Free Download The Beginner’s Guide to Commercial Real Estate Investing by Tyler Cauble – Includes Verified Content:

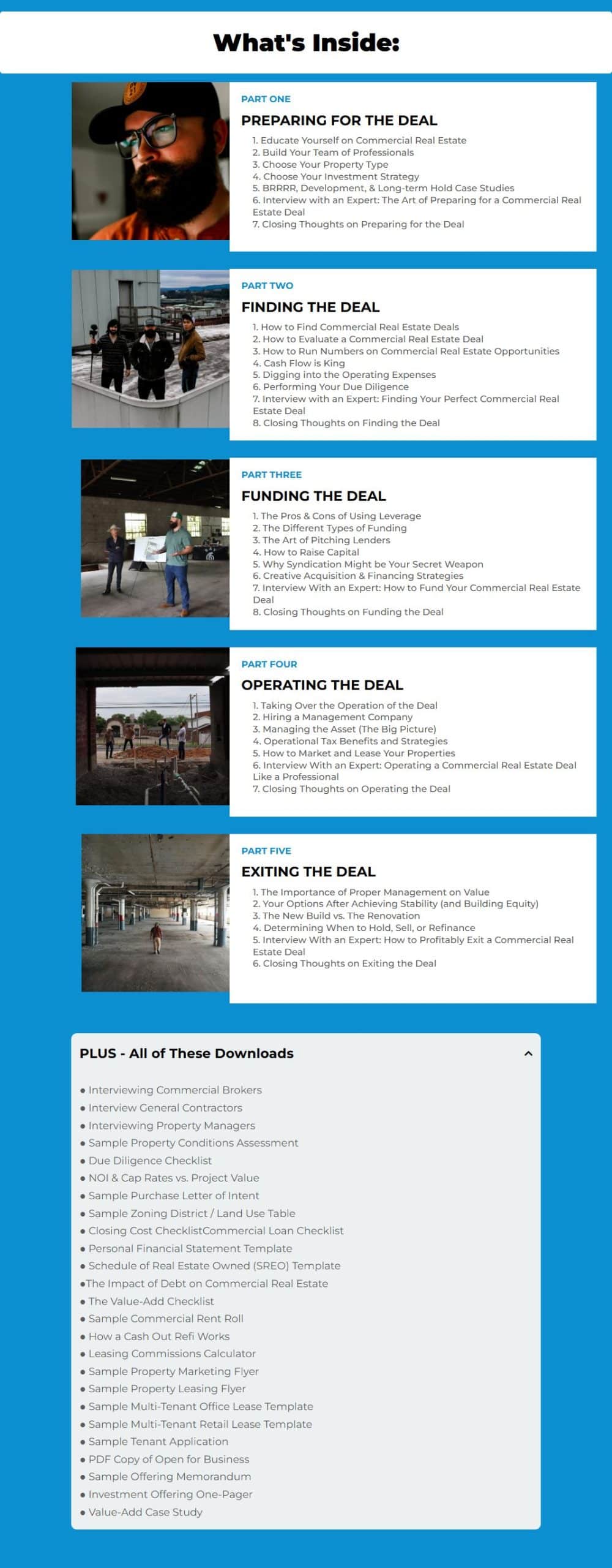

The Beginner’s Guide to Commercial Real Estate Investing by Tyler Cauble – Check Out the Full Course Contents:

Get More Details in Course Content:

Overview 🔑

The Beginner’s Guide to Commercial Real Estate Investing by Tyler Cauble is a self-paced, online program that turns curiosity into ownership. If you’re stuck in single-family, tired of tiny returns, or simply unsure how to begin, this course gives you a field-tested blueprint to find opportunities, underwrite with confidence, raise capital, and close your first commercial deal—without years of guesswork.

Across 6 modules, 80+ lessons, and 17+ hours of video, you’ll walk step-by-step from education to execution. You’ll also get 20+ downloadable tools (underwriting spreadsheets, sample leases, checklists, calculators), 5 expert interviews, and ongoing behind-the-scenes updates—so your playbook grows as the market evolves.

