The Complete Method Stock Swing Trading Course by Cory Mitchell – Immediately Download

Swing trading appeals to international traders for one reason: it can deliver meaningful opportunities without requiring you to sit in front of charts all day. But consistent swing trading is not about catching “random breakouts.” It requires a repeatable method for selection, timing, and risk control—so your winners can outweigh your inevitable losers over a long sample size.

The Complete Method Stock Swing Trading Course by Cory Mitchell (CMT) is designed as a structured, step-by-step program that teaches a complete swing trading workflow plus seven core strategies aimed at identifying stocks that may move strongly over days to several weeks.

-

Course size: 4.67 GB

-

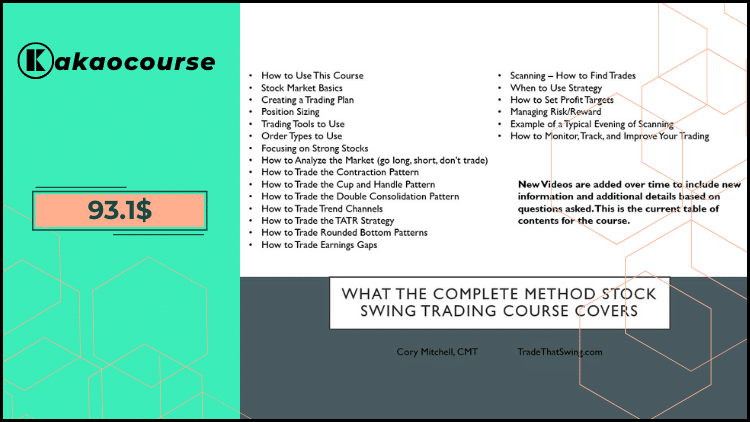

Price: $93.10

The messaging highlights “20%+ moves” as an upside target. In practice, not every trade will perform that way, and results depend on execution, market regime, and risk discipline. The value of this course is the process: how to find high-probability setups, define exits, and protect capital when conditions are unfavorable.

Free Download The Complete Method Stock Swing Trading Course by Cory Mitchell – Here’s What You’ll Get Inside:

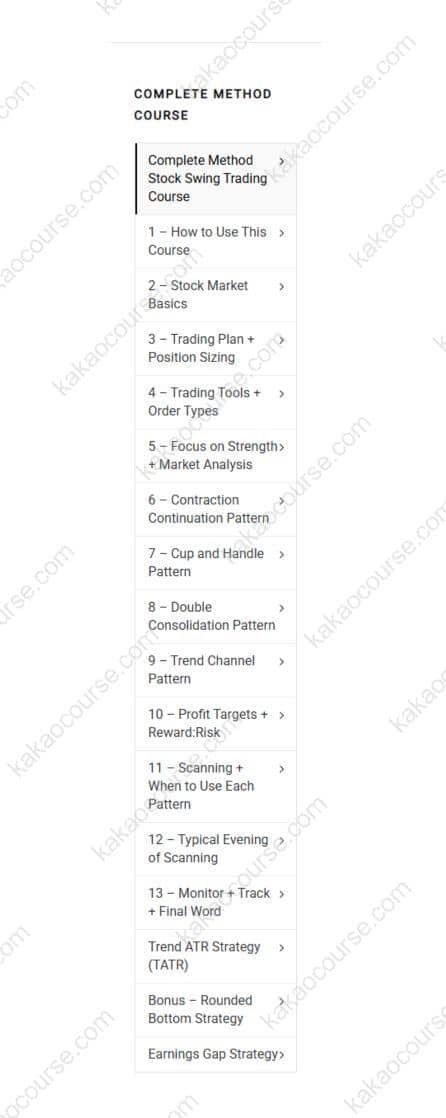

The Complete Method Stock Swing Trading Course by Cory Mitchell, Check Out the Full Course Contents:

The Complete Method Stock Swing Trading Course by Cory Mitchell, Watch Our Free Video Sample to Find Out More:

The Complete Method Stock Swing Trading Course by Cory Mitchell, Check Your Free PDF Sample Here:

🧾 Overview This Course

The Complete Method Stock Swing Trading Course is positioned as a compact but comprehensive swing trading system that you can learn quickly and then practice systematically. It aims to reduce the common early-stage problems in swing trading:

-

Overanalyzing charts without a decision framework

-

Entering late, exiting early, and sizing inconsistently

-

Trading in poor market conditions where edge is reduced

-

Jumping between strategies without understanding when each one applies

The course organizes swing trading into a full workflow, including:

-

Market context: when to go long, when to short (optional), and when not to trade

-

Stock selection: filtering for strength and momentum characteristics

-

Setup recognition: specific chart patterns and event-driven behaviors

-

Execution: order types, position sizing, profit targets, and trade management

-

Continuous improvement: tracking results and refining over time

It is delivered in a 16-video format, each focusing on a critical piece of the trading process or a strategy—making it suitable for learners who want a clear structure without a lengthy, open-ended program.

✅ Why Should You Choose This Course?

A large percentage of traders fail to improve because they collect information but never build a system. This course is positioned for learners who want a complete method: not only “entries,” but also market filtering, trade selection, exits, and ongoing review.

