The $65.5 Million Secret – Build a Business Worth Selling (Even If You Never Do) By John Ratliff and Joe Polish – Immediately Download

If you are an entrepreneur, there is one event that can reshape your financial and personal future more than any other: the moment your company becomes a highly valuable, sale-ready asset. “The $65.5 Million Secret – Build a Business Worth Selling (Even If You Never Do)” by John Ratliff and Joe Polish is a comprehensive, implementation-focused course designed to help you engineer that outcome.

This premium program (3.01 GB of in-depth material, priced at $481.6) distills decades of experience in acquiring, scaling, and exiting businesses into a practical roadmap. Instead of generic advice, you gain a structured, repeatable approach for making your company more attractive to acquirers, more resilient in operations, and more rewarding for you to own.

Whether you plan to sell in three years, thirty years, or never, this course helps you think like a buyer, design like an investor, and operate like a world-class CEO. You will learn how to align your strategy, team, and systems around one powerful objective: building a business that is truly worth selling—even if you decide to keep it forever.

Free Download The $65.5 Million Secret – Build a Business Worth Selling (Even If You Never Do) By John Ratliff and Joe Polish – Here’s What You’ll Get Inside:

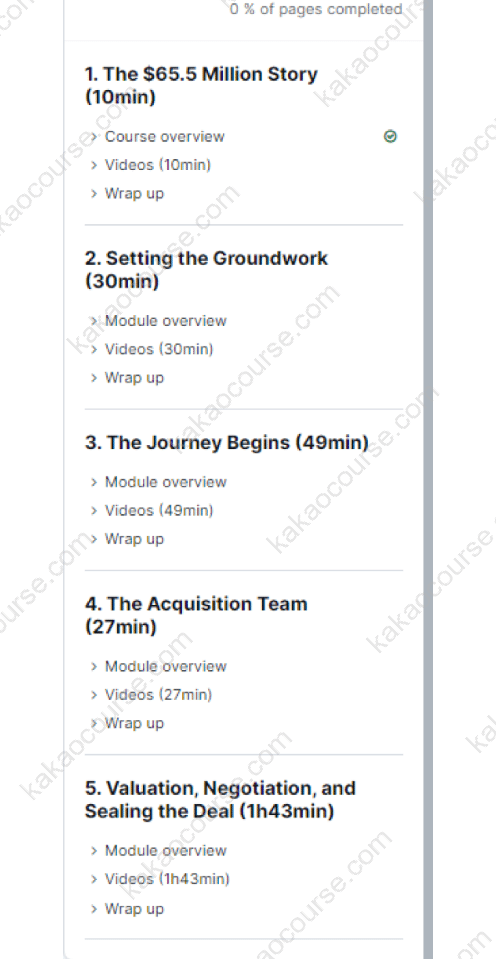

The $65.5 Million Secret – Build a Business Worth Selling (Even If You Never Do) By John Ratliff and Joe Polish, Sneak Peek Inside The Course:

The $65.5 Million Secret – Build a Business Worth Selling (Even If You Never Do) By John Ratliff and Joe Polish, Watch Our Free Video Sample to Find Out More:

The $65.5 Million Secret – Build a Business Worth Selling (Even If You Never Do) By John Ratliff and Joe Polish, Check Your Free PDF Sample Here:

Overview This Course 🚀

“The $65.5 Million Secret – Build a Business Worth Selling (Even If You Never Do)” is a strategic, deal-focused course that shows you how to grow, structure, and position your company for a premium valuation.

Instead of offering abstract theory, the course is anchored in John Ratliff’s real-world experience of acquiring 24 companies and ultimately selling his own business for 14x EBITDA in a market where 3–4x multiples were considered “normal.” You see not only what he did, but why it worked and how you can apply similar principles to your own business.

Inside the course, you will:

-

Map out what makes your company valuable in the eyes of a buyer.

-

Distinguish between financial and strategic buyers—and position for both.

-

Identify “hidden assets” (the “Rembrandts in your attic”) that can dramatically increase your valuation.

-

Plan your exit timing and structure so you retain control and maximize your upside.

The content is delivered in a format that is suitable for international entrepreneurs, founders, investors, and operators who want a clear, rigorous, and actionable framework for value creation and eventual exit.

Why Should You Choose This Course? 💡

Most entrepreneurs invest heavily in marketing, sales, and leadership training—but ignore the single largest financial event of their careers: the wealth-creation event when they sell or partially exit their business.

This course is different because it:

-

Focuses on the exit as a system, not just a one-time negotiation. You learn to design your business from the ground up to be attractive to buyers.

-

Shows you how acquirers actually think. You step into the mindset of buyers, private equity groups, and strategic acquirers so you can position your company as a “must-have” asset, not just another deal in their pipeline.

-

Combines strategy with execution. You are not just told “increase your EBITDA” or “be more scalable.” You are shown the specific levers that drive multiples and the processes that reduce perceived risk for buyers.

-

Is built on real, outsized outcomes. John Ratliff consistently beat industry averages—sometimes by 50–100%—and this course dissects the thinking and methods behind those results.

You should choose this course if you want more than incremental improvement. It is designed for founders who want to:

-

Turn their company into a transferable, high-value asset.

-

Avoid the hidden mistakes that destroy deal value at the negotiating table.

-

Create optionality: the freedom to sell, recapitalize, or keep the business on their own terms.

What You’ll Learn 📘

This course delivers a structured curriculum that walks you from mindset to execution. Among the many topics, you will learn:

-

Why you must structure your company to be “sale-ready”

-

Why even entrepreneurs who “never plan to sell” benefit from building a sale-ready business.

