TWP Price Action Course 2025 by Trade Win Profit – Immediately Download

TWP Price Action Course 2025 by Trade Win Profit is a structured, video-based training program built to help traders develop a clearer, rules-driven approach to price action—covering both day trading and swing trading workflows. Rather than treating trading as a collection of “tips,” the course is organized into progressive modules that move from foundations (candlesticks, support/resistance, timing) to advanced decision-making (market structure, supply & demand, traps, reversals, journaling, and psychology).

For international learners, the value proposition is straightforward: a single curriculum that helps you build a repeatable process for reading markets across up, down, and sideways conditions—while keeping risk, discipline, and documentation central to the learning path.

-

Course size: 3.15 GB

-

Price: $77.70

Trading is inherently risky and outcomes vary. This course is best understood as skill training focused on market-reading, execution structure, and trader development—not as a promise of performance.

Free Download TWP Price Action Course 2025 by Trade Win Profit – Here’s What You’ll Get Inside:

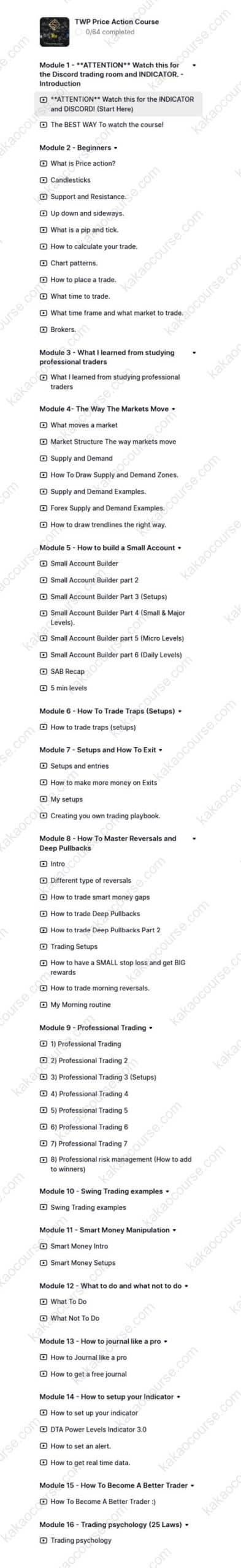

TWP Price Action Course 2025 by Trade Win Profit, Check Out the Full Course Contents:

TWP Price Action Course 2025 by Trade Win Profit, Watch Our Free Video Sample to Find Out More:

TWP Price Action Course 2025 by Trade Win Profit, Free PDF Preview Available Below:

📘 Overview This Course

The TWP Price Action Course 2025 is designed as an end-to-end roadmap for developing competence in price action trading. The curriculum is arranged to support both learners who are starting from zero and traders who already place trades but lack consistent structure.

The program is organized into 16 modules, covering:

-

A beginner pathway that builds core literacy: candlesticks, support and resistance, market directions, sizing basics, chart patterns, execution basics, timeframes, and market selection.

-

A market-behavior pathway that explains how markets move: structure, trendlines, supply and demand zones, and practical examples across instruments such as forex.

-

A practical execution pathway: small-account management, trade traps, entries/exits, reversals and deep pullbacks, swing trading examples, and “smart money” behavior framing.

-

A professional development pathway: risk management practices, journaling, indicator setup and alerts, and trading psychology.

The overall intent is to help you move from “watching charts” to building a trading playbook—a documented set of rules you can follow, evaluate, and refine.

⭐ Why Should You Choose This Course?

Many traders lose money repeatedly for a predictable reason: they enter trades without a stable framework, then change methods whenever the market shifts. This course is positioned to address that by offering a structured system that emphasizes clarity, repeatability, and decision discipline.

Reasons international learners often choose a program like this include:

-

It blends beginner fundamentals with advanced structure ✅

You do not have to stitch together scattered videos from different sources. The course flows from basic concepts to professional-grade routines. -

It prioritizes “how to think” over “what to copy”

Instead of relying on a single setup, you learn how to interpret direction, structure, zones, and reaction behavior—then use that interpretation to guide entries and exits. -

It includes process elements most courses neglect

Journaling, routine design, and psychology are not optional “extras” if you want consistency; they are foundational. -

It addresses multiple market conditions

A common frustration is only knowing how to trade trends. This curriculum explicitly trains approaches for trending and ranging environments, plus transitions such as reversals and deep pullbacks. -

It supports tool-based execution without making the tool the strategy

The program includes indicator setup and alerts, which can help with workflow and monitoring—while the core emphasis remains on price action and decision-making.

If you want a single course that can become your “main textbook” for price action and trading process development, this is a strong fit for the price point.

