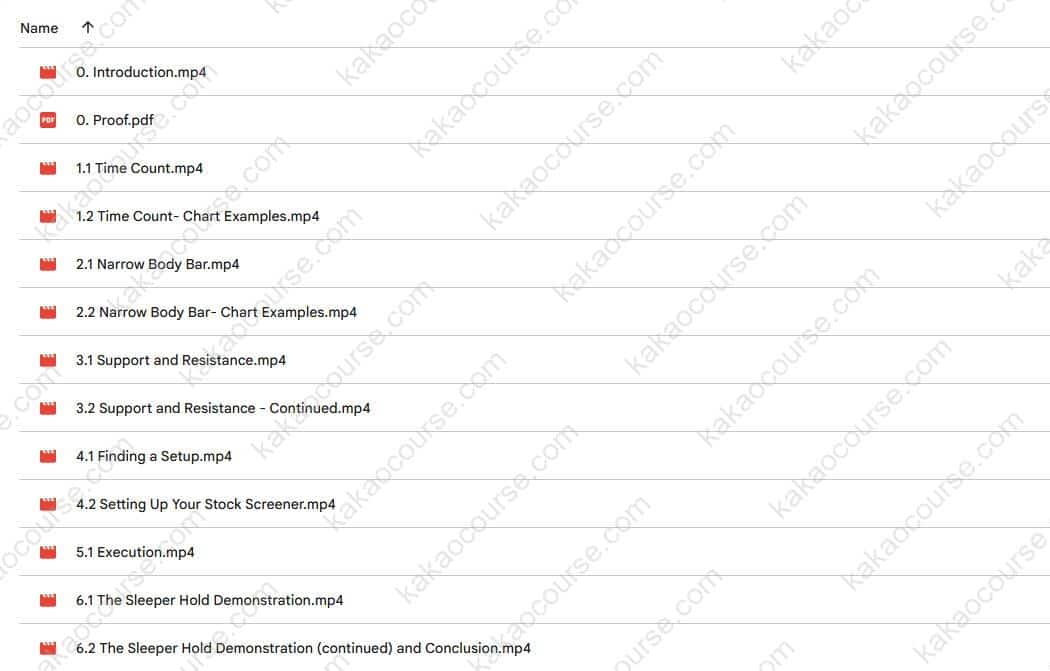

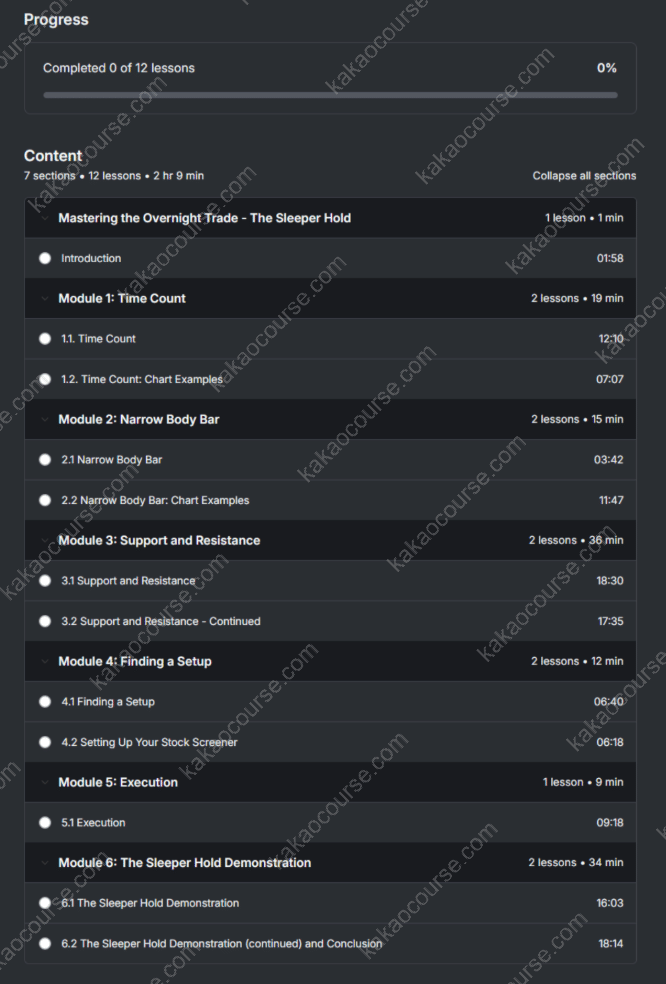

Mastering The Overnight Trade – The Sleeper Hold by Drew Dosek, Check Out the Full Course Contents:

Mastering The Overnight Trade – The Sleeper Hold by Drew Dosek, Watch Our Free Video Sample to Find Out More:

Overview this course

Mastering The Overnight Trade – The Sleeper Hold by Drew Dosek is a concise, end-of-day swing trading curriculum that teaches you how to build and execute a plan in minutes—not hours—by focusing on three objective signals: narrow-body bars, time counts, and key support/resistance. Instead of staring at charts all day, you’ll learn to scan, select, and set up trades at the market close, then manage risk with clear rules while positions work overnight.

This is not a “throw every indicator at the chart” experience. The Sleeper Hold simplifies decision-making to a repeatable checklist: identify contraction (narrow body), align the timing (counting bars/candles into a move), and locate price levels that matter (pivots, Fibonacci zones, gap fills, and trend lines). When the three factors align, you have a high-probability setup with a defined edge. When they don’t, you simply pass.

The course blends step-by-step lessons with real chart deconstructions, so you see exactly how to translate theory into entries, stops, and exits. Whether you’re brand-new to technical analysis or already trading, the result is the same: a calmer, cleaner approach to capturing next-day follow-through without micromanaging intraday noise.

Educational purpose only. All trading involves risk, and past results do not guarantee future outcomes. The course shows a process for planning and managing trades; you remain responsible for your own decisions and risk.

Why should you choose this course?

-

A strategy that respects your time

You’ll learn to do the heavy lifting after the close—scan, shortlist, plan—so the live session becomes execution, not analysis overload. -

Clarity through three objective factors

Narrow body bars reveal contraction, time counts frame momentum cycles, and price levels define risk. Together, they reduce ambiguity. -

Transferable across markets and timeframes

The pattern logic works on daily charts for overnight holds, and translates to weekly/monthly for slower swing horizons. -

Designed for all experience levels

New traders get a structured foundation; experienced traders sharpen entries and exits while trimming indicator clutter. -

Risk management is built-in

Every setup includes logical stop placement, position sizing, and “if/then” rules so you know what to do before the bell. -

Real-world chart reviews

You’ll watch historical and live-like examples annotated candle by candle—what qualified, what invalidated, and how the trade was managed. -

Confidence without complexity

No proprietary black boxes. You’ll leave with a checklist you can apply the same way tomorrow, next quarter, and next year. -

Tool-agnostic workflow

Use the charting platform you already have. The method relies on price, time, and levels—universal elements available everywhere.

What You’ll Learn

1) Narrow Body Bars: the language of contraction

Narrow body candles often precede expansion. You’ll learn to:

-

Define “narrow” relative to recent range (objective, not guesswork).

-

Spot compression zones that trap impatient traders—and position for the break.

-

Filter out false signals by cross-checking trend context and volume behavior.

-

Combine multiple narrow bodies into “squeeze clusters” for higher conviction.

2) Time Counts: rhythm inside the trend

Markets move in observable cycles. Counting bars helps you anticipate when momentum is likely to pause or extend.

-

Count upswings and pullbacks to identify fatigue vs. fresh legs.

-

Align your entries with “right-time” windows rather than chasing late.

-

Use time symmetry (e.g., three down bars inside an uptrend) to frame risk.

-

Blend time counts with session boundaries for overnight follow-through potential.

3) Support & Resistance: where price should respond

Price levels transform a “good idea” into a tradable plan.

-

Map pivots and swing highs/lows to anchor objectives and stops.

-

Apply Fibonacci retracements for confluence with structure—not as stand-alone magic lines.

