The Magic Mahomes Spread by Option Omega – Immediately Download

Options trading rewards discipline more than excitement. Yet many traders—whether new or experienced—still get trapped in the same loop: too many setups, too many decisions, and too much screen time. A strategy that is time-bounded and rule-driven can reduce noise and improve execution quality, especially if you want a repeatable daily routine.

The Magic Mahomes Spread by Option Omega is a live class built around a focused concept: a daily options spread strategy designed specifically for the final 15 minutes of each trading day. The course emphasizes clear entry instructions, adaptable management approaches, and a method to adjust the spread in a way that aims to reduce exposure and protect favorable outcomes—without turning execution into guesswork.

-

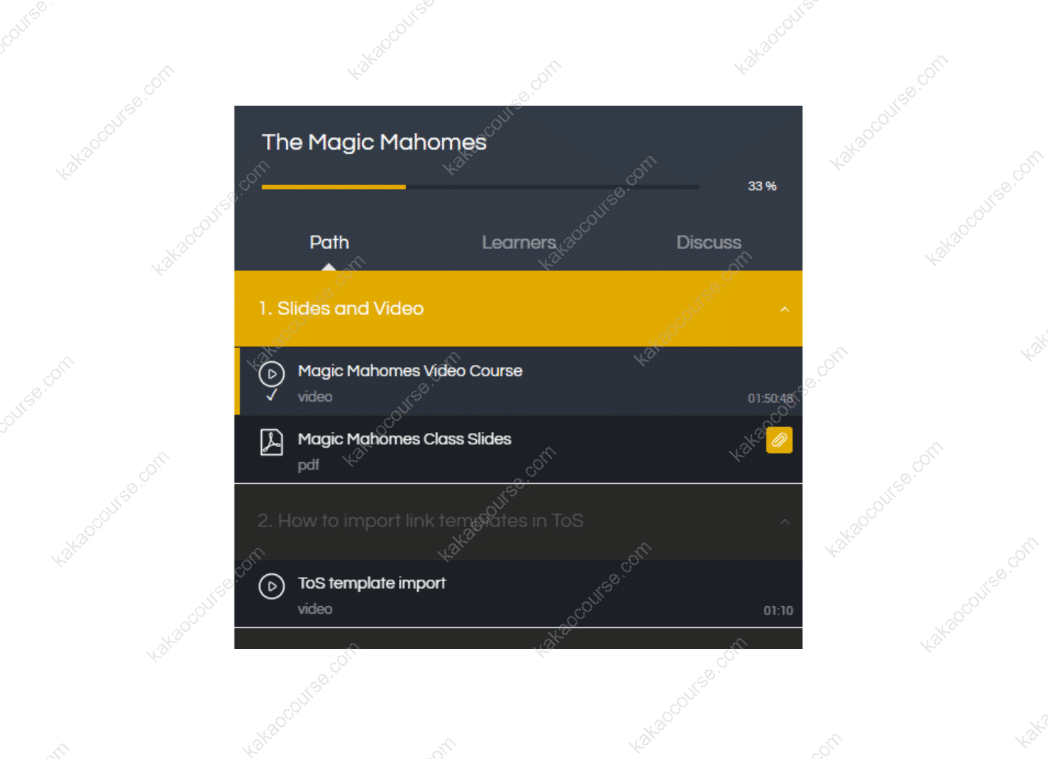

Package size: 405 MB

-

Price: $30.8

Free Download The Magic Mahomes Spread by Option Omega – Here’s What You’ll Get Inside:

The Magic Mahomes Spread by Option Omega, Check Out the Full Course Contents:

The Magic Mahomes Spread by Option Omega, Free PDF Preview Available Below:

🪄 Overview This Course

The Magic Mahomes Spread is designed as a practical “execution class,” not a broad options encyclopedia. Instead of covering dozens of strategies, it goes deep on one repeatable, end-of-day approach and teaches you how to operate it consistently.

The strategy is framed as a daily routine for the last 15 minutes of the session, which matters because time constraints naturally force clarity:

-

You prepare with a short, consistent workflow

-

You enter with a defined instruction set

-

You manage with pre-planned paths rather than improvisation

-

You can build repetition quickly because it is intended to be used daily

The course experience is also intentionally “hands-on.” It includes a live strategy class followed by a live trading session, helping you connect the rules to real-time decision-making rather than learning only from static examples.

For thinkorswim users, the course provides shared order templates, which can reduce execution friction when time is limited and precision matters.

✅ Why Should You Choose This Course?

Many options traders do not struggle with motivation—they struggle with operational consistency. They may understand spreads, Greeks, and market dynamics, but their results vary because execution varies. This course is positioned to solve that by tightening three things: timing, instructions, and management options.

