The Hedge Hog Options Spread by Option Omega – Immediately Download

Master complex options with a strategy built for probability, risk control, and flexibility.

“The Hedge Hog Options Spread” by Option Omega is a focused, advanced-level training program that shows you how to structure and manage one of the most powerful high-probability option spread frameworks in today’s markets.

In a compact but content-rich package of approximately 522 MB, you gain access to a complete video course priced at only $30.8. Inside, you will learn how to build and adjust Hedge Hog spreads, use option skew to your advantage, and employ this structure both as a standalone income engine and as a hedge for other positions.

Designed specifically for experienced traders and well-capitalized accounts, this course does not aim to be introductory. Instead, it gives you a clear, rules-based roadmap for working with a sophisticated options structure that can target success rates above 85% when used under appropriate market conditions and with disciplined risk management.

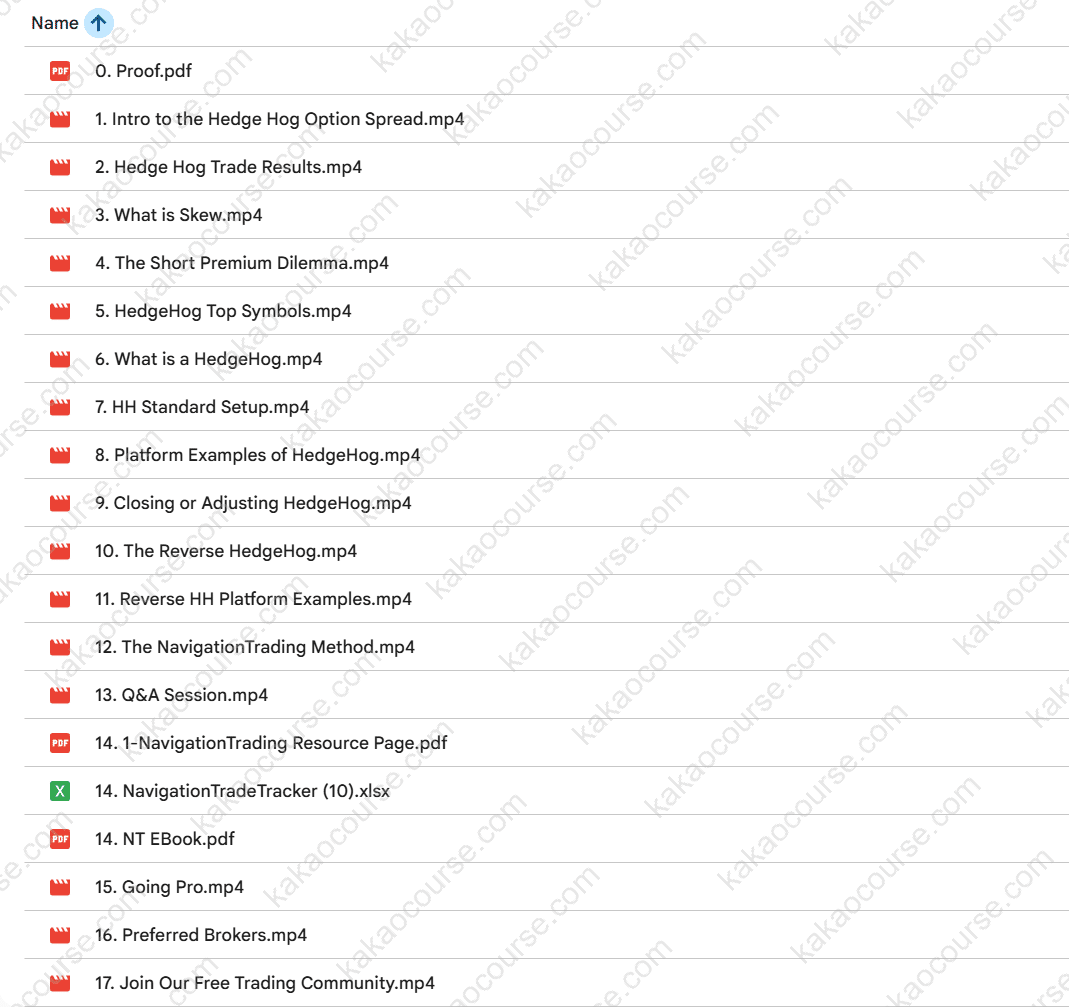

Free Download The Hedge Hog Options Spread by Option Omega – Here’s What You’ll Get Inside:

The Hedge Hog Options Spread by Option Omega, Sneak Peek Inside The Course:=

The Hedge Hog Options Spread by Option Omega, Watch Our Free Video Sample to Find Out More:

Overview This Course

“The Hedge Hog Options Spread” is a specialized course that focuses on one central goal: helping you master a high-probability options structure that can be used both to generate income and to manage portfolio risk.