Reasons this program can be a good fit:

-

It emphasizes a full trading process, not just patterns ✅

Many swing trading courses teach patterns but ignore the surrounding decisions—market regime, stock selection, risk sizing, and trade management. This course is structured around the whole workflow. -

Seven strategies with defined use-cases

Instead of one “holy grail,” it provides a toolkit—patterns and tactics you can apply depending on what the market is doing and what the stock is showing. -

Built for efficiency (time-limited traders)

The course explicitly supports part-time swing trading: scanning, planning, and placing trades on your own schedule—often outside market hours. -

Strong emphasis on risk and capital protection 🛡️

A swing trader’s long-run performance is often driven less by brilliant winners and more by:-

preventing oversized losses,

-

avoiding low-edge environments,

-

and maintaining consistent sizing.

-

-

Clear, practical deliverables

You learn how to create a plan, scan for trades, set targets, choose order types, and monitor performance—so you can actually implement the method.

🧠 What You’ll Learn

This course is designed to give you both strategy and operational competence. Key outcomes include:

1) Swing trading fundamentals that support consistency

-

Stock market basics (as needed for the workflow)

-

Creating a trading plan you can execute repeatedly

-

Position sizing principles so one trade does not dominate your results

-

Tools and order types to reduce execution mistakes

2) Market context and timing

-

How to evaluate whether the market supports long trades, short trades (optional), or staying out

-

How to avoid trading conditions where many traders give back profits

-

How to align strategy choice with market regime (trend vs choppy conditions)

3) Seven swing trading strategies (setup recognition + execution)

The course focuses on strategies designed to capture strong moves over days to weeks, including:

-

Breakout / contraction-style opportunities

Identifying tight consolidations and planning entries/exits systematically. -

Cup-and-handle and related continuation patterns 📌

Recognizing structure that can precede expansion moves, while defining risk clearly. -

Double consolidation structures

Scanning for multi-stage “pause then go” behaviors that can support cleaner entries. -

Trend channels

Using structured trend movement for entries and profit-taking rather than guessing tops/bottoms. -

Momentum / volatility-based strategy elements (e.g., TATR-style)

Applying defined rules to participate in higher-momentum environments with controlled risk. -

Rounded bottom patterns

Identifying longer transitions that may support sustained directional moves. -

Earnings gaps

A specialized strategy focused on post-earnings behavior and price expansion.

4) Scanning and trade selection workflow

-

How to scan efficiently and avoid drowning in thousands of charts

-

How to filter for stronger candidates and higher-quality setups

-

Example walkthrough of a typical scanning session

5) Exits, targets, and risk management

-

How to set profit targets with discipline (rather than emotion)

-

How to manage risk/reward consistently

-

How to monitor and manage open positions without micromanaging

6) Tracking and improving performance

-

How to review trades for patterns (what works, what doesn’t)

-

How to refine execution without constantly changing strategies

-

How to build a feedback loop that improves results over time

🧩 Core Benefits

This course is best understood as a swing trading operating system. If applied with practice and discipline, it can improve decision quality in ways that compound.

1) Faster, clearer decision-making

You move from “I think this might break out” to a structured checklist:

-

Is the market supportive?

-

Does the stock meet selection criteria?

-

Is the setup valid?

-

Where is invalidation?

-

Where is the target?

-

Is the trade worth taking?

2) Better risk control and capital preservation 🛡️

The course emphasizes protecting capital in weak conditions. This matters because many swing traders:

-

perform well in strong markets,

-

then give it back when conditions shift.

A method that teaches when not to trade can be as valuable as a method that teaches entries.

3) Time efficiency for part-time traders ⏱️

With a scan-plan-execute workflow, you can trade on a schedule:

-

scan weekly or nightly,

-

place orders with intention,

-

manage positions with defined rules.

4) Strategy diversity without chaos

Seven strategies provide flexibility, but the course frames them as tools with specific contexts—not a random menu. That helps you avoid strategy-hopping.

5) A measurable improvement loop

Because trade planning and tracking are included, you can evaluate performance scientifically:

-

Which strategy is working in this regime?

-

Which market filters improve results?

-

Which mistakes are recurring?

That’s how trading becomes skill development rather than gambling.

👥 Who Should Take This Course?

The Complete Method Stock Swing Trading Course by Cory Mitchell (CMT) is designed for learners who want actionable strategies and a complete process.

A strong fit if you are:

-

A trader who wants to capture multi-day to multi-week moves without day trading

-

A busy professional who can commit limited time (scanning + monitoring)

-

An intermediate trader who knows basic charts but lacks a complete method

-

A disciplined learner willing to test, track, and refine execution

-

A trader who wants structured optional exposure to shorting concepts

Not ideal if you are:

-

Looking for guaranteed outcomes or “always works” strategies

-

Unwilling to follow risk limits or position sizing rules

-

Expecting fast profits without practice and review

-

Preferencing purely long-term investing rather than active trade management

🧾 Conclusion

The Complete Method Stock Swing Trading Course by Cory Mitchell (CMT) is a structured swing trading program that teaches a complete workflow plus seven strategies for identifying high-probability opportunities, setting targets, managing risk, and scanning efficiently. Its focus on process—market filtering, stock selection, execution rules, and performance tracking—makes it particularly suitable for traders who want consistency and time efficiency rather than endless theory.

For purchase clarity:

-

Course size: 4.67 GB

-

Price: $93.10

-

Delivered as 16 videos covering both core process and strategy modules

If you want a clear, repeatable swing trading system you can learn quickly and then practice systematically, this course is a strong, cost-efficient foundation to build from. 🚀

Start by implementing one strategy at a time, track results for at least several dozen examples, and let your data—not emotions—tell you what is truly working.

Reviews

There are no reviews yet.