-

Identify gap fills and trend lines that attract liquidity.

-

Rank levels: if several reference points cluster, the level matters more.

4) Finding a Qualified Setup: the three-factor checklist

You’ll synthesize the core factors into one page:

-

Contraction: a clear narrow-body bar or cluster.

-

Timing: a favorable count within the current swing.

-

Location: entry near support (for longs) or resistance (for shorts) with logical invalidation.

If all three align, you have a Sleeper Hold candidate. If one is missing, skip or wait.

5) Trade Execution & Management: plan first, act second

Precision is less about prediction and more about rules you’ll actually follow.

-

Entry tactics: stop vs. limit triggers, staged entries, and avoiding slippage traps.

-

Stop-loss logic: place stops beyond structure, not arbitrary round numbers.

-

Position sizing: risk a fraction of equity per trade so one loss never defines your month.

-

Profit taking: scale at measured moves, partials into resistance, let the remainder trail intelligently.

-

Fallback plans: what to do if the setup fails, chops, or gaps against you overnight.

6) Stock Screening & Watchlist Building

Repeatable selection beats reactive chasing.

-

Create scans for narrow bodies inside established trends.

-

Layer filters for liquidity, ATR (average true range), and clean structure.

-

Build a focused watchlist of 10–20 symbols rather than 200 distractions.

-

Pre-plan entries/levels so you’re prepared, not surprised, at the close.

7) Real-Life Demonstrations & Case Studies

You’ll see:

-

Winners and losers dissected with the same honesty, so you learn from both.

-

“Almost” setups that fail one criterion—and why passing saved risk.

-

Multi-timeframe agreements: using weekly to validate a daily overnight hold.

-

Post-trade reviews and journaling prompts to improve the next decision.

8) Psychology & Process (the hidden edge)

A simple system shines when your behavior is stable.

-

Build a nightly routine that takes 20–30 minutes, tops.

-

Convert fear of missing out into patience by committing to the checklist.

-

Track only a few metrics (win rate, average R, time in trade) that actually matter.

-

Write “if/then” statements to pre-commit actions and reduce emotion.

9) The Sleeper Hold Playbooks

Short, printable sequences you can keep next to your keyboard:

-

Bullish Overnight: contraction near rising support + favorable time count.

-

Bearish Overnight: contraction under falling resistance + favorable time count.

-

Neutral to Breakout: box consolidation with defined borders and trigger rules.

-

Gap Scenarios: how to respond when the open changes your risk math.

Who Should Take This Course?

-

Day traders who want a dependable, end-of-day setup to reduce intraday stress and overtrading.

-

Swing traders seeking a crisp, rules-first framework that targets next-session follow-through.

-

Beginners who need structure, plain language, and guardrails to build confidence quickly.

-

Experienced traders ready to refine entries/exits, standardize risk, and cut noise.

-

Busy professionals who can’t babysit screens but still want market exposure via planned overnight holds.

-

Global traders across time zones who prefer a method that can be executed at/near the close and reviewed on their own schedule.

If you appreciate checklists more than hot takes—and you’d rather make a handful of quality decisions than dozens of impulsive ones—this curriculum fits how you think.

Conclusion

The Sleeper Hold makes overnight trading feel methodical instead of mysterious. By centering on three objective factors—contraction (narrow bodies), rhythm (time counts), and location (support/resistance)—you’ll know exactly why a setup qualifies, where your risk lives, and how you’ll manage the position while the market is closed. The course replaces anxious screen-time with a quiet routine: scan, shortlist, plan, execute, review.

As you practice, you’ll notice tangible shifts: fewer forced trades, clearer entries, tighter stops set beyond real structure, and a steadier equity curve driven by process rather than adrenaline. You won’t be chasing every candle; you’ll be waiting for your pitch. That’s how consistency begins—one planned trade at a time.

Ready to turn end-of-day analysis into next-day opportunity with a three-factor plan you can trust? Enroll in Mastering The Overnight Trade – The Sleeper Hold and start building a calmer, rule-based overnight strategy today.

Reviews

There are no reviews yet.