🧠 What You’ll Learn

The course covers a wide surface area, but the learning outcomes can be organized into a few practical capabilities—each directly relevant to building consistency.

1) Price action foundations

-

Candlestick understanding and basic chart literacy

-

Support and resistance as a structured framework (not random lines)

-

Market directions: uptrend, downtrend, range

-

Core trading mechanics: what a trade is, how to place it, and how to evaluate it

2) Timeframes, timing, and market selection

-

How to select timeframes for your trading style

-

When to trade (session logic and practical timing considerations)

-

How to choose markets/instruments appropriate to your workflow

3) Market structure and the way markets move 📌

-

How structure forms and transitions

-

How to draw trendlines correctly and avoid common mistakes

-

How to interpret movement as sequences rather than isolated candles

4) Supply & demand methodology

-

How to draw supply and demand zones

-

How to use examples to validate zone quality

-

How to integrate zones into a broader plan (entries, invalidation, exits)

5) Small-account planning

-

Building discipline around sizing and risk control

-

Separating micro levels vs major levels vs daily levels

-

Creating a structured approach that helps reduce emotional overtrading

6) Setups, traps, reversals, and pullbacks

-

Understanding traps and how markets lure poor entries

-

Building entries and exits around rule-based logic

-

Reversal and deep pullback frameworks for higher-quality timing

-

Developing tighter invalidation logic (knowing clearly when your idea is wrong)

7) Professional routines: playbook, journal, psychology

-

Creating your own trading playbook (rules you can follow)

-

Journaling like a professional for measurable improvement

-

Psychology principles that support consistency and reduce impulsive behavior

8) Indicator and alert setup

-

Practical steps for configuration and alerts

-

Using tools to support execution discipline and monitoring—without outsourcing judgment

✅ Core Benefits

The core benefit is not “more information.” It is more structure in your decisions, which can improve consistency, confidence, and risk awareness over time.

Benefit 1: A repeatable decision framework

You learn to make choices using consistent checkpoints such as:

-

What is the market condition (trend/range/transition)?

-

Where are key zones and structural levels?

-

What is the entry trigger and invalidation point?

-

What is the exit plan (partial, full, trailing, or time-based)?

-

Is the trade aligned with your plan and timeframe?

Benefit 2: Better risk clarity and fewer emotional trades 🛡️

A system that emphasizes zones, structure, and invalidation helps reduce “hope-based” trading. You are encouraged to define risk first, then evaluate opportunity.

Benefit 3: Stronger execution through entries and exits training

Many traders focus on entries but leak performance through poor exits. This course includes exit thinking as part of the strategy—not as an afterthought.

Benefit 4: Practical adaptability across instruments

Price action, structure, and supply/demand concepts can be applied across markets. International learners benefit from a methodology that is not tied to one broker, one region, or one asset type.

Benefit 5: A professional development loop (journal + psychology)

When journaling and psychology are integrated into training, you improve faster because your feedback becomes actionable:

-

Was the setup valid?

-

Did you follow rules?

-

Did you misread structure?

-

Was the loss due to strategy limitations or execution behavior?

This turns trading into a skill-building process rather than an emotional cycle.

👥 Who Should Take This Course?

TWP Price Action Course 2025 is best suited for serious learners who want a structured curriculum and are willing to practice.

A strong fit if you are:

-

A beginner who wants a complete path from fundamentals to execution

-

An intermediate trader who trades actively but lacks consistent rules

-

A trader who wants to learn supply & demand and market structure systematically

-

Someone who wants to build a playbook, journal routinely, and improve discipline

-

An international learner seeking a course that can support both day trading and swing trading workflows

This course may not be ideal if you are:

-

Looking for guaranteed outcomes, “automatic money,” or signal-only content

-

Unwilling to document trades, practice, and follow risk limits

-

Expecting one strategy to work in all markets without adaptation

🧾 Conclusion

TWP Price Action Course 2025 by Trade Win Profit is a comprehensive, modular program that teaches price action from the ground up while also covering the professional habits that support consistency—market structure, supply & demand, entries/exits, traps, reversals, journaling, indicator setup, and trading psychology. For international learners, its strength is the breadth of coverage paired with a practical emphasis on building a repeatable trading process.

For purchase clarity:

-

Course size: 3.15 GB

-

Price: $77.70

If you want a structured path to upgrade your market-reading skill, formalize your trading rules, and build a stronger execution routine, this course is a practical, cost-efficient step forward. 🚀

Choose a start date, follow the modules in order, and begin documenting one rule-based setup in your journal each week until your playbook becomes truly executable.

Reviews

There are no reviews yet.