-

How this mindset improves operations, culture, and strategic focus today—not just at exit.

-

-

The $65.5 Million Story

-

How John Ratliff grew through acquiring 24 companies.

-

The key decisions that allowed him to achieve a 14x EBITDA exit in a 3–4x industry.

-

Lessons you can adapt, regardless of your sector or company size.

-

-

The Mindset of a Buyer

-

What acquirers truly care about before they acquire a company.

-

How they evaluate risk, quality of earnings, team strength, and strategic fit.

-

The questions they ask that most entrepreneurs never anticipate.

-

-

The 4 “Drivers of Value” in the Exit Process

-

The core dimensions that turn your company into a high-demand asset.

-

How to systematize these drivers so your business is less dependent on you.

-

-

Timing Your Exit Intelligently

-

When to start thinking about exit—and why the answer is “now,” no matter where you are in your journey.

-

How macro conditions, industry cycles, and company readiness intersect.

-

-

Key Roles and Team Design for Maximum Value

-

The critical team member(s) who can dramatically increase your company’s valuation.

-

How to build an internal team that supports, not sabotages, your exit.

-

-

Understanding EBITDA and Multiples

-

What EBITDA really is and why buyers rely on it.

-

Typical multiples across industries—and how to position yourself above the average.

-

How to think about valuation from the acquirer’s perspective.

-

-

Financial Sale vs. Strategic Sale

-

The crucial differences between financial and strategic buyers.

-

How to identify and unlock overlooked strategic value in your business.

-

-

Finding and Qualifying Buyers

-

Where to find potential acquirers—beyond the obvious.

-

Two essential questions to qualify buyers early and avoid wasting time.

-

Red flags indicating a deal is unlikely to be good for you in the long run.

-

-

Legal, Deal Structures, and the Right Attorney

-

The three main types of deal structures and how each impacts risk and reward.

-

How to select an attorney who protects value instead of killing deals.

-

-

The “Rembrandt in the Attic” Concept

-

How to identify overlooked intangible assets (IP, processes, data, relationships, systems) that buyers may value far more than your current cash flow.

-

How to present these assets so they translate into higher multiples.

-

-

Life After the Exit

-

The emotional and practical challenges many entrepreneurs face after selling.

-

How to prepare for meaning, purpose, and your next chapter to avoid “entrepreneurial postpartum depression.”

-

Core Benefits 🌟

By the end of this course, you will not just understand exit theory—you will have a new lens for viewing and running your company. Core benefits include:

-

A Clear Exit-Ready Blueprint

-

You gain a structured framework for making your business more attractive, more stable, and more valuable over time.

-

-

Higher Potential Valuation

-

You learn practical methods to increase your EBITDA and, more importantly, your multiple—so you are not limited by “average” industry valuations.

-

-

Stronger Strategic Positioning

-

You will see your business from the outside, as a sophisticated buyer would, and adjust your operations, positioning, and messaging accordingly.

-

-

Reduced Risk for Acquirers (and for You)

-

By designing systems, roles, and processes correctly, you reduce the perceived risk for buyers, which usually translates into better terms and higher prices.

-

-

Greater Entrepreneurial Freedom

-

An exit-ready company is easier to run, less dependent on the founder, and more enjoyable to own. It gives you options: sell, partially exit, or hold long term.

-

-

Deeper Understanding of Deal Dynamics

-

You will walk into any future negotiation with a sophisticated understanding of how deals are structured, where value is created, and where it is often lost.

-

-

Personal Clarity About “What’s Next”

-

You will be better prepared for the life and identity shifts that come with a major liquidity event, so you can move toward your next purpose with intention.

-

Who Should Take This Course? 🎯

This course is designed for a global audience of entrepreneurs and business leaders who are serious about building meaningful, transferable value. It is particularly relevant if you are:

-

Founders and Owners of Small to Mid-Sized Businesses

-

You want to engineer a future exit—or at least create the option—at a premium valuation.

-

-

CEOs and Managing Directors

-

You are responsible for growth, strategic direction, and shareholder value and want a clear roadmap for building a sale-ready company.

-

-

Investors and Acquirers

-

You acquire, roll up, or recapitalize businesses and want to understand a proven approach to creating and recognizing strategic value.

-

-

Entrepreneurs Planning a Partial or Full Exit

-

You’re considering selling now or in the next few years and want to avoid costly mistakes that could reduce your payout.

-

-

Ambitious Founders Early in the Journey

-

You are still in the building phase but want to “get it right” from the start by designing your company around the drivers of value.

-

If you aspire to create not just a profitable business, but a truly valuable asset that others will compete to own, this course is built for you.

Conclusion 🧩

“The $65.5 Million Secret – Build a Business Worth Selling (Even If You Never Do)” combines strategic clarity with real-world, battle-tested experience from entrepreneurs who have successfully navigated the full acquisition lifecycle. With 3.01 GB of detailed, high-value content, priced at $481.6, you gain not just information, but a comprehensive framework for transforming how you build, manage, and ultimately exit your company.

You will come away with a deeper understanding of what drives valuation, how to avoid common exit pitfalls, and how to uncover the “Rembrandts in your attic” that can dramatically increase what your business is worth. Most importantly, you will have a much clearer path toward your own wealth-creation event—designed on your timeline, under your terms.

If you are ready to stop running your business day-to-day without a strategic endgame—and instead start building a company that acquirers genuinely want to buy—this is the moment to commit to that shift and enroll in this course today.

Reviews

There are no reviews yet.