Free Download Momentum Mastery by JR Romero – Here’s What You’ll Get Inside:

Momentum Mastery by JR Romero, Watch Our Free Video Sample to Find Out More:

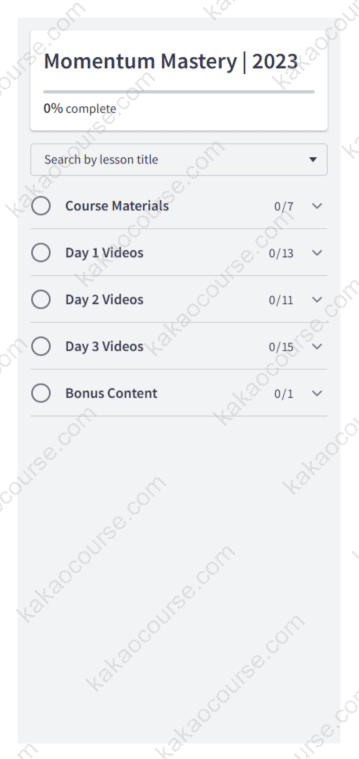

Momentum Mastery by JR Romero, Check Out the Full Course Contents:

Overview this course

Momentum Mastery by JR Romero is a comprehensive training program for traders who live on charts and want a disciplined, repeatable way to read price, time, and volume with confidence. This isn’t a skim-the-surface tutorial; it’s an intensive framework for decoding market structure on any timeframe—so you can separate noise from signal, define risk precisely, and act decisively when momentum shifts.

Across 15+ hours of in-depth lessons paired with a 654-page desktop guide, you’ll learn how to analyze the market’s “story” bar by bar. You’ll map phases and cycles, use volume to locate meaningful levels, and apply modernized Wyckoff concepts without the common traps that derail traders. Most programs either overwhelm you with indicators or reduce everything to a single pattern. Momentum Mastery does neither. It gives you an operational roadmap: identify the environment, diagnose who’s in control, pick the correct play, place your risk where the narrative breaks, and review the outcome so your edge compounds.

If you’re a serious day or swing trader who wants to stop second-guessing and start executing with a professional decision process, this course meets you at that level—no fluff, no hype, just the craft of price action done right.

Educational use only. Trading involves risk, and no methodology guarantees profits. You are responsible for your own decisions and risk management.

Why should you choose this course?

-

A true A–Z of price action

Go beyond pattern names. Learn the underlying mechanics—who is trapped, where liquidity sits, when momentum is likely to expand or fade. -

Five objective drivers of movement

JR distills the market’s chaos into five factors that actually move price (environment, location, effort vs. result, participation, and speed). You’ll treat each trade like a testable thesis, not a guess. -

Wyckoff, modernized

Use accumulation/distribution, springs/upthrusts, and tests without turning your charts into spaghetti. You’ll learn how to avoid classic Wyckoff pitfalls on intraday and higher timeframes. -

Volume that means something

Volume isn’t a decoration. You’ll read volume profile and participation to determine where support/resistance genuinely holds—and when it’s likely to fail. -

Actionable “slow vs. fast” taxonomy

Some structures demand patience; others require speed. You’ll learn to classify patterns by tempo so your entries, stops, and targets fit the tape. -

Institutional location, not guesswork

Draw pivots the right way. Anchor levels to where large players are likely acting, then plan trades around those battlegrounds. -

An operating system for decisions

Scan → diagnose phase → pick play → define risk/targets → execute → debrief. Rinse and repeat. Process replaces emotion. -

Serious reference material

The 654-page guide isn’t filler. It’s your desk companion with checklists, diagrams, and examples you’ll reference daily. -

Built by a practitioner

JR Romero, leader of Momentum Express VTF®, has traded since 2001. His approach blends chart structure, news flow, and intermarket context into high-probability ideas you can actually execute.

What You’ll Learn

Read the environment like a pro

-

Market phase & context: Identify accumulation, markup, distribution, and markdown across timeframes so you know when to press and when to protect.

-

Actionable vs. ignorable: Filter out weak signals. If a setup lacks location, participation, or timing, you’ll pass—saving capital and attention for A+ trades.

