Free Download Small Apartment Investing Course 2025 by William Bronchick – Here’s The Content Available For You:

Small Apartment Investing Course 2025 by William Bronchick, Check Out the Full Course Contents:

Small Apartment Investing Course 2025 by William Bronchick, Watch This Free Video Sample to Learn More:

Small Apartment Investing Course 2025 by William Bronchick, Check Your Free PDF Sample Here:

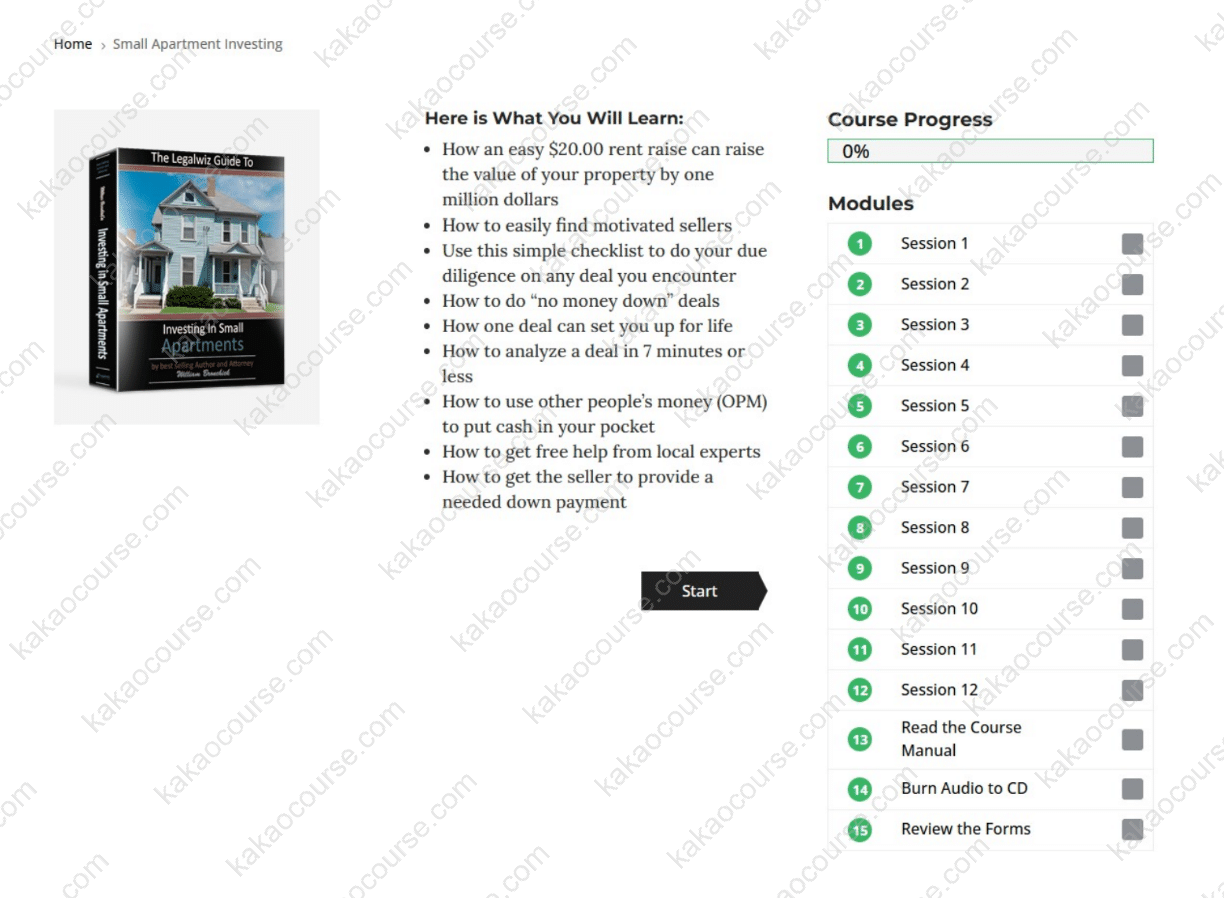

Overview this course

Small Apartment Investing Course 2025 by William Bronchick is a practical, step-by-step program that shows you how to acquire and operate small multifamily properties—typically 5 to ~40 units—for durable cash flow and long-term equity growth. Built for today’s market realities, the curriculum teaches you how to source motivated sellers beyond the MLS, underwrite deals in minutes, negotiate terms with confidence, and structure transactions so the numbers work from day one.

