The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori – Trading Terminal – Immediately Download

Reading raw price movement across multiple time frames is one of the most critical skills any active trader can develop. Instead of relying solely on indicators or external opinions, mastering price action allows you to understand what the market is actually doing in real time.

If you want a structured, professional approach to this skill, The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori – Trading Terminal is built exactly for that purpose.

This in-depth program delivers a full training experience in a compact 2.88 GB package, priced at $178.5. You get a complete framework for reading price action from the weekly chart all the way down to the 1-minute chart, so you can identify high-probability entries, targets, and market phases with much greater confidence. 📈

Developed by a full-time proprietary trader and mentor, the course condenses what normally takes thousands of hours of screen time into a step-by-step learning path that helps you shorten the learning curve and upgrade your chart-reading skills in a systematic way.

Free Download The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori – Trading Terminal – Here’s What You’ll Get Inside:

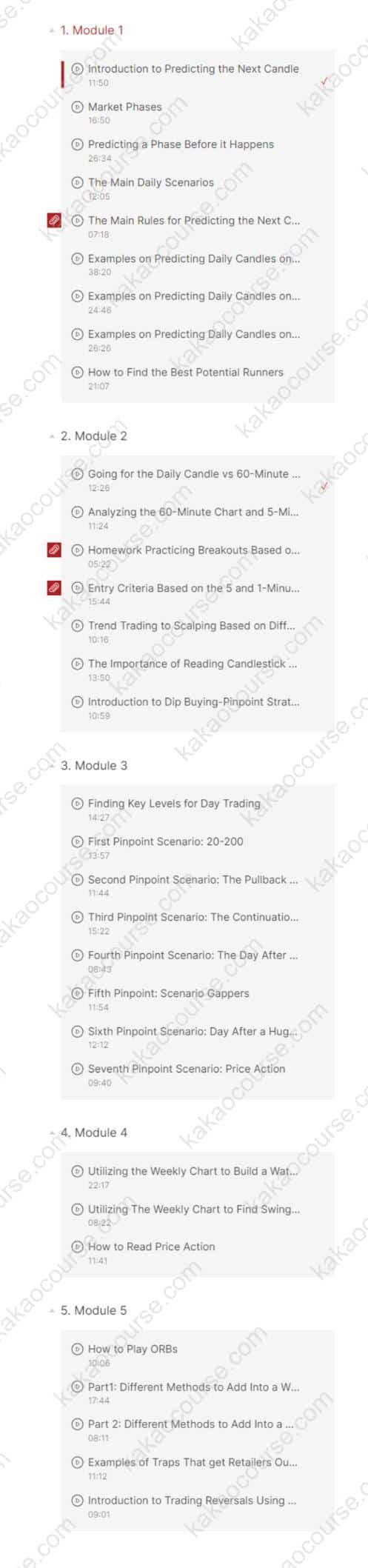

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori – Trading Terminal, Check Out the Full Course Contents:

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori – Trading Terminal, Watch Our Free Video Sample to Find Out More:

Overview This Course 📘

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action is a comprehensive training program dedicated to one core objective: helping you read markets clearly across multiple time frames and translate that understanding into better trading decisions.

Instead of focusing on one specific strategy or indicator, this course teaches you how to:

-

Start from higher time frames (weekly, daily) to understand market context

-

Drill down into intraday charts (60-minute, 5-minute, 1-minute) for precision timing

-

Recognize market phases such as accumulation, distribution, trends, and choppy ranges

-

Identify key levels where high-quality entries and exits are likely to appear

The curriculum is organized into five modules, guiding you through:

-

Predicting the next candle and understanding daily scenarios

-

Connecting daily, 60-minute, 5-minute, and 1-minute charts in one coherent view

-

Using the Pinpoint Strategy to enter at optimal dips and locations

-

Building watchlists and swing ideas from the weekly chart

-

Applying multiple time frame analysis to breakouts, ORBs (Opening Range Breakouts), and reversals

By the end of the course, you are not just memorizing setups. You are learning how to think in multiple time frames, interpret price behavior logically, and align your strategy with what the market is actually showing you.

Why Should You Choose This Course? 🎯

There are many trading courses that promise quick results, but few focus deeply on the one universal skill every day trader needs: reading price action across multiple time frames. This course stands out for several reasons:

-

Skill-based, not indicator-dependent

-

The emphasis is on price action and structure, not on a specific indicator or signal service.

-

This means you can apply the concepts to almost any strategy or platform you already use.

-

-

Bridges higher and lower time frames

-

You learn how weekly and daily levels shape intraday behavior and how to coordinate those with 60-minute, 5-minute, and 1-minute charts.

-

This integrated approach is crucial for timing entries, managing risk, and setting realistic profit targets.

-

-

Designed for real-world day trading

-

The course content reflects the actual challenges day traders face: choppy markets, sudden reversals, false breakouts, and changing volatility.

-

You learn how to adapt to these conditions using clear rules and structured analysis instead of guesswork.

-

-

Condensed expertise from a professional prop trader

-

Aiman shares methods and insights developed in a proprietary trading firm environment, where consistency and risk control are paramount.

-

Instead of spending years piecing together concepts, you follow a coherent path refined through mentoring and live trading experience.

-

-

Focus on reducing the learning curve

-

Many traders acquire chart-reading skills painfully slowly over thousands of hours of trial and error.

-

This course is specifically designed to compress that learning process by showing you patterns, phases, and scenarios that typically take a long time to recognize on your own.

-

What You’ll Learn 📊

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action covers both foundational concepts and advanced nuances. Key outcomes include:

-

Predicting the next candle with context

-

Understand how to think about the next bar or candle within the larger daily and intraday narrative.

-

Learn “main daily scenarios” and how to interpret them in names like AMD, CCL, CVX, and other actively traded symbols.

