Free Download Real Estate Cash Cow Online Course 2025 by William Bronchick – Here’s What You’ll Get Inside:

Real Estate Cash Cow Online Course 2025 by William Bronchick, A Peak into the Course:

Real Estate Cash Cow Online Course 2025 by William Bronchick, Watch This Free Video Sample to Learn More:

Real Estate Cash Cow Online Course 2025 by William Bronchick, Check Your Free PDF Sample Here:

Real Estate Cash Cow Online Course 2025 by William Bronchick

“Cash flow without clogged-toilet calls” isn’t a fantasy—it’s a different structure. Real Estate Cash Cow Online Course 2025 by William Bronchick teaches you how to create durable monthly income using wraparound (wrap) financing—owner-finance transactions where you buy or sell on terms and collect a consistent spread, while end buyers take on taxes, insurance, and day-to-day maintenance.

Curated by William Bronchick, Esq.—best-selling author, attorney, and investor with three decades in the field and 1,400+ wrap transactions closed as principal, counsel, mentor, and closer—this program shows you the legal building blocks, the paperwork, and the step-by-step workflow to operate professionally in any city or market cycle.

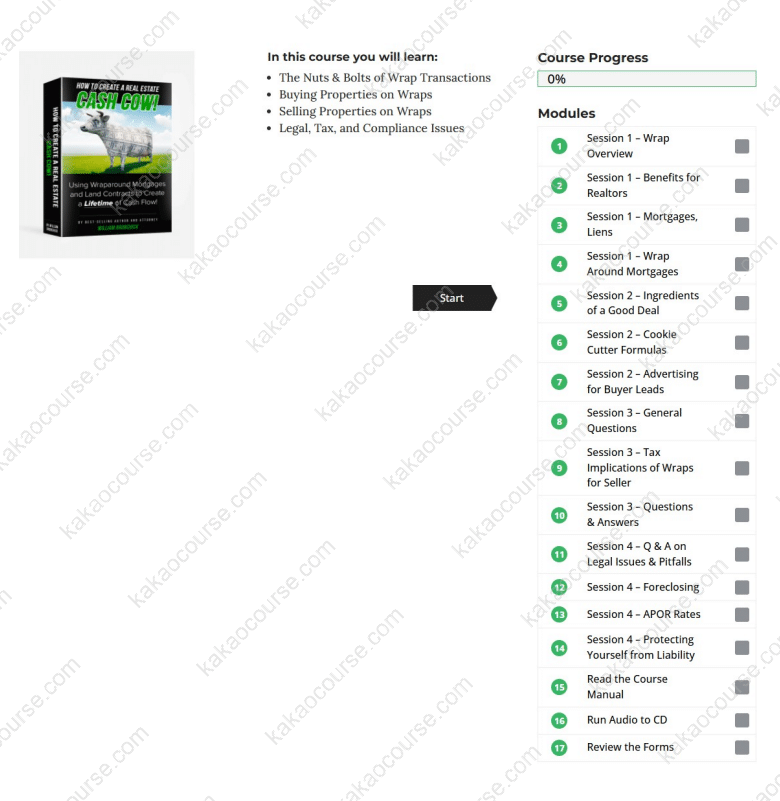

You’ll receive a 143-page searchable manual, ~7 hours of HD training with slides, audio recordings for on-the-go review, 100+ editable legal forms and clauses (with video explanations), and the Cash “COWCulator” Excel tool to price deals in minutes.

Why Should You Choose This Course?

A cash-flow model designed for NOW

Rental income can be thin after mortgages, repairs, and vacancies. Wrap transactions shift responsibility for upkeep to the buyer while you collect interest income and a monthly spread—an elegant alternative to landlord headaches.

Attorney-led clarity

With Bronchick’s dual perspective (law + investing), you learn structures and documents that align with real-world practice. The curriculum emphasizes compliance with relevant federal and state rules so you can proceed with confidence.

From “what” to “how”

No vague theory. You’ll see exactly how to structure, document, and close wraps, including title considerations, due-on-sale awareness, and servicing logistics, plus template language you can adapt with local counsel.

Consistent pipeline, not one-off deals

The course pairs technical knowledge with repeatable marketing and negotiation frameworks—so you can source sellers, qualify buyers, and keep cash flow turning month after month.

Numbers first, always

The Cash COWCulator breaks down purchase price, underlying loan terms, payment schedules, reserves, and exit timing. You’ll know your spread, cash-on-cash, and sensitivity to rate or timeline shifts before you commit.

Flexible across markets

Tight inventory? High rates? Out-of-state? Wraps travel well. You’ll learn to size opportunities and risks in any region, then standardize your process so outcomes are predictable.

What You’ll Learn

1) Wraps, AITDs, and Land Contracts—The Foundations

-

How a wrap works: you acquire or control a property with an existing loan in place and then sell on owner financing at new terms, collecting the spread between the outgoing and incoming payments.

-

When to use wraparound mortgages, all-inclusive trust deeds (AITDs), or installment land contracts—and how each affects title, possession, and remedies.

-

Mapping the paper trail: deed and security instrument, promissory note, wrap rider, disclosures, and servicing setup.

2) Buying on a Wrap—Control Without Bank Gatekeepers

-

Sourcing motivated sellers who value speed, certainty, or relief from payments over top-dollar price.