Rather than teaching a broad survey of unrelated strategies, the program dives deeply into the Hedge Hog itself:

-

What it is and how it is built

-

When it should be deployed

-

How it behaves in different volatility and skew environments

-

How to open, adjust, and close trades in a systematic way

You begin with a conceptual introduction, move quickly toward understanding option skew and short-premium dynamics, and then see how to translate theory into practice through platform demonstrations, real trade examples, and a detailed Q&A session.

The course emphasizes:

-

Probabilistic thinking instead of prediction

-

Risk-first design rather than aggressive speculation

-

Adaptation to market conditions, not static rules that ignore volatility or skew

By the end, the Hedge Hog is no longer an abstract idea; it is a clearly defined tool that you can integrate into your overall options trading framework.

Why Should You Choose This Course?

There are many options courses, but very few focus so precisely on one advanced, probability-driven structure. This course is a strong choice if you value depth, rigor, and practical application.

You should consider it because:

-

It teaches a truly differentiated strategy

The Hedge Hog is not a simple credit spread or basic iron condor. It is a nuanced construction that uses option skew and carefully chosen strikes to tilt odds in your favor. -

It emphasizes probability and trade design

Instead of relying on backtests alone, the course trains you to think in terms of:-

Probability of profit

-

Risk exposure

-

Market context and volatility regimes

-

-

It addresses both income and hedging

The Hedge Hog can:-

Operate as a stand-alone income strategy

-

Function as a protective overlay for other positions in your portfolio

-

-

It is built for experienced, serious traders

This is not an entry-level introduction. The content assumes you already understand options basics and are ready to work with more sophisticated structures, sometimes including naked components. -

It includes live-style examples and platform walkthroughs

Rather than abstract theory, you will see:-

How trades are set up on a real platform

-

How positions evolve

-

How adjustments and exits are executed in specific scenarios

-

If you want more than generic options education, and you are ready to work with a professional-grade strategy, this course is tailored to that ambition.

What You’ll Learn

The curriculum is organized to take you from conceptual understanding to detailed practical implementation. By completing the course, you will learn:

-

Foundations of the Hedge Hog Options Spread

-

What defines a Hedge Hog spread and how it differs from more common structures

-

How the payoff profile is constructed and how risk is distributed

-

Why this structure can achieve very high probability setups when appropriately designed

-

-

Understanding and Using Option Skew

-

What “skew” means in the context of options pricing

-

How differences in implied volatility across strikes create opportunity

-

How to align your Hedge Hog structure with favorable skew conditions

-

-

The Short Premium Dilemma and Its Solutions

-

The trade-off between collecting premium and managing tail risk

-

How the Hedge Hog attempts to balance income potential with defined or managed risk

-

Practical considerations when selling premium in different market environments

-

-

Top Symbols and Market Selection

-

What characteristics make a symbol well-suited for Hedge Hog setups

-

Why some underlyings are best avoided for this strategy

-

How liquidity, volatility, and product structure affect your choices

-

-

Standard Hedge Hog Setup

-

Step-by-step construction of the standard Hedge Hog

-

How to choose:

-

Expiration dates

-

Strike distances

-

Contract size

-

-

How to evaluate risk/reward and probability of profit before sending the order

-

-

Platform Implementation

-

Detailed platform demonstrations showing:

-

Order entry

-

Position monitoring

-

Adjustment triggers and implementation

-

-

How to read P&L, Greeks, and risk graphs as the trade matures

-

-

Closing and Adjusting Trades

-

Criteria for taking profits or reducing risk

-

Common adjustment techniques used when price or volatility moves against you

-

Frameworks for making decisions instead of reacting emotionally

-

-

Reverse Hedge Hog Variant

-

How the Reverse Hedge Hog differs from the standard setup

-

When a reverse configuration may be more appropriate, depending on market bias or volatility shape

-

Platform examples illustrating real-world implementation

-

-

The NavigationTrading / Option Omega Methodology

-

How the instructors approach probability, risk, and market selection

-

How the Hedge Hog fits within a broader portfolio of strategies

-

Practical insights from actual Q&A with traders applying the method

-

Taken together, these modules provide you with a complete toolkit for incorporating Hedge Hog strategies into your existing trading practice with clarity and discipline.