The Beginner’s Guide to Commercial Real Estate Investing by Tyler Cauble, Watch Our Free Video to Find Out More:

The Beginner’s Guide to Commercial Real Estate Investing by Tyler Cauble, Grab Your Free PDF Sample Below:

Why it matters 📈

Most investors plateau because they’re stuck in the residential hamster wheel: more time, more tenants, minimal scale. Commercial real estate (CRE) changes the equation:

-

Bigger levers, better efficiency: One deal can produce meaningful cash flow, equity growth, and tax advantages.

-

Professional tenants & longer leases: Less drama, clearer numbers, more predictable operations.

-

Valuation you can influence: Improve NOI, force appreciation, and choose smarter exit paths.

But the learning curve is real—cap rates, lease structures, lender expectations, syndication mechanics. This course compresses that curve so you act with clarity and speed.

Benefits you’ll notice 🎯

-

Clarity from day one: A start-to-finish framework that shows you exactly what to do next.

-

Confident underwriting: Use templates and rules of thumb to evaluate deals in hours—not weeks.

-

Smarter financing: Understand lender boxes, structure offers, and speak the bank’s language.

-

Deal flow that fits you: Learn where opportunities live (on and off-market) and how to build a pipeline.

-

Risk management baked in: Due-diligence checklists prevent expensive surprises.

-

Operational know-how: Leasing, marketing, property management, and asset strategy—no more blind spots.

-

Flexible exits: Hold, refinance, or sell—learn to pick the path that maximizes returns.

-

Lifetime access: Revisit lessons as you grow from beginner to operator.

What you’ll learn 🧠

-

Market & asset selection: Retail vs. office vs. industrial vs. multifamily—how each earns, risks, and cycles.

-

Deal sourcing: Brokers, owner outreach, listing platforms, and creative channels to find value-add.

-

Underwriting essentials: Revenue modeling, expenses, reserves, cap-ex, NOI → value mapping.

-

Debt & equity: Bank loans, SBA, private debt, syndications, promote structures, and when to use each.

-

Capital raising basics: Present your thesis, build credibility, and pitch the right investors.

-

Legal & due diligence: Title, survey, zoning, environmental, leases, estoppels, tenant interviews.

-

Offer & negotiation: LOI terms that matter, timelines, deposits, and risk-shift clauses.

-

Close & operate: Onboarding management, leasing strategy, tax positioning (work with your CPA), and KPI tracking.

-

Value-add playbook: Practical levers—re-tenanting, rent rationalization, expense audits, minor cap-ex, branding.

-

Exit strategies: Hold vs. refi vs. disposition—build decision rules before emotions take over.

Key features & modules 🧩

6 modules • 80+ lessons • 17+ hours • 20+ downloads • 5 expert interviews • Updates added quarterly

-

Module 1 — Preparing for the Deal 🧭

Build your foundation: key CRE concepts, choose your property type and strategy, assemble a pro team, and review case studies (BRRRR-style, development, long-term hold).

Outcome: A clear thesis, defined criteria, and your advisory bench. -

Module 2 — Finding the Deal 🔎

Where deals hide and how to evaluate quickly: cap rates, comps, rent rolls, T-12s, and the “cash flow first” lens. Deep dive into operating expenses and due diligence flow.

Outcome: A repeatable pipeline and screening framework. -

Module 3 — Funding the Deal 💰

Debt vs. equity, pros/cons of leverage, pitching lenders, raising capital ethically, and syndication structures that align interests. Creative acquisition tactics included.

Outcome: Financing plans that actually close. -

Module 4 — Operating the Deal 🏗️

Smooth handoff on day one: management onboarding, leasing & marketing, asset management dashboards, and operational tax strategies (coordinate with your CPA).

Outcome: Systems that protect NOI and grow value. -

Module 5 — Exiting the Deal 🔄

Recognize stability, measure value created, compare hold / sell / refinance, and weigh new build vs. renovation.