-

Structuring terms that solve sellers’ problems: small or staged down payments, interest-only windows, balloon timing, and performance protections.

-

Documenting the acquisition side clearly so your downstream sale is simple to execute and easy to audit.

3) Selling on a Wrap—Turn Terms into a Cash Cow

-

Creating a buyer pool: who qualifies for owner financing, how to evaluate capacity responsibly, and which documents verify income and reserves.

-

Pricing for velocity and safety: down-payment standards, payment schedules that cover the underlying loan plus spread, and appropriate reserves.

-

Drafting wrap riders, amortization schedules, and servicing instructions so payments are collected and applied correctly every month.

4) Legal, Tax, and Regulatory Guardrails (Plain English)

-

How to approach Dodd-Frank, the SAFE Act, TILA/Reg Z considerations when selling on terms to consumers—when to integrate an RMLO or specialized compliance support.

-

Due-on-sale awareness: what it is, why lenders include it, and business-level risk controls professionals use.

-

Tax basics of installment sales, dealer issues, and recordkeeping practices to review with your own advisors.

-

Insurance alignment: evidence of coverage, loss-payee clauses, and why you must verify renewals.

5) The Documents That Keep You in Control

-

Purchase and sale agreements tailored for wraps (with disclosures).

-

Promissory notes, deeds of trust/mortgages, wrap riders, and assignment of rents language where appropriate.

-

Escrow instructions that sequence recording and funding to ensure your lien position is perfected before money moves.

-

Collections infrastructure: third-party servicing, payment tracking, and late-fee/default protocols that are clear from day one.

6) Risk Management You Can Explain in One Page

-

Underwriting your deal, not the story: conservative LTV/ITV, realistic resale value, and a payment-shock check for buyer sustainability.

-

Reserves for taxes/insurance, vacancy between resale and onboarding, and one-time legal or filing costs.

-

Early-warning indicators (payment delays, insurance lapses, title notices) and how to act before small issues become losses.

7) The Math Behind Durable Cash Flow

-

Modeling your spread: underlying PITI vs. incoming PITI, escrow handling, and cash-on-cash.

-

Amortization advantage: how the interest rate and term you negotiate create long-tail income.

-

Sensitivity analysis: rate changes, resale timing, early payoff, or refinance—and what each does to your IRR.

8) Finding Deals, Every Month

-

Ten reliable channels to source properties and sellers: tired landlords, inherited homes, job relocations, rate-locked owners, and long-DOM listings.

-

Ethical messaging that attracts both sides—sellers who want relief and buyers who want a path to ownership.

-

A weekly cadence: outbound touches, follow-ups, and a short decision tree (advance, re-structure, or pass).

9) Session-by-Session Roadmap (What’s Inside the Course)

-

Session 1: Nuts & Bolts of Wrap Transactions

Title and deed mechanics; mortgages vs. deeds of trust; AITDs; land contracts; and where each structure shines. -

Session 2: Buying Properties on Wraps

Negotiation frameworks, low-cash entry, and acquisition documents that set up a smooth resale on terms. -

Session 3: Selling Properties on Wraps

Buyer qualification, compliant advertising, down-payment sizing, and document execution from offer to closing. -

Session 4: Legal, Tax, and Compliance

Dodd-Frank/SAFE/TILA awareness, installment-sale reporting concepts, and practical file hygiene for clean audits and seamless servicing.

10) Tools You’ll Use on Day One

-

143-page PDF manual with step-by-step checklists and filled-out examples.

-

~7 hours of HD video with PowerPoint slides—recorded from a live event for real-world context.

-

Downloadable audio to reinforce learning during commutes.

-

100+ editable MS Word forms and clauses—with short video walk-throughs.

-

Cash “COWCulator” Excel model to compute spreads, yields, and stress tests in minutes.

11) Case Patterns and Pitfalls (So You Don’t Learn the Hard Way)

-

Strong candidates: well-located homes with serviceable underlying loans and sellers prioritizing certainty.

-

Avoid or restructure: severe functional obsolescence, complex title encumbrances, HOA litigation, or insurance red flags.

-

Hand-off to servicing: how to avoid being the bill collector while maintaining visibility into performance.

Who Should Take This Course?

-

Income-focused investors who prefer interest income and documented spreads over tenant management.

-

Busy professionals who want a scalable, checklist-driven model that can be run part-time and systematized quickly.

-

Agents, wholesalers, and acquisition managers ready to monetize leads that don’t fit conventional financing.

-

Landlords looking to transition selected holdings into term sales that produce stable, hands-off cash flow.

-

Analytical beginners who value legal clarity, measurable KPIs, and templates over trial-and-error.

If you appreciate structure, documentation, and numbers you can defend, this course provides the operating system to build a portfolio of cash-flowing notes with clear downside controls.

Conclusion

Cash flow that arrives on schedule and doesn’t call you at midnight is built—not hoped for. Real Estate Cash Cow Online Course 2025 by William Bronchick gives you the blueprint: acquire or control properties the smart way, resell on terms that serve buyers and protect your position, document every step with professional-grade forms, and manage payments through servicing for clean, predictable income. With clear legal guardrails, disciplined underwriting, and a simple math model, you can create a portfolio of wraps that performs—regardless of inventory or interest-rate cycles.

Ready to turn terms into dependable income? Enroll today and build your first wrap with confidence—then repeat it again and again.

Reviews

There are no reviews yet.