Instant Download Volume Profile Trading Course by Cammy Capital – Here’s What You’ll Get Inside:

Volume Profile Trading Course by Cammy Capital, Watch Our Free Video Sample to Find Out More:

Overview this course

The Volume Profile Trading Course by Cammy Capital is a structured, practitioner-led program designed for traders who want to replace social-media noise with a disciplined, evidence-based approach to the markets. Instead of chasing patterns that trend for a week and vanish the next, you will learn how to read the market’s actual auction—where, at each price, buyers and sellers have left footprints in the form of traded volume. This course distills that information into a repeatable process you can use day after day.

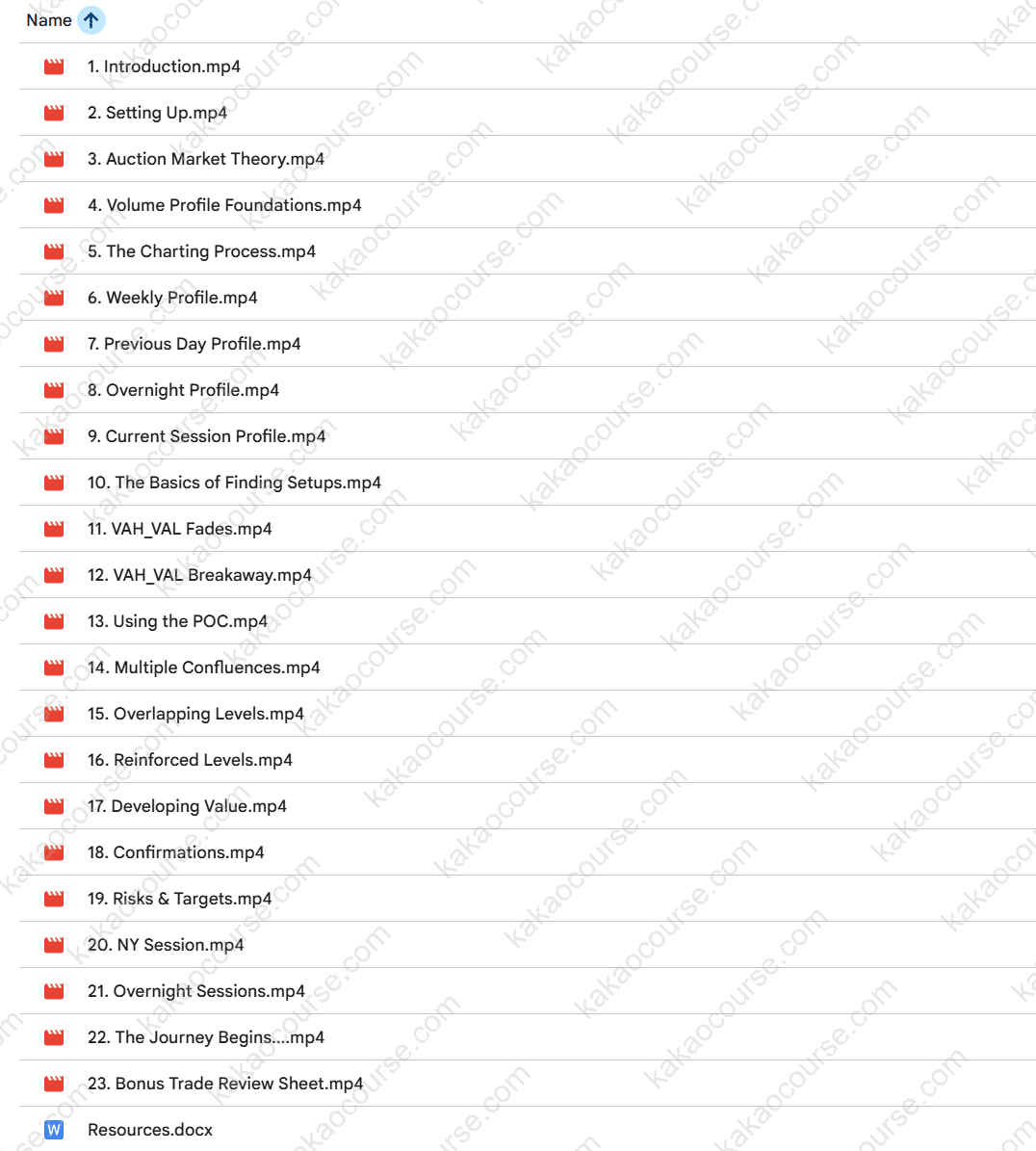

Across multiple hours of step-by-step video modules, you will build a complete playbook: how to configure the volume profile tool, how to interpret multiple profiles through a session, how to mark your charts to prepare for the day, and how to act on clearly defined setups that appear frequently across instruments and sessions. The curriculum favors clarity over hype and focuses on practical application—what to do, when to do it, and why it matters—so you can make decisions with confidence rather than emotion.

Because the program centers on volume profile and auction market theory, it fits naturally with futures day trading and can complement swing or intraday strategies in other products. You’ll see real-world examples that show how theory translates into tradeable structure: value areas, points of control, high-volume nodes, low-volume nodes, and the transitions that often precede opportunity. Each lesson connects back to risk management and process, helping you think like a professional who understands context, timing, and execution—not just entries.