Core Benefits

Applying the principles and techniques in this course can offer several important benefits to your trading:

-

Higher Emphasis on Probability and Risk Control

-

Design trades that explicitly target high success rates

-

Understand your risk exposure before entering any position

-

Use structural advantages (like skew) instead of relying purely on direction calls

-

-

Potential for Consistent Income

-

Use the Hedge Hog as a recurring strategy that, when carefully managed, seeks steady premium collection

-

Integrate the approach into a broader income-trading framework alongside other spreads or neutral strategies

-

-

Enhanced Portfolio Protection

-

Deploy the Hedge Hog as a hedge for other core positions, especially those exposed to specific directional or volatility risks

-

Balance offensive (income-seeking) and defensive (protective) uses of the same underlying structure

-

-

Clarity in Trade Management

-

Move from vague notions of “I’ll see what happens” to clearly defined:

-

Entry criteria

-

Adjustment rules

-

Exit targets

-

-

Reduce emotional decision-making with pre-planned responses to different market outcomes

-

-

Professional-Level Strategy With Practical Guidance

-

Access a strategy that is typically reserved for more advanced traders

-

Learn it through structured videos, platform walk-throughs, and extended Q&A that addresses real implementation questions

-

These benefits are not guaranteed outcomes, but they represent the capabilities you can develop when you internalize the methods taught and apply them consistently with appropriate risk management.

Who Should Take This Course?

Because of the complexity and risk characteristics of the Hedge Hog structure, this program is designed for a specific audience. You are well-suited for this course if you are:

-

An Experienced Options Trader

-

You already understand:

-

Calls and puts

-

Spreads, credit/debit concepts

-

Basic Greeks and volatility

-

-

You are ready to move into more advanced structures that may include limited naked exposure in certain variations.

-

-

Managing a Medium to Large Account

-

The recommended minimum account size for fully utilizing the diverse Hedge Hog variations is around $50,000.

-

You want to implement strategies where position sizing and margin usage are thoughtful and well managed.

-

-

Comfortable With Probability-Driven, Non-Backtest-Only Methods

-

You appreciate that not all strategies are purely backtest driven.

-

You are interested in methods grounded in:

-

Probability

-

Market environment

-

Risk/reward logic

-

-

-

Seeking Both Income and Hedging Tools

-

You want a strategy that can:

-

Generate premium systematically

-

Help offset risk in other positions or strategies

-

-

-

Committed to Continuous Learning

-

You value in-depth explanations, platform examples, and Q&A content.

-

You are prepared to study, review, and refine your application of the strategy over time.

-

If you recognize yourself in these descriptions, this course can become a central part of your advancement as an options trader.

Conclusion

“The Hedge Hog Options Spread” by Option Omega is a focused, advanced training course that opens up one of the most powerful high-probability option structures available to serious traders. With a total size of approximately 522 MB and a highly accessible price of $30.8, it delivers concentrated knowledge that can significantly deepen your understanding of probability-based options trading.

Inside the course, you will learn how to:

-

Use option skew and short-premium dynamics to structure trades

-

Construct standard and reverse Hedge Hog setups with clear rules

-

Choose appropriate symbols and market conditions

-

Adjust and close trades using disciplined, pre-planned methods

If you are an experienced options trader with a sufficiently funded account, and you are looking for a strategy that can serve as both an income engine and a risk-management tool, this course provides the frameworks, demonstrations, and insights necessary to put the Hedge Hog Options Spread to work in your own portfolio.

Take this opportunity to move beyond general options theory and start working with a professional-grade Hedge Hog structure that is designed around probability, risk control, and real-world market behavior—enroll now and begin mastering the Hedge Hog Options Spread today.

Reviews

There are no reviews yet.