Free Download Weekly SPX 15-Day Calendar (entered on Thursdays) by Dan Sheridan

Check content proof, now:

Weekly SPX 15-Day Calendar (entered on Thursdays), see what’s included in this course:

Weekly SPX 15-Day Calendar (entered on Thursdays), Free Download PDF Sample:

Review of the Weekly SPX 15-Day Calendar (Entered on Thursdays) by Dan Sheridan

In the fast-paced arena of options trading, having a methodical and disciplined strategy can be the difference between success and failure. One such “battle-proven” approach is Dan Sheridan’s SPX 15-Day Calendar, tailored specifically for traders who want to harness market trends strategically. This course doesn’t just explain the technical mechanics of the calendar trade—it also highlights the importance of market timing, especially entries on Thursdays. By applying this framework, traders can sharpen their skills and improve their effectiveness in navigating market volatility.

The SPX 15-Day Calendar delivers a well-rounded learning experience, offering tools, insights, and practical guidelines for building confidence in trading. The focus on Thursday entries is particularly important, as it aligns with increased market activity and volatility mid-week, giving traders an edge. Let’s break down the course and see what makes it stand out in the competitive field of trading education.

Comprehensive Instructions on the Calendar Trade

At the heart of the SPX 15-Day Calendar is its detailed guidance on structuring the calendar trade. The program walks traders through each step, ensuring clarity on execution, entry timing, and risk considerations.

Thursdays are emphasized as optimal entry points. By this point in the trading week, the market often reflects accumulated news, events, and sentiment shifts. Sheridan demonstrates how this setup creates an advantage, allowing traders to harness volatility for stronger returns.

Beyond just execution, the material also covers how to adapt in different market environments. This equips traders to identify the best scenarios for entering trades, building both precision and confidence in their decision-making.

Leveraging the Greeks in Trading

A major highlight of the course is its deep dive into the Greeks—delta, gamma, theta, and vega. These key measurements form the backbone of professional options trading.

-

Delta shows how sensitive an option’s price is to movements in the underlying.

-

Gamma explains how quickly delta itself changes, useful in fast-moving markets.

-

Theta represents time decay, which is particularly important in calendar spreads.

-

Vega measures sensitivity to volatility, helping traders anticipate the effects of market swings.

By mastering these concepts, traders gain the ability to analyze trades more deeply, anticipate risks, and fine-tune their positions. Sheridan emphasizes not just the theory but also the real-world application of the Greeks, making them practical tools instead of abstract numbers.

Market Insights and Guidelines

This program goes beyond technical setups by weaving in critical market insights. Sheridan helps traders understand how external factors—like earnings announcements, macroeconomic data, and geopolitical events—impact SPX and SPY options.

Rather than relying solely on charts, participants are encouraged to blend technical signals with fundamental awareness. This holistic approach improves decision-making and ensures that traders adapt their strategies to real-world conditions.

Continuous observation of market behavior is also stressed. By reviewing performance and adjusting as conditions shift, traders build resilience and improve long-term consistency.

Trade Management Techniques

Trade management is central to long-term profitability, and this course provides traders with clear rules for adjustments. Sheridan demonstrates how to:

-

Roll positions when market conditions change.

-

Lock in profits at favorable points.

-

Cut losses strategically when trades don’t work out.

This practical guidance gives traders confidence in knowing how to respond under pressure. Instead of being reactive, they can approach the market with structured methods that protect capital and enhance returns.

Hands-On Educational Experience

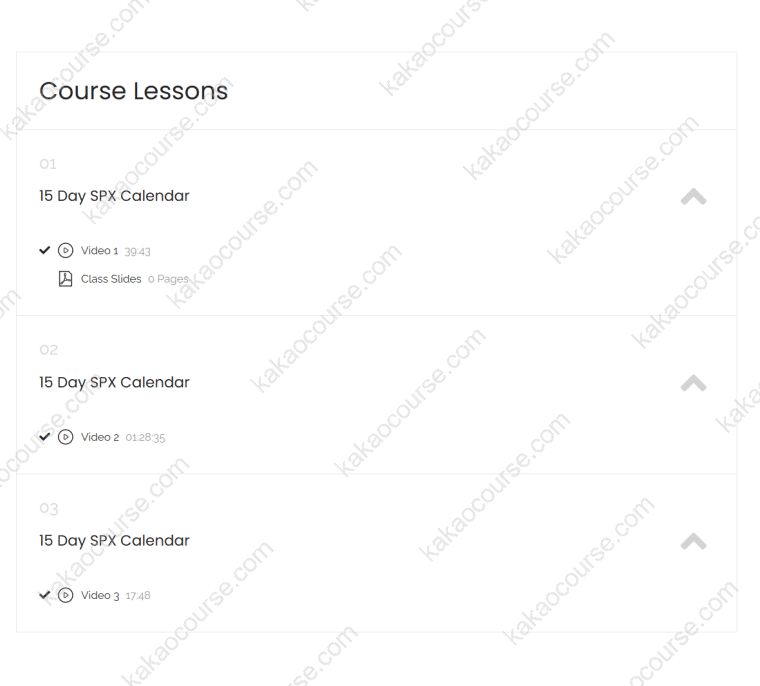

The course features over two hours of video training and 50+ PowerPoint slides, making it a blend of visual and practical learning. Each section builds on the last, ensuring that participants gradually develop a full understanding of both strategy and execution.

Real-world examples and case studies further enrich the learning process. These demonstrations show how the strategies perform in actual market conditions, making the lessons easy to apply.

Dan Sheridan’s teaching style is approachable yet thorough. He simplifies complex material without oversimplifying, creating an environment where traders feel supported and empowered to apply what they’ve learned.

Emphasizing Long-Term Profitability Strategies

The ultimate goal of the SPX 15-Day Calendar is to create sustainable profitability rather than chasing quick wins. Sheridan emphasizes developing a trading plan that is adaptable, consistent, and growth-oriented.

Participants learn how to track results, evaluate strategies over time, and refine approaches as markets evolve. The course instills a mindset of discipline and adaptability, critical traits for building long-term trading success.

This focus on steady progress and resilience is what differentiates Sheridan’s program from many others that prioritize short-term gains.

Conclusion

Dan Sheridan’s SPX 15-Day Calendar course is a well-structured, practical resource for traders aiming to improve their options skills. With a focus on timing entries on Thursdays, mastering the Greeks, and managing trades effectively, it equips participants with both the theory and the practice needed to succeed.

Whether you’re a beginner seeking structure or an experienced trader refining your edge, this program provides the tools, strategies, and mindset to achieve greater consistency. In a market where discipline and adaptability define success, Sheridan’s SPX 15-Day Calendar stands as a valuable roadmap for long-term profitability.

Reviews

There are no reviews yet.