Free Download Price Action Scalping: Value and Candlesticks by JBearTrades – Here’s What You’ll Get Inside:

Overview this course

When every tick matters, clarity and discipline are your edge. Price Action Scalping: Value and Candlesticks by JBearTrades is a tightly structured program for traders who want to read the tape through candles, locate value quickly, and execute high-quality scalps with defined risk. Instead of drowning in indicators, you’ll learn to let the chart speak—through structure, volatility, and the micro-stories candles tell in real time.

This course shows you how to translate pure price action into a daily routine: define your risk before the open, map areas where order flow is likely to react, wait for confirmation at the candle level, and manage trades with rules that protect your equity curve. You’ll also see how expectancy actually works—so each decision is grounded in math, not impulse.

Drawing on years of live trading, JBearTrades distills scalping into three proven setups you can recognize, test, and repeat. You’ll practice reading individual candles as a “price ladder,” spotting absorption, trapped traders, failed breaks, and the subtle shifts that precede expansion. Three recorded live sessions then bring the concepts together, so you can observe planning, entries, exits, and post-trade review under realistic market pressure.

At a glance

-

Focus: Value mapping, candlestick decision-making, risk frameworks, and three repeatable scalping setups

-

Format: Step-by-step lessons plus 3 live trading session replays to anchor habits

-

Outcomes: Clear daily risk limits and targets, positive-EV trade selection, and a concise playbook you can execute with confidence

-

Philosophy: Price first, probabilities always, process over prediction

Why should you choose this course?

-

Risk first, every day. You’ll learn to hard-wire daily loss limits and realistic profit targets so a single session never defines your month.

-

Expectancy over excitement. The math behind positive expected value (EV) is made simple and practical—so you stop chasing and start filtering.

-

Three setups, zero clutter. Instead of 20 patterns you’ll never use, you’ll internalize three high-signal plays with clear rules and variations.

-

Candles as a language. Treat each candle like a price ladder—wick traps, body dominance, and exhaustion are decoded into precise entry/exit logic.

-

Proof in practice. Watch three live sessions to see planning, patience, execution, and management decisions play out second by second.

-

Scalable process. The same routine works whether you trade one market or three; whether you prefer the open drive or midday rotations.

-

Ethical and realistic. No hype, no promises—just a risk-aware framework built to protect capital and sharpen decision-making over time.

What You’ll Learn

You’ll build a compact, professional playbook built around five pillars: risk, value, price behavior, setups, and review.

1) Structured Risk Management

-

Daily guardrails: Set a max loss that keeps you solvent and a daily target that prevents over-trading after early wins.

-

Per-trade risk: Define cents/ticks risk via structural levels (swing high/low, prior value edge, session VWAP region) instead of arbitrary numbers.

-

Position sizing: Scale entries to keep risk per trade consistent; adapt size when volatility expands or contracts.

-

Drawdown protocol: What to do when you hit your loss limit, how to step down size, and when to stop for the session.

2) Trade Expectancy Mastery

-

EV explained plainly: Expectancy=p(win)×avg win−p(loss)×avg loss\text{Expectancy} = p(\text{win}) \times \text{avg win} – p(\text{loss}) \times \text{avg loss}. Learn how each variable is influenced by your rules.

-

Edge identification: Separate location edge (trading at value extremes) from timing edge (candle confirmation) and management edge (asymmetric exits).

-

Tracking and iteration: Build a lightweight log that records R-multiple, MAE/MFE, and context—so improvements are data-driven, not vibes-driven.

3) Value Mapping (so you know where to act)

-

Context layers: Prior day high/low, session open, overnight high/low, VWAP/standard deviations, and liquidity pools.

-

Value extremes: Identify areas where responsive buyers/sellers tend to step in; know the difference between rotation and genuine trend.

-

Timing windows: Open drive, first pullback, lunchtime fade, and late-day squeeze—how behavior shifts across the session.

4) Candlestick Reading Skills

-

Candles as order-flow clues:

-

Wicks = rejection/absorption attempts; bodies = commitment; inside/outside = compression/expansion.

-

Read sequences: failed breakout → engulf → continuation, or exhaustion → base → reversal.