Outcome: Exit decisions based on numbers, not nerves. -

Module 6 — Expert Perspectives & Advanced Plays 🎙️

Five in-depth interviews plus behind-the-scenes breakdowns of real deals—so you can see how operators think in the wild.

Outcome: Pattern recognition that shortcuts your learning.

Tools & downloads you’ll use 🧰

-

Underwriting spreadsheets & calculators (NOI → value, leasing commissions, cash-out refi).

-

Sample leases (office & retail), LOI templates, marketing & leasing flyers.

-

Due diligence, closing, and commercial loan checklists.

-

SREO & personal financial statement templates.

-

Zoning/land-use sample tables, rent roll templates, property condition assessment samples.

-

Offering memorandum examples, one-page investment summaries, and a value-add case study.

Who it’s for 👥

-

Complete beginners: Follow the playbook even if you’re starting with limited cash and zero experience.

-

Residential investors: Trade weekend maintenance calls for professional tenants and scalable returns.

-

CRE brokers: Master the investor mindset to win listings, close bigger deals, and invest for yourself.

-

Busy professionals: Learn a numbers-first, time-efficient approach that fits around your schedule.

If you want to move from “learning” to owning, you’re the audience.

Why learn from Tyler Cauble 🧩

Tyler’s path is proof that action beats theory. After leaving college, he entered brokerage (2013), closed $100M+ for clients, and then pivoted to ownership—amassing 2.1M+ square feet and $60M+ in projects (he’s known for East Nashville). Inside the course, he open-sources tactics, templates, and lessons from wins and mistakes, so you avoid the slow, expensive route.

How the framework turns knowledge into a deal 🚀

-

Define your box → markets, asset class, deal size, returns, risk.

-

Create deal flow → brokers, owners, platforms, direct outreach.

-

Underwrite fast → standard templates, rule-of-thumb checks, sensitivity tables.

-

Secure capital → lender matrix, equity pitch, structure that fits the plan.

-

Negotiate & diligence → LOI → purchase & sale → checklists prevent leaks.

-

Close & operate → management onboarding, leasing, KPI cadence.

-

Decide exits early → hold/refi/sell rules tied to NOI and market data.

Repeat this loop and each cycle compounds your confidence, contacts, and outcomes.

Sample weekly rhythm (busy-proof) ⏱️

-

Monday (45 min): Underwrite one deal from your pipeline; log pass/advance notes.

-

Tuesday (30 min): Lender or broker calls; add two warm relationships.

-

Wednesday (45 min): Deep dive on expenses & rent roll for your top lead.

-

Thursday (30 min): Equity outreach touchpoints; refine your one-pager.

-

Friday (30 min): Education sprint inside the course + checklist review.

-

Weekend (60–90 min): Property tour or desktop diligence; update your thesis.

Small, consistent actions → real momentum.

FAQs ❓

Do I need a lot of cash to start?

No. You’ll learn creative financing and how to structure partnerships or syndications responsibly.

Is this U.S.-centric?

Yes, but the underwriting logic and operating principles are globally useful. Always adapt to local laws and tax codes.

Is this financial or legal advice?

It’s education. You should consult licensed professionals for legal, tax, and investment decisions.

How long until I close a deal?

That depends on your market, pipeline, and effort. The course gives you the shortest practical path and the tools to execute.

Conclusion ✅

Commercial real estate isn’t complicated—wandering without a map is. Tyler Cauble’s Beginner’s Guide gives you a straight line from curiosity to your first closed deal: how to source, underwrite, finance, operate, and exit with confidence. With lifetime access, expert interviews, and download-and-use templates, you’ll stop watching others build wealth and start building your own portfolio.

-

Learn the language lenders trust.

-

Underwrite cleanly, negotiate smartly.

-

Operate like an owner, not a spectator.

-

Choose exits that lock in the upside.

Your next move 🧭

If you’re serious about buying your first commercial property, this is your moment. Enroll in Ultimate Beginner Guide: Commercial Real Estate Investing today, download the tools, and start building the portfolio you know you’re capable of—find it, fund it, close it.

Reviews

There are no reviews yet.