Authored by William Bronchick—best-selling author, attorney, and veteran investor—the course blends legal clarity with field-tested tactics. You’ll learn not only what to do, but in what order, with which documents, and why each step matters. The training is comprehensive and implementation-ready:

-

A downloadable, searchable course manual with checklists and completed examples

-

Streaming video lessons recorded live to deepen each topic

-

Audio modules you can listen to anywhere

-

Editable MS Word forms and disclosures to customize with local counsel

-

Excel calculators to price offers and model cash flow quickly

-

A copy of the slide deck to reference during your first deals

The entire learning experience is designed so a committed beginner can move from reading to making offers—ethically and professionally—in weeks rather than months.

Why should you choose this course?

-

Built for 2025, not 2015

Lending standards, pricing dynamics, and cap-rate expectations have shifted. This program reflects current sourcing channels, realistic underwriting rules, and documentation workflows aligned with how deals close now. -

Attorney-investor perspective

You’re learning from a practitioner who has completed thousands of transactions. The curriculum translates complex legal and tax concepts into plain English so you can act decisively without stepping outside the lines. -

Cash-efficient acquisition strategies

You’ll study multiple ways to reduce out-of-pocket capital—seller financing, structured terms, and “other people’s money” models—while keeping risk controls front and center. -

Remote-friendly playbook

Can’t find deals locally? You’ll learn how to screen out-of-area markets, build a dependable on-the-ground team, and manage with professional oversight. -

Operations that scale

You are not expected to plunge toilets. The course shows how to hire, brief, and audit third-party property managers so the property pays them (not you) and reporting keeps everyone accountable. -

Ethical, transparent, professional

From first contact through closing, you’ll master disclosures, documentation, and negotiation language that protect relationships—and your reputation. -

Tool-rich and immediately usable

Checklists, scripts, and calculators ensure you’re never guessing what to analyze, say, or sign next.

What You’ll Learn

1) The Small Apartment Advantage

-

Why 5–40 units often outperform single-family rentals on stability and scale.

-

How modest operational improvements (occupancy, rent, expenses) multiply value via cap-rate math.

-

The core formula: ΔValue = ΔNOI ÷ Cap Rate—e.g., a $12,000 annual NOI boost at a 6% cap adds ~$200,000 in value; at higher unit counts, the same principles create six- and seven-figure gains.

2) Finding Motivated Sellers—Anywhere

-

Off-MLS sourcing: owner-direct mail, niche online advertising, local attorney and property-manager referrals, landlord forums, code-violation lists, probate/estate channels.

-

How to spot “tell-tale” motivations: self-managed landlords leaving town, fatigue from repairs, partial vacancy, partnership disputes, or debt maturities.

-

A weekly prospecting rhythm: outreach targets, follow-up cadences, and pipeline hygiene so momentum never stalls.

3) Rapid Underwriting (The 7-Minute Screen)

-

Pulling rent rolls and T-12s (trailing 12-month statements) fast—and what to do when sellers don’t have them.

-

Normalizing income and expenses to a realistic “stabilized” view.

-

Quick-calc methods for MAO (maximum allowable offer), DSCR, break-even occupancy, and sensitivity checks.

-

When to move forward to full diligence—and when to pass confidently.

4) Due Diligence, Simplified

-

A plain-English checklist covering leases, deposits, service contracts, utilities, permits, zoning, and insurance.

-

Physical diligence essentials: roofs, plumbing, electrical, HVAC, parking, and life-safety items.

-

Rent roll audits and estoppel letters—what to verify and how.

-

Avoiding “value traps”: the warning signs that look like opportunity but aren’t.

5) Financing & Creative Deal Structures

-

Conventional and bank portfolio financing: documents, ratios, timelines.