-

-

Micro-confirmation: Entry triggers that go beyond “green/red”—e.g., wick-through + body close back inside value, or engulf after a sweep.

-

Avoiding false reads: Spot low-quality signals (micro dojis in chop, late chases into expansion, entries against higher-timeframe bias).

5) The Three Proven Scalping Setups

(Exact names differ by trader—here they’re defined by behavior so you can test them precisely.)

-

A) Value Rejection Reversal (VRR):

-

Where: Prior day high/low, overnight extremes, or VWAP ± band.

-

Trigger: Sweep beyond value → immediate close back inside + follow-through candle confirms.

-

Plan: Enter on confirmation with stop beyond sweep; scale at mid-range, trail toward opposite value edge.

-

-

B) Break-Pullback-Go (BPG):

-

Where: Break of an intraday range or opening range that sticks.

-

Trigger: Break → shallow pullback that holds above/below broken level → ignition candle.

-

Plan: Enter on ignition with stop beyond pullback low/high; take partials into prior swing, hold runner with structure-based trail.

-

-

C) Liquidity Wick Fade (LWF):

-

Where: Into obvious liquidity—round numbers, prior highs/lows, session open.

-

Trigger: Long wick through level + body close rejecting it; second candle fails to continue → fade the move.

-

Plan: Define tight risk behind the wick; quick partials at first opposing level, then manage with a time stop if momentum stalls.

-

6) Entry, Exit, and Management Rules

-

Entries: Require alignment of location (value) + signal (candle behavior) + context (trend/rotation).

-

Exits: Pre-plan partials (1R or structural level), final target (opposite side of range or measured move), and a hard stop that never moves wider.

-

Trade management: Use MFE/MAE to adjust trails; avoid converting winners into scratch by moving stops only on structure or time-based criteria.

-

Session management: Limit number of attempts per setup to prevent revenge trading.

