Free Download Stock Options Strategy: The CROC trade (low risk) by My Options Edge

Check content proof, now:

Stock & Options Strategy: Volatility Surf Trade (low risk) by My Options Edge, see what’s included in this course:

Stock Options Strategy: The CROC trade (low risk) by My Options Edge, Free Download Video Sample:

Stock Options Strategy: The CROC Trade (low risk)

A reliable and effective approach designed to generate monthly income from VXX using options, while staying protected from sudden volatility surges!

Course Description

Note: I personally execute this strategy when market conditions align and provide it exclusively for Full Trades members!

You should join this program if you:

-

… previously purchased an options course but found it too theoretical, without a solid, actionable strategy

-

… understand basic options concepts and want a practical system to apply in real markets

-

… struggle to stay consistent trading stocks, forex, or options (derivatives)

-

… fail to achieve profits when scalping or swing trading stocks

-

… rely on technical analysis that isn’t giving the results you expected

-

… use indicators that constantly trigger unprofitable trades

-

… have lost money shorting volatility during unexpected spikes

-

… want to follow a structured trading plan with clear, rule-based entries and exits (fully mechanical)

Following the success of my two earlier courses, some students encouraged me to design another strategy that reduces upside volatility risk while still profiting from VXX price decay. After months of testing and student feedback, the Croc Trade was created — now with stronger profitability and improved management rules!

This program introduces an intermediate-level options strategy focused on VXX! Students should at least be familiar with delta and theta (option greeks). The technique builds on my prior experience with SPX option spreads but adapts them to VXX in a defensive, controlled manner.

Thanks to its structure, there’s no need for daily monitoring!

The course begins with the essentials of volatility analysis, explaining how volatility instruments — especially VXX — behave. Then it moves into the specific setup, including the strategy rules, reasoning, mechanics, and adjustments based on time and price movement.

By completing this course, you’ll gain access to a steady and profitable options system that can be used to create monthly cash flow!

This trading method is unique — you won’t find it in conventional options trading books!

The “Croc Trade v2.0” (named for its distinctive structure) offers everything a volatility options trader seeks in a position:

-

Built-in upside protection (self-hedged against sudden volatility spikes)

-

Controlled downside exposure

-

Profits from VXX’s natural decay (driven by contango and roll yield)

-

Takes advantage of options time decay (Theta positive)

-

Reduced delta sensitivity compared to many other setups

-

Strong reliability and repeatability

Best of all, this strategy is eligible for IRA accounts.

Course content:

- My Background / Experience

- Price Action: VIX® Index vs Stock

- Why Volatility investing is much more interesting

- Volatility trading risks (and how to control them)

- Instruments of Volatility Trading

- VIX® futures Term Structure

- Contango, Backwardation and Roll Yield

- Strategy characteristics / presentation

- Strategy dynamics

- Options Trading Rules

- Trade Management

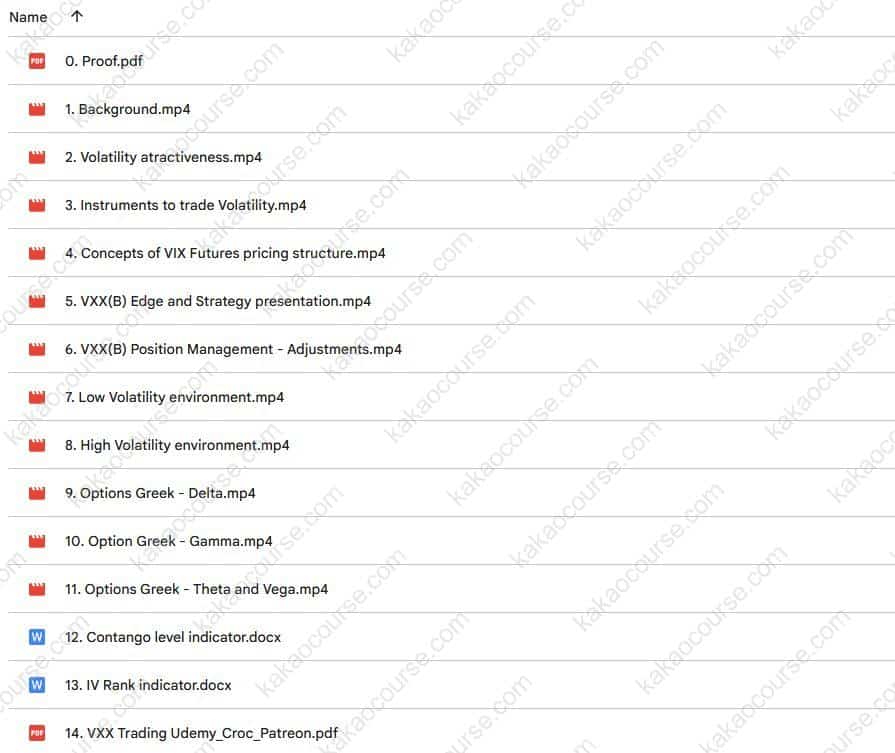

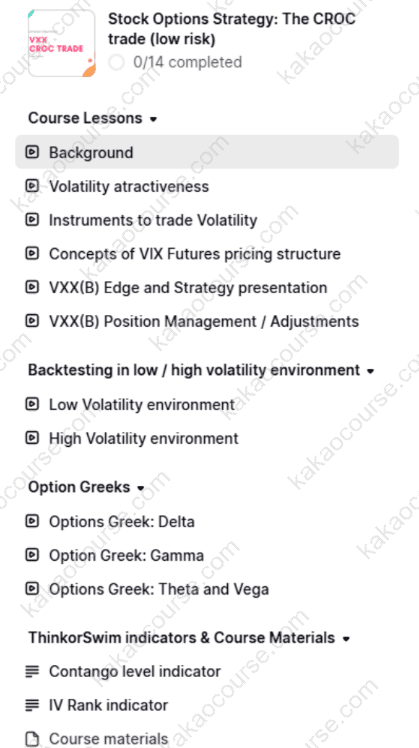

Contents

Course Lessons

- Background3 mins

- Volatility atractiveness6 mins

- Instruments to trade Volatility5 mins

- Concepts of VIX Futures pricing structure13 mins

- VXX(B) Edge and Strategy presentation12 mins

- VXX(B) Position Management / Adjustments9 mins

Backtesting in low / high volatility environment

- Low Volatility environment10 mins

- High Volatility environment9 mins

Option Greeks

- Options Greek: Delta8 mins

- Option Greek: Gamma7 mins

- Options Greek: Theta and Vega5 mins

ThinkorSwim indicators & Course Materials

- Contango level indicator

- IV Rank indicator

- Course materials

Reviews

There are no reviews yet.