1) A defined daily time window supports discipline

Strategies that require constant monitoring often lead to fatigue, overtrading, or late reactions. By focusing on the final 15 minutes, this approach encourages a more controlled routine, especially for traders who want a structured process at the end of the day.

2) “Exact entry instructions” reduce ambiguity

Ambiguity is expensive in options trading. When you know precisely how to enter, you reduce second-guessing and avoid the common trap of making micro-changes mid-execution.

3) Multiple trade management styles increase flexibility

Traders do not share the same risk tolerance, account size, or stress threshold. A single rigid management rule can be a deal-breaker. This course includes multiple management styles so you can apply the approach in a way that matches your preferences—while still staying systematic.

4) Execution becomes smoother with templates (for thinkorswim users)

A good strategy can underperform if it is hard to execute. Order templates help reduce mechanical errors and shorten decision time, which is especially valuable in an end-of-day window.

5) Accessible approach across account sizes and trading constraints

The course description positions the method as suitable for any account size and designed to avoid Pattern Day Trader concerns. While broker rules vary by jurisdiction, the practical intent is clear: a repeatable process that does not rely on rapid-fire intraday trading.

📚 What You’ll Learn

This course is engineered to help you execute the Magic Mahomes Spread with clarity, not just understand it conceptually. The learning outcomes revolve around entry precision, risk-aware adjustments, and repeatable management.

You can expect to learn how to:

-

Build a daily end-of-day trading routine

-

How to prepare consistently before the final window begins

-

How to reduce “random trades” by following a time-boxed process

-

-

Enter the trade step-by-step

-

The exact sequence for setting up and placing the spread

-

How to maintain consistency across days instead of reinventing execution

-

-

Use “spread transformation” to manage exposure

-

How to adjust the spread in a structured way

-

How to think in terms of reducing risk and protecting favorable outcomes when conditions change

-

-

Choose among multiple trade management styles

-

How different management paths align with different trader profiles

-

How to apply decision rules without emotional overrides

-

-

Execute efficiently with thinkorswim order templates

-

How templates can support consistency and speed

-

How to reduce mis-clicks and rushed adjustments during a short time window

-

-

Connect theory to practice through live trading

-

Seeing how the rules translate into real-time decisions

-

Observing pacing, sequencing, and execution habits that traders often miss in written-only education

-

🔎 In short: you are not only learning a spread—you are learning a repeatable operating procedure for executing it.

🎯 Core Benefits

A good trading course should improve your behavior more than your vocabulary. The Magic Mahomes Spread is designed to strengthen the habits that typically drive results: preparation, consistent execution, and structured management.

Key benefits you can reasonably expect from this structure:

-

Reduced decision fatigue

-

A time-boxed strategy minimizes endless scanning and impulsive trades

-

-

Higher consistency through repeatable steps

-

“Exact entry instructions” encourage doing the same thing the same way

-

-

More control over trade management

-

Multiple management styles can make the strategy more adaptable to your preferences

-

-

Cleaner execution in a short window

-

Templates (for thinkorswim users) can shorten the time between decision and action

-

-

A learning format that accelerates understanding

-

Live class + live trading helps you internalize sequencing and practical decision points

-

📌 Professional note: options trading carries risk and is not suitable for all traders. A structured course can improve process quality, but responsible use still requires personal risk limits and disciplined sizing.

👥 Who Should Take This Course?

The course description positions this strategy as suitable for “anyone,” and in practice it can fit multiple experience levels because it focuses on execution clarity rather than advanced theory. Still, the best-fit profile is the trader who values structure.

This course is a strong fit if you are:

-

A beginner who wants a clear routine rather than scattered strategy content

-

An intermediate trader who knows options basics but wants more consistent execution

-

An experienced trader looking for an end-of-day strategy framework you can run daily

-

A trader with limited screen time who prefers a time-boxed approach

-

A thinkorswim user who benefits from shared order templates for smoother execution

-

A trader who wants a method positioned to avoid common PDT-related friction (subject to your broker’s rules)

This course may be less suitable if you are:

-

Seeking a broad, multi-strategy options curriculum rather than one focused method

-

Unwilling to follow defined entry/management rules (the value is in repeatability)

-

Expecting a “signals” product instead of skill-building and execution training

✅ If you want a strategy you can practice daily with a consistent sequence, this course is aligned with that objective.

🧾 Conclusion

The Magic Mahomes Spread by Option Omega is a live, execution-driven class centered on a daily options spread strategy for the final 15 minutes of each trading day. It emphasizes exact entry instructions, a structured way to transform/manage the spread, multiple management styles, and a live trading component to reinforce real-time application. For thinkorswim users, shared order templates aim to make execution more seamless.

-

Package size: 405 MB

-

Price: $30.8

For traders who value structure, time efficiency, and repeatable execution, this course offers a practical framework you can incorporate into a disciplined end-of-day routine without turning your entire day into a trading session.

Reviews

There are no reviews yet.