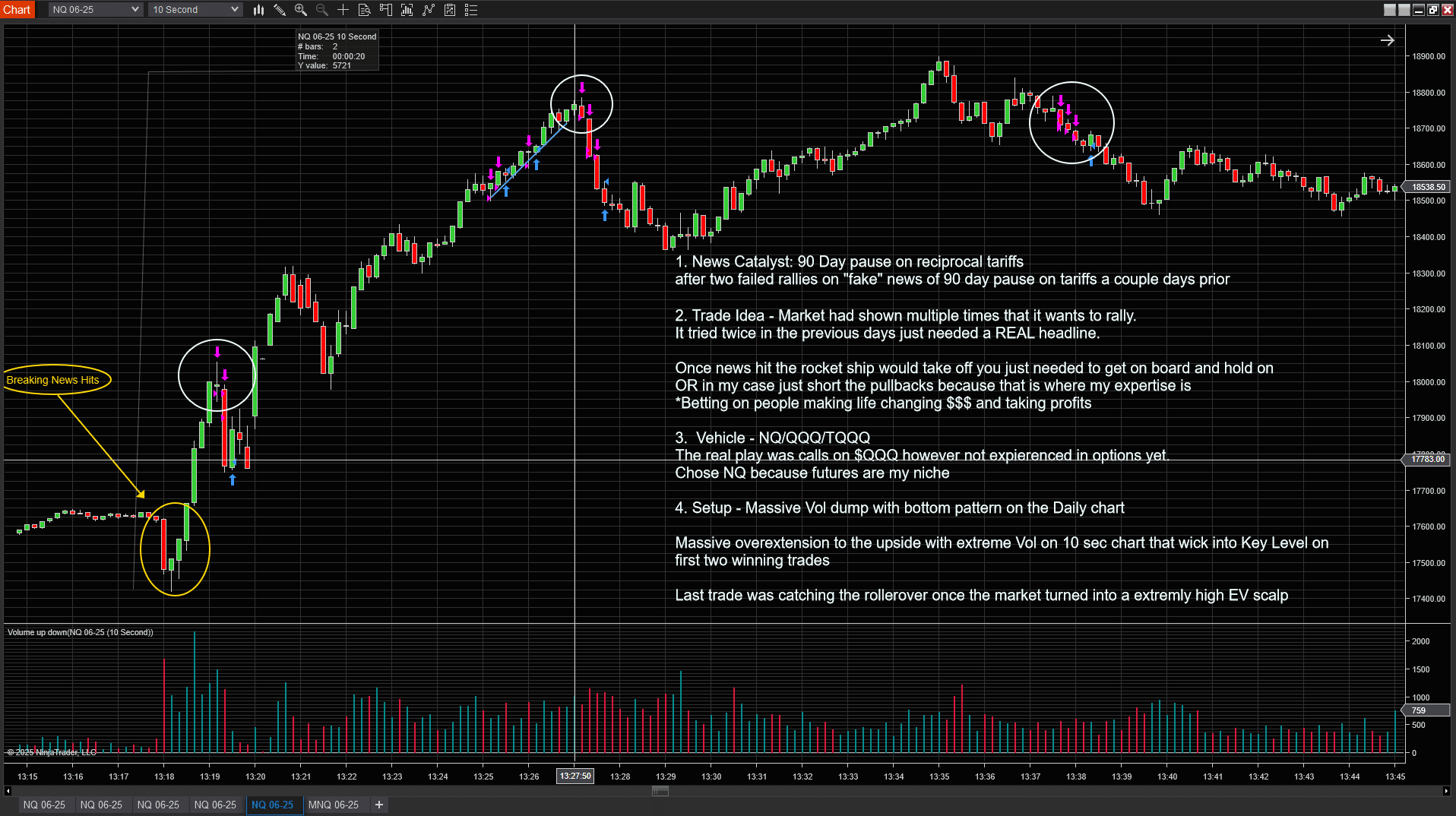

7) The Live Sessions (3 Replays)

-

Session 1: Mapping value and planning the open—how levels become scenarios, then trades.

-

Session 2: Execution under pressure—what “wait for the candle” looks like when price is racing.

-

Session 3: Post-trade review—annotating charts, calculating expectancy, and writing one improvement for tomorrow.

8) Building Your Personal Playbook

-

Checklists: Pre-market (levels, bias, scenarios), in-trade (entry/exit rules), post-market (journal prompts).

-

Screens & templates: Minimal layouts that keep attention on price, not indicators.

-

Metrics that matter: R-multiple per day, % played plans vs. improvised trades, and average hold time by setup.

9) Professional Habits

-

Process > prediction: Your job is to execute a known edge, not call tops or bottoms.

-

One change at a time: Modify rules based on logs, not emotions.

-

Health & focus: Protect sleep, movement, and breaks—fast decisions require a rested mind.

-

Ethics & responsibility: Trade with capital you can afford to risk; respect your plan and the market.

Note: This program is educational. It does not provide financial advice or guarantee results. Trading involves risk, including the possible loss of principal.

Who Should Take This Course?

-

Intraday traders who prefer clarity over complexity

If you want a rules-driven approach that focuses on location, candles, and clean risk, this is your lane. -

Scalpers aiming to professionalize their routine

You have a feel for momentum but need structure—risk caps, expectancy, and a short list of reliable setups. -

Swing or position traders adding a day-trading sleeve

Use scalps to complement longer-term holdings with tight risk and repeatable patterns. -

Analytical learners who value evidence

If you’re drawn to data, logs, and measured improvements, the expectancy framework will feel like home.

Helpful starting point

-

Basic chart literacy (candles, highs/lows, support/resistance) and the ability to follow a simple checklist. Coding is not required; indicator clutter is discouraged.

Conclusion

Profitable scalping isn’t about being first—it’s about being selective. With a risk plan that survives bad days, expectancy that clarifies what to take and what to skip, value mapping that narrows your focus, candlestick triggers that confirm timing, and three reliable setups you can execute repeatedly, you’ll trade with purpose. The result is a calmer session, fewer forced trades, and a record you can actually learn from.

Price Action Scalping: Value and Candlesticks gives you that structure. It replaces guesswork with a compact playbook and shows you, candle by candle, how patience and precision can compound. If you’ve been searching for a method that is simple enough to use daily yet rigorous enough to respect the numbers, you’ve found it.

Ready to start?

Open your charts, set your daily guardrails, and dive into the first module—then practice the three setups with the live sessions until your execution feels natural and your journal shows consistent, positive-EV decisions.

Reviews

There are no reviews yet.