-

-

Recognizing market phases early

-

Identify accumulation, distribution, trending, and choppy stages before they are fully obvious.

-

Learn how to adjust your expectations and tactics depending on which phase is developing.

-

-

Using daily vs. 60-minute vs. 5-minute vs. 1-minute charts together

-

See how to go from a daily bias to concrete intraday plans.

-

Learn to use 60-minute and 5-minute charts for structure, then refine your entries using 1-minute signals when appropriate.

-

-

Pinpoint Strategy for dip entries

-

Apply the Pinpoint Strategy to find high-probability dip entries instead of chasing price.

-

Understand when buying a pullback makes sense and when it is safer to stay on the sidelines.

-

-

Identifying key levels for day trading

-

Learn to map out critical support and resistance levels that can act as inflection points.

-

See how these levels emerge from weekly, daily, and intraday charts and why they attract liquidity.

-

-

Scenario-based price action patterns

-

Explore multiple “pinpoint scenarios,” such as:

-

20–200 relationships

-

Pullback days

-

Continuation days

-

Gapper days

-

Days after huge runners

-

-

Understand how each scenario affects your expectations for movement, volatility, and risk.

-

-

Building watchlists and swing ideas from the weekly chart

-

Learn how to use weekly charts not just for long-term views, but as a tool for structuring your day trading watchlist.

-

See how weekly context can also support swing trading opportunities.

-

-

ORBs and adding into winners

-

Gain a detailed look at Opening Range Breakouts (ORBs) and how to handle them with multiple time frame context.

-

Learn several methods to add into winning trades without losing control over your risk.

-

-

Traps, reversals, and retail pain points

-

Examine common traps that shake retail traders out of their positions.

-

Learn how multiple time frame analysis can help you identify and trade reversal setups more confidently.

-

Each module includes practical examples, step-by-step explanations, and applications that connect theory to live market action.

Core Benefits 💡

This course is designed not just to inform you, but to transform how you see charts. Some of the core benefits you can gain include:

-

Clearer market vision

-

Instead of seeing random candles, you start to recognize structured behavior: ranges, transitions, and momentum shifts.

-

Multiple time frame analysis helps you avoid tunnel vision and place each move in its proper context.

-

-

Improved entries and exits

-

With a stronger understanding of key levels and intraday structure, you can refine where you enter and where you take profits or cut losses.

-

This can reduce impulsive entries and late exits driven by emotions.

-

-

Better survival in choppy markets

-

The course teaches you to recognize when choppy stages are starting to form and how to respond appropriately.

-

This helps you avoid overtrading noisy periods and preserve capital for cleaner opportunities.

-

-

Stronger confidence in your decision-making

-

Knowing how higher and lower time frames fit together gives you a logical basis for your trades.

-

This can reduce hesitation and second-guessing, especially around volatile moves and pullbacks.

-

-

Transferable skills across strategies

-

Because the course is focused on price action and structure, the skills you learn can be applied to:

-

Trend trading

-

Scalping

-

Breakouts and breakdowns

-

Reversals

-

Swing trading

-

-

You are not locked into a single strategy; instead, you gain a foundational skill set that supports many approaches.

-

-

Condensed professional insight

-

You benefit from the experience of a trader who has mentored over 100 active traders, many of whom became consistently profitable.

-

This perspective helps you avoid common mistakes and accelerate your development. 🚀

-

Who Should Take This Course? 👨💻👩💻

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action is designed for traders who are serious about building long-term skill, not just chasing quick tips. You are likely to benefit most if you are:

-

An active or aspiring day trader

-

You trade intraday or plan to, and you know that understanding 1-minute, 5-minute, and 60-minute charts is essential.

-

You want clearer rules for when to engage the market and when to stand aside.

-

-

A trader using indicators who wants deeper context

-

You already use indicators or algorithms, but you feel you’re missing the “bigger picture.”

-

You want to understand the price action underneath those signals to make better discretionary decisions.

-

-

A developing prop or retail trader

-

You are interested in prop-style thinking: structured processes, edge definition, and continuous improvement.

-

You value learning from someone actively trading and mentoring within a professional trading environment.

-

-

A swing or hybrid trader

-

You hold positions for multiple days but want better timing for entries and partial exits.

-

You want to integrate weekly and daily context with intraday refinements.

-

-

A committed learner seeking to shorten the screen-time curve

-

You are willing to study, review charts, and practice—but you also want high-quality guidance so you don’t waste years on ineffective methods.

-

You appreciate a well-organized curriculum that takes you from foundational ideas to advanced applications.

-

If these descriptions sound like you, this course can become a central building block in your trading education.

Conclusion 🔍

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori – Trading Terminal provides a structured, professional-grade roadmap for mastering one of the most important skills in active trading: understanding price behavior across time frames.

Packed into a 2.88 GB course package and priced at $178.5, the program brings together five detailed modules that walk you from predictive daily scenarios and intraday structures to pinpoint entries, weekly watchlist building, ORBs, and reversal frameworks. Rather than offering a single “holy grail setup,” it gives you a comprehensive method for reading markets more clearly, managing risk with better context, and aligning strategy with real price action.

For traders who want to move beyond surface-level patterns and build a skill that remains valuable across strategies, symbols, and market cycles, this course offers substantial long-term value. It compresses years of screen time and prop-trading experience into a structured learning journey you can apply immediately and refine over time.

If you are ready to elevate your chart-reading skills and bring professional-level multiple time frame analysis into your trading routine, now is the ideal moment to enroll in The Complete Guide to Multiple Time Frame Analysis & Reading Price Action By Aiman Almansoori – Trading Terminal and start transforming the way you see and trade the markets. 📊✨

Reviews

There are no reviews yet.