If you are looking to give yourself a genuine edge, this course offers a rigorous pathway to do just that, using tools and concepts that professionals actually rely on.

Why should you choose this course?

It is built for traders who are done with recycled “tips.”

If you’re tired of regurgitated strategies from social media, you’ll appreciate a program that prioritizes market structure and data over buzzwords. The lectures explain the why behind each decision, so you can reason about the market rather than memorize patterns.

It teaches an institutional way of seeing the market.

Volume tells a story about participation and conviction. By learning to profile volume across price and time, you’ll begin to map where the market accepted value, where it rejected value, and how that context can inform higher-probability trades.

It emphasizes repeatability and routine.

You will learn how to mark your charts every day in a consistent manner, identify key reference points before the bell, and track how the session’s auction evolves. That routine anchors discipline and reduces impulsive decisions.

It bridges theory and execution.

The course doesn’t stop at definitions. You’ll watch how to move from abstract ideas—value area, point of control, distributions—to concrete, rules-based setups, including entries, invalidation, and management logic.

It is practical, not promotional.

Lessons are focused, tightly scoped, and grounded in real market behavior. No fluff, no theatrics—just a serious, methodical education that respects your time and goals.

Reported outcomes from learners include:

-

A more professional lens for reading price and context.

-

Greater consistency in preparation and trade selection.

-

Clearer understanding of where trades do not exist—an underrated edge.

(Results vary; the program teaches process and probability, not promises.)

What You’ll Learn

By the end of the course, you will have a well-defined framework for reading and trading the auction using volume profile. Key competencies include:

-

First principles of volume profile

-

What volume profile represents and why it matters for intraday decision-making.

-

The relationship between participation, acceptance, and rejection across prices.

-

How auction market theory explains trend, balance, and transitions.

-

-

Professional platform setup

-

How to configure the volume profile tool for daily use.

-

Choosing and aligning profile types (composite, session, intraday) with your plan.

-

Building clean, repeatable chart layouts that reduce clutter and bias.

-

-

Reading multiple profiles in real time

-

Interpreting session-to-session changes in value area and point of control.

-

Spotting developing imbalance, responsive vs. initiative activity, and rotation.

-

Using high-volume and low-volume nodes to frame targets and invalidation.

-

-

Daily chart marking and preparation

-

The pre-market checklist: context, key references, scenario planning.

-

How to annotate levels that matter before the open (and why they matter).

-

Creating objective plans for both trending and balancing sessions.

-

-

High-probability trade setups

-

Identifying recurring structures that appear in any session.

-

Entry triggers tied to profile references rather than arbitrary signals.

-

Invalidation rules, partials, and adaptive management using profile shifts.

-

-

From theory to action

-

Applying auction concepts to real examples in futures day trading.

-

Distinguishing true opportunity from noise by reading acceptance vs. rejection.

-

Avoiding common pitfalls: chasing breaks, misreading rotations, over-trading.

-

-

Templates and workflows

-

Downloadable chart and journaling templates to standardize your routine.

-

A post-trade review process that links outcomes back to plan and context.

-

Methods to measure progress and refine your edge without guesswork.

-

-

Risk and process integration

-

Sizing around setup quality and contextual confidence.

-

Structuring trades so losers are small and winners can develop.

-

Building a weekly cadence that compounds learning and consistency.

-

Who Should Take This Course?

This program is ideal for traders who want a mature, methodical approach to the markets:

-

Self-taught traders who have tried popular strategies and now want a coherent, theory-driven framework based on volume and auction dynamics.

-

Futures day traders seeking a structured way to read intraday context and align entries with evolving value.

-

Intermediate traders who can operate their platform but need a repeatable plan for preparation, execution, and review.

-

Discretionary traders who prefer to make informed decisions rather than follow rigid mechanical rules—but still want objective references.

-

Ambitious beginners ready to learn foundational concepts the right way from the start, focusing on process, not shortcuts.

-

Professionals from adjacent fields (e.g., quants, analysts, developers) who want to connect data-driven market structure with practical trading decisions.

If your aim is to think and act like a professional—calm, contextual, and prepared—this course is designed for you.

Conclusion

Trading rewards preparation, context, and patience. The Volume Profile Trading Course by Cammy Capital teaches you to see the market as an auction, to recognize where value is forming, and to act when probability aligns with structure. Instead of chasing the latest indicator, you will learn to read the market’s own language—volume distributed across price—and translate that into a focused daily routine. The result is a trading process with fewer impulsive decisions, clearer invalidation, and a higher standard for opportunity.

Your journey through the modules is practical and progressive: understand the principles, configure your tools, mark your charts, execute defined setups, and review intelligently. Along the way, you will adopt the habits that separate hobbyist behavior from professional practice. It is serious education for serious traders—direct, applicable, and grounded in the way markets truly operate.

If you are ready to replace noise with structure and speculation with process, this program offers a robust framework to help you do exactly that.

Take the first step toward a professional, volume-driven trading routine with Cammy Capital today.

Reviews

There are no reviews yet.