-

The five true factors:

-

Environment (trend/phase and higher-timeframe bias)

-

Location (pivots, volume nodes, prior range edges, gaps)

-

Effort vs. result (range/volume alignment)

-

Participation (breadth, sector/leader confirmation)

-

Speed (how fast/slow the move develops and what that implies)

-

Modern Wyckoff without the myths

-

Springs & upthrusts: Recognize genuine tests vs. random wicks; learn confirmation rules before committing capital.

-

Composites & campaigns: See how smart money accumulates or distributes over time—and how that translates to your entry and stop.

-

Avoiding traps: Why “calling tops” is expensive; how to let structure confirm first.

Volume profile & significance mapping

-

High/low volume nodes: Map where price is accepted or rejected. Use these zones to forecast reactions and set measured targets.

-

Participation tells: Spot transitions from passive to aggressive activity; gauge when continuation is more likely than fade.

-

Level validation: Combine profile with swing structure to determine whether a level is “first touch” tradable or requires more proof.

Pivots & institutional levels

-

Draw pivots that institutions actually care about—anchor to clear swing points, prior day/week extremes, gaps, and composite VWAPs.

-

Align stops just beyond structure, not round numbers, so you define risk where your thesis truly breaks.

“Slow” vs. “Fast” patterns

-

Slow: Bases, triangles, rounded retests—require patience and acceptance of grind.

-

Fast: Breakouts, momentum ignitions, liquidation breaks—demand decisive entries, reduced slippage, and proactive scale-outs.

-

Calibrate expectations: the same target size doesn’t fit both.

Momentum shifts that matter

-

Diagnose shifts via impulse vs. correction dynamics, range expansion/contraction, and failed follow-through.

-

Learn to recognize “character change” candles and what they imply for the next sequence of bars.

Angles & speed analysis

-

Draw angles to measure move velocity. When slope steepens/shallows, your risk and management adjust.

-

Use time symmetry (e.g., number of bars in a leg) to anticipate exhaustion or continuation.

Building an operational roadmap

-

Pre-trade: Identify higher-timeframe bias, mark levels, plan scenarios.

-

Execution: Define entry trigger, invalidation, and partial profit zones; decide before you click.

-

Post-trade: Tag outcome, log context, screenshot structure. Your future self will find patterns faster.

Putting it together: case studies

-

Day and swing examples—winners and losers—broken down step-by-step so the checklist becomes muscle memory.

-

“Almost” setups that fail one criterion (tempo, participation, location) and why staying patient saved risk.

Tooling without clutter

-

Candles and a handful of references (volume, profile, VWAP/anchored VWAP, a moving average for slope context).

-

No indicator zoo—just the minimal set that improves clarity.

Risk, probability, and trade management

-

Position sizing via R-multiples; avoid the “one trade ruins the week” outcome.

-

Scaling rules for both slow and fast patterns; how to trail intelligently without giving back the meat of the move.

-

A daily guardrail plan: stop trading after max loss, limit attempts per idea, end-of-day debrief.

Who Should Take This Course?

-

Hardcore chart readers who want a rigorous, non-contradictory method they can run daily.

-

Active day and swing traders who rely on momentum and structure—not opinions—to drive decisions.

-

Technicians upgrading from pattern names to actionable logic: phases, participation, and location that actually control probability.

-

Process-driven learners who appreciate checklists, journaling, and truth-in-data reviews to refine edge.

-

Experienced beginners who already speak “chart” and want to accelerate beyond random entries or indicator overload.

If you’re looking for shortcuts or passive signals, this isn’t it. If you’re ready to treat trading like a craft—with rules you can defend and repeat—Momentum Mastery was built for you.

Conclusion

Predicting price is less about crystal balls and more about reading the present precisely enough to define risk and ride the next likely sequence. Momentum Mastery gives you that precision. You’ll learn to diagnose the environment, locate battles that matter, measure effort vs. result, and adjust to the market’s tempo—fast when it’s fast, patient when it’s slow. The outcome is a calmer screen, fewer forced trades, tighter stops set beyond real structure, and decisions you can justify before and after the fact.

With 15+ hours of training and a 654-page reference guide, this program becomes your daily operating system: phase → location → participation → speed → plan → execute → review. As you apply it, your edge stops being an idea and becomes a habit. You won’t eliminate uncertainty. You will, however, master how to act when the odds are on your side—and stand down when they aren’t.

Ready to turn charts into a clear decision process and momentum into disciplined trades? Join Momentum Mastery today and build a professional roadmap for reading and trading price action.

Reviews

There are no reviews yet.