-

Seller financing—when and how to ask, interest-only vs. amortizing, balloons, performance-based clauses.

-

Blended structures: small cash down + seller carry + improvement reserves.

-

Practical ways to bring in equity partners responsibly and document roles and distributions.

6) Negotiation That Moves Deals

-

Discovery questions that reveal a seller’s true constraints (timing, taxes, management fatigue).

-

Offer architectures: price-vs-terms, rent credits, repair allowances, and closing cost strategies.

-

How to present your offer so the seller—and their advisor—can say “yes” without friction.

7) Professional Management Without Headaches

-

Selecting a management company (references, unit-count fit, fee structure, early-exit clauses).

-

The essential monthly reports (rent roll, income statement, delinquency, work orders) and how to read them quickly.

-

KPI targets for small apartments: economic occupancy, loss-to-lease, turn times, and expense ratios.

8) Value-Add Without Speculation

-

Low-risk improvements that increase NOI: modest unit turns, utility bill-backs, pet programs, storage/parking income, RUBS where lawful.

-

Smart rent adjustments: how a $20 average increase across enough units compounds valuation—without aggressive assumptions.

-

Expense discipline: vendor bidding, preventive maintenance schedules, bulk services, and tax/insurance reviews.

9) Out-of-Market Acquisitions

-

Screening metros for job diversity, rent growth, landlord-tenant balance, and property taxes.

-

Building your local triad: broker + property manager + contractor/inspector.

-

How to tour, underwrite, and close when you don’t live nearby—and what to automate afterward.

10) Legal & Tax Building Blocks (Plain English)

-

Entity choices for liability and partnership alignment.

-

Purchase and sale contract clauses that protect you (inspection outs, document delivery, prorations, assignment language where appropriate).

-

Documentation flow at closing so your file is complete and auditable.

-

High-level tax concepts to discuss with your own professionals.

11) Control Without Ownership (Advanced)

-

When an option, a master lease, or a short-term control agreement can create income or an assignment fee—without taking title—and when to avoid these tools.

-

Ethics and transparency guidelines so counterparties feel protected.

12) Your First 90 Days—Operating Cadence

-

A simple weekly plan: prospect → analyze → offer → diligence → close → improve → report.

-

What to do in week 1 after closing: utilities, bank accounts, notices, insurance, rent collection systems, maintenance queues.

-

How to review performance monthly and set quarter-by-quarter improvement goals.

Tools You’ll Use on Day One

-

Ready-to-edit letters, scripts, and addenda tailored to small multifamily.

-

Excel models for cash flow, offer pricing, and sensitivity analysis.

-

A deal-review checklist so every file follows the same quality standard.

-

A concise owner’s dashboard to track KPIs and spot issues early.

Who Should Take This Course?

-

Committed beginners who want a clear, ethical path into multifamily without guessing on numbers or documents.

-

Busy professionals seeking durable cash flow with third-party management and straightforward oversight.

-

Single-family investors ready to scale into properties where one decision affects many doors.

-

Out-of-state buyers who need a replicable checklist to evaluate and operate in new markets.

-

Agents and small operators looking to monetize overlooked leads and present institutional-grade analyses to sellers and partners.

-

Retirement-minded planners who prefer cash flow and steady value creation over speculation.

If you value clarity, checklists, and accountability—and you want assets that can pay you while professionals handle day-to-day operations—this program is for you.

Conclusion

Small apartments are a rare blend of accessibility and scale: large enough to run like a real business, small enough to win without institutional capital. Small Apartment Investing Course 2025 by William Bronchick distills the process into a repeatable system—find motivated sellers, underwrite conservatively, negotiate terms that serve both sides, document cleanly, and manage through metrics.

You’ll learn how to create value with modest, controllable improvements; how to avoid projects that only work if the market bails you out; and how to assemble a local team so the property pays for professional management. Most importantly, you’ll leave with the confidence to make offers based on numbers you trust and a file you can defend.

Turn the next 90 days into a blueprint for dependable income and long-term security—start now and analyze your first small-apartment deal this week.

Reviews

There are no reviews yet.